Asian indices moved in a tight range on Thursday, with mixed moves from the Nikkei and Hang Seng, as investors awaited three key data from the US that will weigh on the Federal Reserve’s stance on interest rates in the not-too-distant future.

The US will release numbers on wholesale inflation, consumer spending and weekly jobless claims later in the day, all of which could offer insight into the Fed’s three key areas of focus – growth, price pressures and the labour market.

The Fed’s policy meeting is scheduled for next week, where investors will focus on clues as to how soon policymakers could commence their rate-easing cycle.

Also on AF: China Says US TikTok Bill an ‘Act of Bullying’ That Will Backfire

The Bank of Japan also meets next week. Officials including Governor Kazuo Ueda have sought to temper expectations of an imminent shift out of negative interest rates, which has set the yen on course for its worst weekly performance in a month.

The anticipation on major policy weighed on investors across Asia trading floors on Thursday. MSCI’s broadest index of Asia-Pacific shares outside Japan was last little changed and strayed not too far from a seven-month peak hit in the previous session, as traders shrugged off higher-than-expected US inflation rate data.

Japan’s Nikkei snapped a three-day losing streak to close 0.29% higher, despite making a slow start. The benchmark index slipped as much as 0.76% early on but changed course in the second-half of trading.

The turnaround came on the back of energy shares and as heavyweight chip stocks narrowed early losses. “Japan’s major chip stocks mirrored the weak performance of US chip stocks. It looks like the fever for Nvidia is over,” said Shigetoshi Kamada, general manager at the research department at Tachibana Securities.

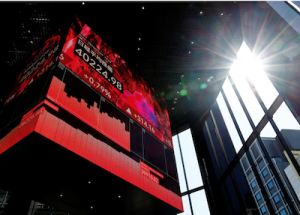

“For the Nikkei to cross the 40,000 level again, Tokyo Electron and its peers need to get a boost.”

The Nikkei crossed 40,000 for the first time earlier this month, driven by gains of chip-making equipment maker Tokyo Electron and chip-testing equipment maker Advantest. On Thursday, the shares of the firms fell 0.45% and 2.35%, respectively.

The Japanese index also found support from shares of Nissan Motor, which jumped 2.23% after a local media reported the automaker was considering a business partnership with Honda Motor to make electric vehicles. Honda rose 1.1% on the news.

US tensions weigh on China stocks

Meanwhile, in China, the blue-chip CSI300 Index and Shanghai Composite Index both fell for a second consecutive day. Stocks remained flat, however, as a rally in biotech stocks offset weakness in gaming and chip companies.

The CSI 300 Healthcare Index rose as much as 3.6% in early trade amid talks of potential policy support for China’s biotech sector, but gave up most of its gains by the close of trading.

Shares of China’s pharmaceutical giant Hengrui and biotech company Beigene jumped 5% and 8%, respectively, and shares of clinical trials and contract research firms also rose.

In contrast, Hong Kong-listed shares of biotech firm WuXi AppTec fell sharply on news that a Washington-based global trade association representing biotechnology companies is taking steps to “separate” from the company.

Wuxi’s shares in Hong Kong closed at a 12% slump, after registering their biggest intraday percentage drop since March 7. The company’s shares are down 40% for the year on the back of geopolitical tensions with the US.

Weakness in Wuxi weighed on Hong Kong’s Hang Seng Index which slid 1% in early trade. A near 2% slump in technology stocks also weighed on the index.

Hang Seng pared its early losses to close down 0.71%.

Elsewhere across the region, Singapore, Taiwan, Manila and Bangkok all closed in the green. Shares on India’s benchmark Nifty 50 and BSE Sensex also ended in the green, making a small recovery from Wednesday’s bloodbath.

Key figures

Tokyo – Nikkei 225 < DOWN 0.29% at 38,807.38 (close)

Hong Kong – Hang Seng Index < DOWN 0.71% at 16,961.66 (close)

Shanghai – Composite < DOWN 0.18% at 3,038.23 (close)

London – FTSE 100 < DOWN 0.06% at 7,767.18 (1303 GMT)

New York – Dow > UP 0.39% at 39,190.80 (Wednesday close)

- Reuters, with additional editing by Vishakha Saxena

Also read:

Trump Launched CIA Covert Influence Operation Against China

China’s Nio, CATL to Work on Batteries With Longer Lifespans

Many Chinese Carmakers Opening Factories Abroad Despite Rows

China Lunar New Year Holiday Caps Global EV Sales