South Korean chipmaker SK Hynix’s CEO says his firm’s market value could double in just three years thanks to the demand for artificial intelligence tech.

CEO Kwak Noh-Jung told reporters at the CES 2024 tech conference in Las Vegas the company might be worth $152 billion by 2027, as AI systems develop and customer demands for memory diversify.

“If we prepare the products we are currently producing well, pay attention to maximising investment efficiency and maintaining financial soundness, I think we can attempt to double the current market capitalisation of 100 trillion won to 200 trillion won within three years,” Kwak said.

Also on AF: Red Sea Oil Tanker Flows Continue Despite Houthi Attacks

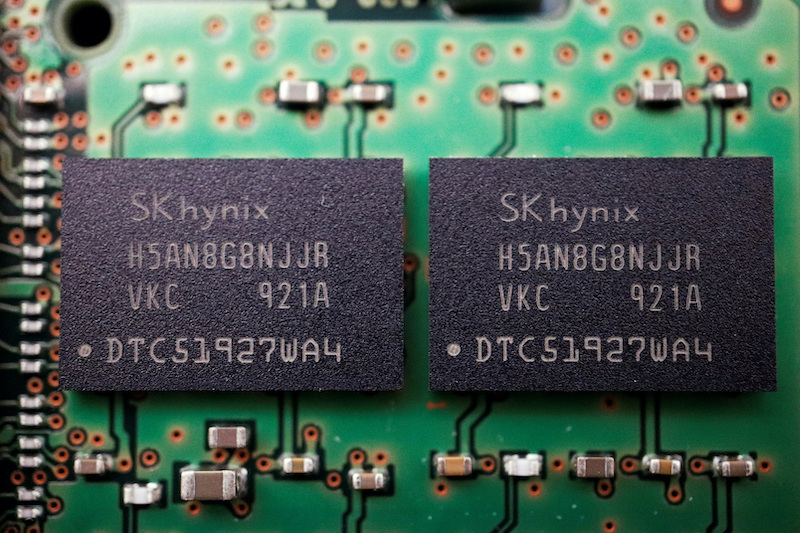

SK Hynix was ahead of rivals in developing the latest in high bandwidth memory (HBM) chips used in the fast-growing field of generative AI, securing AI-chip leader Nvidia as a client.

The chips, known as HBM3, can feed more data into chips used for generative AI, enabling them to compute at high speed.

With rivals Samsung Electronics and Micron having developed their own versions of the next generation, called HBM3E, SK Hynix has consolidated its internal HBM capabilities to stay ahead, Kwak said.

As for when SK Hynix’s production cuts might end, Kwak said “changes need to be made in the first quarter” for DRAM chips used in tech devices, signalling an increase in production, while for NAND flash chips used to store data, the chipmaker plans to respond to market conditions after mid-year.

Memory chip makers including SK Hynix and Samsung have engaged in extensive production cuts since early last year to weather the worst industry downturn in decades as high inflation dented demand for gadgets containing chips.

However, during the fourth quarter industry No1 Samsung took in more supply of silicon wafers – the building blocks for semiconductors – signalling it was gearing up to increase production as memory chip prices rebounded.

SK Hynix traded up 1.2% in afternoon trade, giving it a market capitalisation of 100.1 trillion won. The wider market was down 0.1%.

- Reuters with additional editing by Sean O’Meara

Read more:

China, US Scientists’ Graphene Chip Breakthrough – IndraStra

S Korea’s Samsung, SK Hynix Win US Chip Tech Export Waivers

China is Using AI to Ramp up Espionage, US Says – WSJ

Chipmaker SK Hynix to Slash Investment as Recession Looms