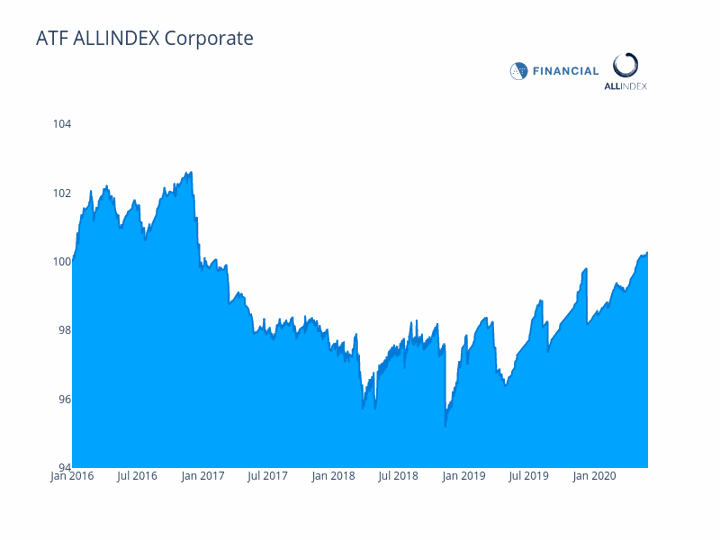

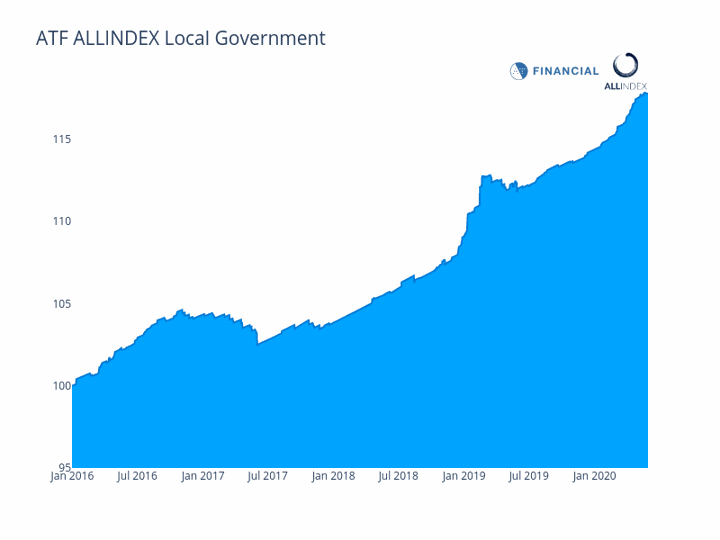

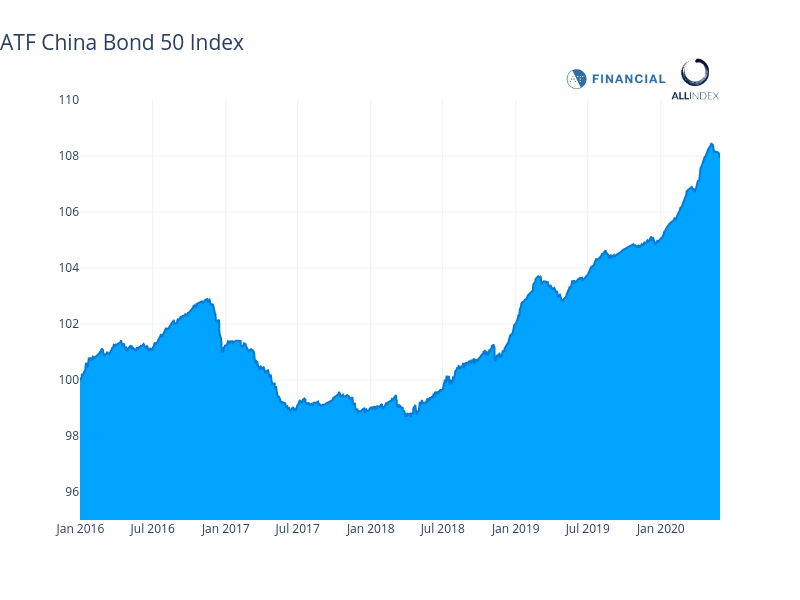

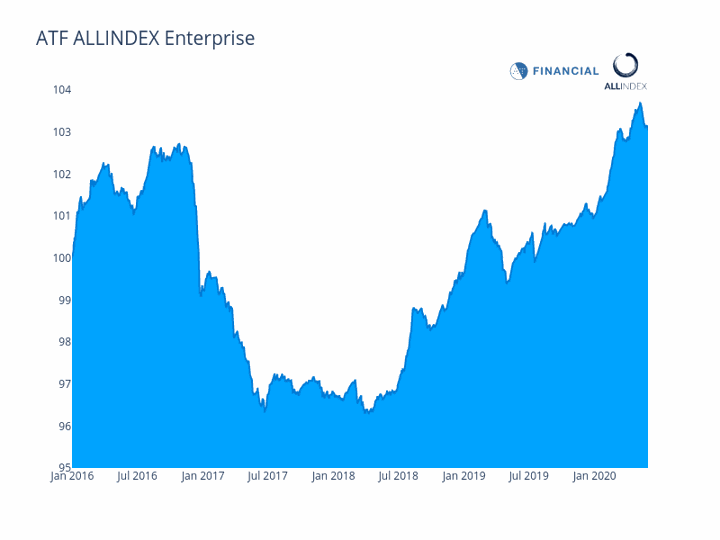

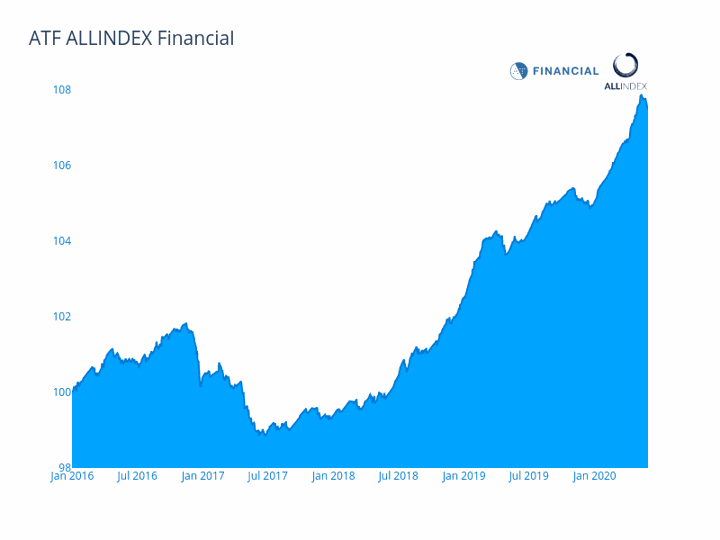

(ATF) The flagship ATF China Bond 50 index fell 0.03% to 107.90 on Tuesday. The ATF ALLINDEX Enterprise was down by the same amount, closing at 103.04. Meanwhile, the ATF ALLINDEX Corporates, Financials and Local Governments gauges were up 0.01%, closing at 100.32, 107.49, and 117.78, respectively.

Within the ATF ALLINDEX Enterprise, PetroChina Company Limited’s bond dropped substantially, losing 0.35% to closed at 103.90. The company announced last month it had received China Securities Regulatory Commission approval, valid for 24 months, to issue up to 80 billion yuan in new bonds.

Xi’An Hi-Tech Holding Co. also retreated, with its bonds losing 0.51% and closing at 108.86.

Several issuers in the ATF ALLINDEX Financials gauge also recorded losses: China Cinda Asset Management (-0.23%), the Export-Import Bank of China (-0.69).

China Development Bank shed a further 0.86% after Monday’s drop following the announcement that the policy bank had tendered for the re-opening of its three-year 5 billion yuan 1.86% offering due 2023. This follows its $50.4 billion commitment last month to finance the development of the Greater Bay Area, a Chinese government scheme, according to Caixin.

The scheme aims to link the cities of Hong Kong, Macau, Guangzhou, Shenzhen, Zhuhai, Foshan, Zhongshan, Dongguan, Huizhou, Jiangmen and Zhaoqing into an economic and business hub.

Chongqing Rural Commercial Bank, gained 0.23% to close at 101.42.