(ATF) Federal Reserve chairman Jerome Powell will speak on Thursday after Treasury yields drove up again on Wednesday March 3, pushing the Nasdaq down almost 3% and renewing the global investor debate about relative value across asset classes.

The benchmark 10-year US Treasury yield pushed out to almost 1.5% – well below the 1.61% touched during a period of market panic last Thursday, but also up by 50% since the end of 2020 on fears of future inflation, and well above the 1.4% seen at the start of this week.

Powell will answer questions about the US economy at a conference event that may be his last public appearance before the Fed’s next policy-setting meeting starting on March 16.

He could signal a move towards a more explicit policy of talking down long-end interest rates in reaction to repeated recent upward pushes in Treasury yields, and some strains on market liquidity during bouts of selling.

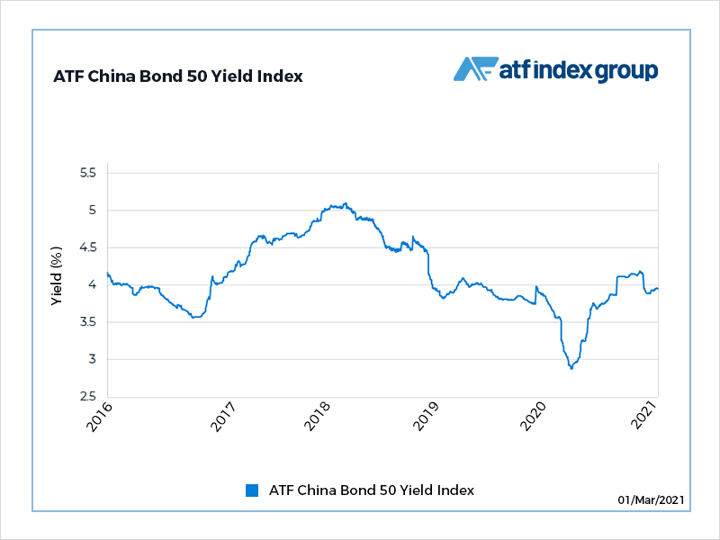

Each recent significant spike in Treasury yields has been accompanied by technology stock selling and reassessment of the relative value on offer in some debt markets that have been more stable and already offer higher returns, such as the Chinese corporate bond sector.

Among major US technology stocks, Microsoft, Apple and Amazon all dropped more than 2% on Wednesday, weighing more than other stocks on the S&P 500.

The S&P 500 financial and industrial sector indices reached intra-day record highs, by contrast. Most other S&P 500 sectors declined.

The Dow Jones Industrial Average fell 0.39% to end at 31,270.09 points, while the S&P 500 lost 1.31% to 3,819.72.

Nasdaq down

The Nasdaq dropped 2.7% to 12,997.75. That left it at its lowest since early January and eroded almost all of its gain so far in 2021.

The US economic recovery continued at a modest pace over the first weeks of this year, with businesses optimistic about the months to come and demand for housing “robust,” but only slow improvement in the job market, the Federal Reserve reported.

Another report showed US services industry activity unexpectedly slowed in February amid winter storms, while a measure of prices paid by companies for inputs surged to the highest level in nearly 13 years.

The 10-year Treasury yield rose to 1.49% before easing slightly at the US close – a move that was enough to pressure areas of the markets with high valuations.

Asian stocks could see similar pressure before Powell speaks around midday US eastern time on Thursday.

ALSO SEE: