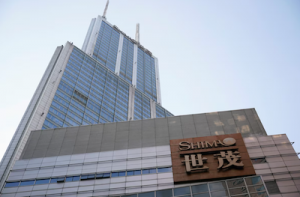

Chinese property developer Shimao Group said on Friday it would sell a hotel in Shanghai to state-owned Shanghai Land Group for 4.5 billion yuan ($707.83 million), as it seeks to reduce its debt amid a crisis in the country’s property sector.

The deal is part of the Chinese government’s push to buy assets from cash-strapped private developers, as Beijing steps up efforts to stabilise and tighten control over a beleaguered sector that accounts for a quarter of its economy.

Shimao, which defaulted on a trust loan earlier this month, said it will sell an entity whose principal asset is the Hyatt on the Bund hotel to Shanghai Land.

The developer in 2022 has $1.7 billion maturities offshore and 8.9 billion yuan onshore, according to Moody’s.

“Continuous asset disposals are required and we see the disposals as benefiting the short end bonds more,” Nicholas Yap, Nomura analyst in Hong Kong, said.

Menawhile, Agile Group, another embattled Chinese property firm, sold stakes in several units worth nearly 2 billion yuan to state-owned China Overseas Land & Investment and China Conch Venture.

Regulatory curbs on borrowing have driven China’s property firms into a debt crisis, with sector bellwether China Evergrande grappling with $300 billion in liabilities.

- Reuters, with additional editing by George Russell

READ MORE:

Cash-Strapped Shimao Sells Joint Venture Stake to Raise Cash

China Developer Shimao to Use Own Funds to Pay Onshore Bonds

Shimao Says No Deal to Sell Shanghai Plaza, Shares Slump