China’s property sector still only has a partial solution to its protracted debt crisis.

A package of 16 supportive measures announced recently by financial officials in Beijing is expected to bring much needed relief for developers.

But bankers, developers and analysts say the market still needs buyers, and with the country’s economic slowdown they are currently elusive.

From a sweeping purge a couple of years ago to a series of financing measures now, China’s changed approach towards the property sector, a key pillar of the economy, reflects how dire the situation has become.

Weighed down by protracted Covid curbs, falling home prices and rising unemployment in the world’s second-largest economy, many prospective buyers are putting off their plans. That has become a challenge for developers and policy-makers.

“These policies will have little lasting effect and the property prices will not go up significantly,” said Jack Yang, an engineer in Beijing, noting that “future income” had become a key concern for homebuyers.

Yang said he had put plans to sell his home and buy a new one on hold due to Covid restrictions, cuts in his salary and concerns he may lose his job.

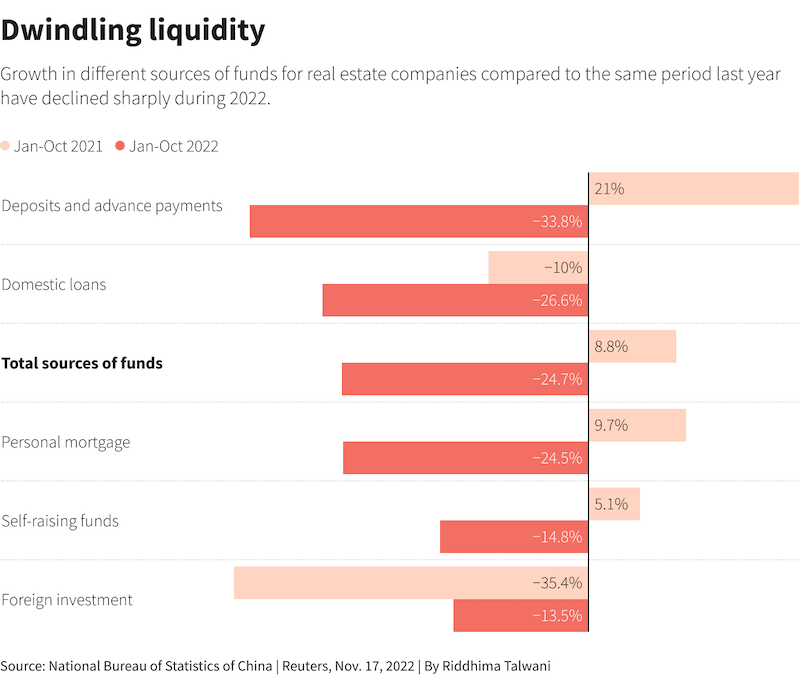

Chinese regulators outlined 16 supportive measures last week, mainly aimed at boosting liquidity for developers, in the most comprehensive rescue package for the sector since it was hit by a debt crisis last year.

ALSO SEE:

Guangzhou Plans 250,000 Quarantine Beds as Covid Spreads

Markets cheered the measures, which included loan repayment extensions and easier access to fresh funding, but bankers and analysts say they only address the property market’s supply problems, with the demand recovery still a key concern.

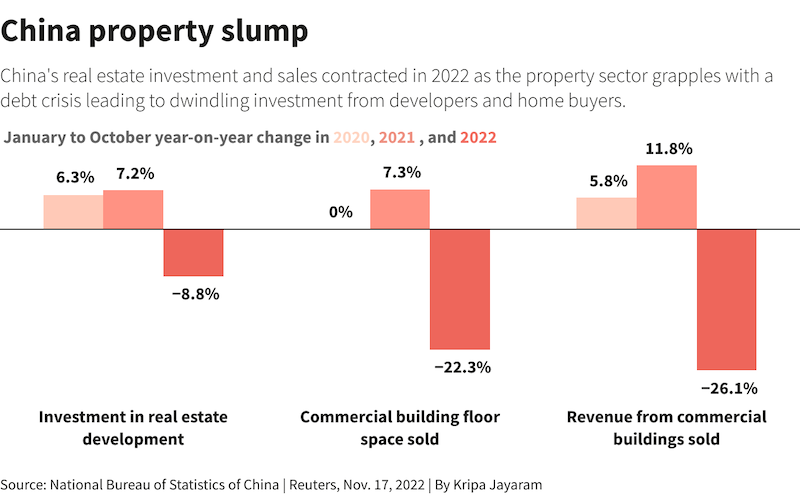

Demand for property, a sector that accounts for roughly a quarter of China’s economy, took a big hit this past year as many developers lurched from crisis to crisis and halted the construction of apartments as they ran out of money.

The economic fallout of Covid lockdowns in many cities also contributed to buyers like Yang putting off plans to take on debt to buy new homes – a trend that bankers and analysts say is unlikely to change anytime soon.

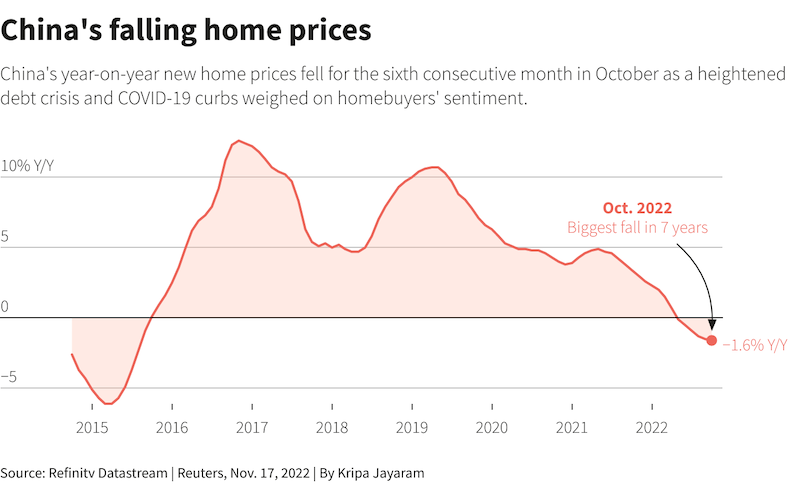

Property sales measured by floor area fell for a 15th straight month in October, while new home prices fell at their fastest pace in over seven years, official data showed this week.

John Lam, head of China and Hong Kong property research at UBS said the government’s move to support liquidity “kind of breaks the negative cycle”, adding this “should be a positive in terms of the demand recovery”.

But rating agency Fitch said on Tuesday it was sticking to its forecast for a “largely flat trend” in new home sales in 2023 even after the latest support measures.

Housing demand “hinges on a recovery in homebuyers’ sentiment and employment prospects, which we think depends on sustained easing of China’s pandemic-related controls,” it said.

China last week eased some Covid rules, but analysts say the zero-Covid strategy will continue to weigh on economic activity.

While Beijing has cut mortgage costs and relaxed some curbs this year to boost new home purchases, analysts say authorities’ focus mostly on affordable housing and President Xi Jinping’s ‘common prosperity’ push are likely to keep a lid on demand.

Investment Option

The fall in home prices is a major concern for homebuyers in China given a large share of them buy new homes as an investment option, with returns historically reaching as high as 30%-50% over a period of time in some cities.

Despite the recent liquidity-boosting measures, some bankers say developers continue to face credit risks given the uncertain outlook.

“The measures will improve the real estate financing environment, which means that for banks, the vicious cycle and death spiral between real estate risks and financial risks have been alleviated,” an official at a mid-sized commercial bank said.

“But it is too early to say that the credit risk alert of real estate has been lifted,” said the banker, who declined to be named as he was not authorised to speak to the media.

According to UBS, Chinese banks have roughly 88 trillion yuan ($12.43 trillion) worth of exposure to the property sector.

It estimates the property sector downturn will cost the banking system up to 1.4-1.5 trillion yuan in the next few years, mainly from potential losses in banks’ unsecured property development loans, bonds, and non-standard assets.

For now, however, the main concern for some homebuyers is whether the latest measures will enable developers to come out of the crisis and resume the construction of apartments.

Sam Wang, a 22-year-old freelancer in the catering industry, said a relative had bought “a property for presale in full payment” in Wuhan about three years ago, but it was still unfinished.

“For me, I am about to buy a house for residential purposes, and in the short term, I’ll take a wait-and-see attitude,” said Wang.

- Reuters with additional editing by Jim Pollard

ALSO SEE:

China Home Prices See Biggest Drop in Seven Years in October

China Property Stocks Soar Over Push to Boost Liquidity

China Property Bonds Being Shunned Over Default Danger

China’s Economy Stumbles as Property, Covid Struggles Rage