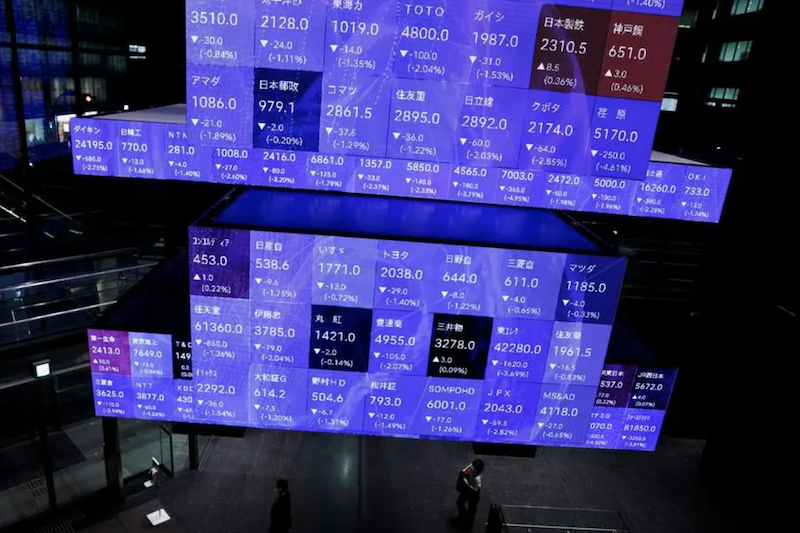

Asian stocks fell on Thursday in the wake of a Wall Street slide as uncertainty over US interest rates and China’s stumbling recovery preoccupied investors.

A sharp fall in oil prices to a six-month low and a soft reading on the US labour market boosted the global bond market, also limiting the appetite for risk across the region.

Japan’s Nikkei share average fell sharply following New York’s overnight declines ahead of more key jobs data that should provide clues on how soon the US Federal Reserve could start cutting rates.

Also on AF: China’s Big Fund Bumps Up Investments in Chip Supply Chains

The Nikkei share average fell 1.76%, or 587.59 points, to close at 32,858.31, while the broader Topix was down 1.14%, or 27.29 points, to 2,359.91.

Energy was the biggest decliner, after crude oil dropped to six-month lows. Chip shares were also standout underperformers, making up two of the Nikkei’s three biggest drags.

China’s blue-chip shares hit a nearly five-year low, and Hong Kong stocks also fell as Moody’s cutting its credit outlook for both regions added to investor concerns about China’s weak recovery.

Moody’s put Hong Kong, Macau and swathes of China’s state-owned firms and banks on downgrade warnings on Wednesday, following an identical move the previous day on the mainland government’s ratings.

Economic data hasn’t shown a strong recovery. China’s exports grew for the first time in six months in November, customs data showed on Thursday, while imports unexpectedly fell following the previous month’s increase.

The blue-chip CSI 300 Index lost 0.24% after touching its lowest level since February 2019, and the Shanghai Composite Index was down 0.09%, or 2.73 points, at 2,966.21. The Shenzhen Composite Index on China’s second exchange retreated 0.27%, or 4.95 points, to 1,850.20.

In Hong Kong, tech giants dropped 1.8% and the Hang Seng Index lost 0.71%, or 117.37 points, to end at 16,345.89. The Hang Seng China Enterprises Index declined 0.85%

Elsewhere across the region, in earlier trade, Manila fell more than 1%, while Sydney, Seoul, Singapore, Taipei, Mumbai, Bangkok and Jakarta were also in the red.

Japan’s Yen Strengthens

European stockmarkets looked wary as well ahead of their open, with both Eurostoxx 50 futures and FTSE futures down 0.6%. S&P 500 and Nasdaq futures were little changed.

The Japanese yen strengthened 0.4% to 146.76 per dollar after Bank of Japan Governor Kazuo Ueda flagged several options on what interest rates to target once the central bank pulls short-term borrowing costs out of negative territory.

Data overnight showed US private payrolls increased less than expected in November in yet another sign that the American labour market is gradually cooling.

Traders are turning their focus to the weekly jobless claims data later in the day, ahead of the non-farm payroll report due on Friday. Economists expect the economy added 180,000 new jobs in November, picking up from 150,000 the previous month.

The US dollar hovered near a two-week high at 104.19 against its major peers heading into the non-farm payroll release. Markets have priced in so much easing that they are clearly vulnerable to an upside payroll surprise.

Brent crude futures edged up 0.6% to $74.72 a barrel while US West Texas Intermediate futures rose 0.6% to $69.78 a barrel.

Key figures

Tokyo – Nikkei 225 < DOWN 1.76% at 32,858.31 (close)

Hong Kong – Hang Seng Index < DOWN 0.71% at 16,345.89 (close)

Shanghai – Composite < DOWN 0.09% at 2,966.21 (close)

London – FTSE 100 < DOWN 0.29% at 7,493.41 (0934 GMT)

New York – Dow < DOWN 0.19% at 36,054.43 (Wednesday close)

- Reuters with additional editing by Sean O’Meara

Read more:

EU Leaders Meet Xi in Beijing Amid Concern on Trade Imbalance

December Highs Take India’s Market Cap to Record $4.2 Trillion

German Firms Blame Taiwan Tensions For China De-Risking Push

Tech Gains Boost Nikkei, Hang Seng Rallies on Fed Hopes