Economic events

(ATF) The focus this week will be on PMI updates in US, Europe, Japan and Australia which will be assessed for the impact from the easing in lockdowns earlier this month. Central bank decisions in China, Thailand, New Zealand and Philippines are due this week with investors closely monitoring, especially those central banks which have barely any easing space left.

“The People’s Bank of China will carry out its monthly exercise of adjusting the prime lending rates next week. Boosting economic growth remains a top priority for the central bank amid a second wave of the disease,” Prakash Sakpal, ING’s senior economist in Asia, said. He expects a 10-20 basis point cut to the 1-year and 5-year lending rates.

“While the PBoC seems to be saving its ammunition, most regional central banks have almost run out of bullets,” said Helen Qiao and Bum Ki Son, economists at BofA Securities, while adding that in ASEAN, central banks delivered cumulative policy-rate cuts of 75bp in Indonesia and Thailand, 100bp in Malaysia, 125bp in the Philippines, and 150bp in Vietnam.

NZ, Philippines

So, a lot of attention will be paid to the Reserve Bank of New Zealand’s decision as analysts look for indications that the policy-rate may move into negative territory.

“This could have ramifications for central banks across Asia Pacific as an increasing number (such as Indonesia and the Philippines) are tapping into unconventional monetary policies to support the economy,” Bernard Aw, principal economist at IHS Markit Singapore, said.

Although recent comments from government officials in the Philippines suggest a possibility of delay, Barclays analysts expect the BSP to lower its policy rate once more.

“We believe benign inflation outlook, coupled with a likely much weaker-than-expected Q2 GDP print, will warrant near-term easing by the central bank,” Barclays economists said in a report.

Data releases this week will give clues as to the length and depth of recessions caused by the Covid-19 pandemic, as PMI updates are published.

“The PMI surveys provided an early indication that the worst of the economic impact from the virus outbreak appears to have hit in April, with the global PMI staging a record rise in May, albeit remaining worryingly weak by historical standards,” Chris Williamson, chief business economist at IHS Markit, said. “With lockdowns having increasingly eased into June, further gains in the PMIs will be needed to corroborate growing expectations that economic recoveries are gaining traction.”

The IMF will release its World Economic Outlook Update on Wednesday June 24. The release assumes greater importance after the IMF’s Gerry Rice said last Thursday: “The de facto lockdown in the US has continued for longer than we had anticipated . This is likely to mean the contraction in the second quarter will be deeper than we had anticipated previously, and that the pace of recuperation, may be slower.” Gita Gopinath, the IMF’s economic counsellor, will be releasing the update to the World Economic Outlook, including updated forecasts for the global economy.

Fund flows

Emerging markets equity funds continued to bleed cash with the weekly outflow stretch nearing the 2014 record of 22 weeks when the taper tantrum spooked investors, fund-flow data provider EPFR Global said. Worries about escalating US-China tensions and the India-China border clash, extended the outflows to 18 weeks.

“As China and India clashed in the Galwan Valley, mutual fund investors had already reduced their exposure to both markets for a variety of reasons ranging from trade tensions (China) to policy disappointments (India). China Equity Funds saw their current outflow streak hit nine weeks and $14 billion, while India Equity Funds experienced their biggest weekly outflow since mid-April,” EPFR Global said.

Its data also showed Money Market Funds extended their longest run of inflows since 4Q18 and equity funds with socially responsible (SRI) or environmental, social and governance (ESG) themes drew their 74th weekly inflow since the start of 2019.

The attraction of risk assets dulled with slowdown of inflows noticed across credit, equities and EM debt funds. Emerging Markets Bond Funds saw their modest inflow streak come to an end and flows into High Yield Bond Funds – while healthy – were the second lowest since their current run began in late March, EPFR said.

“Inflows strengthened into government bond funds as the ECB continues to favour public over private debt. Carry trades have also suffered with EM debt funds witnessing small outflows as EM FX has softened recently,” BofA Securities said in a note, while adding that the pace of inflows into high-grade funds more than halved last week after setting two back-to-back weekly inflow records.

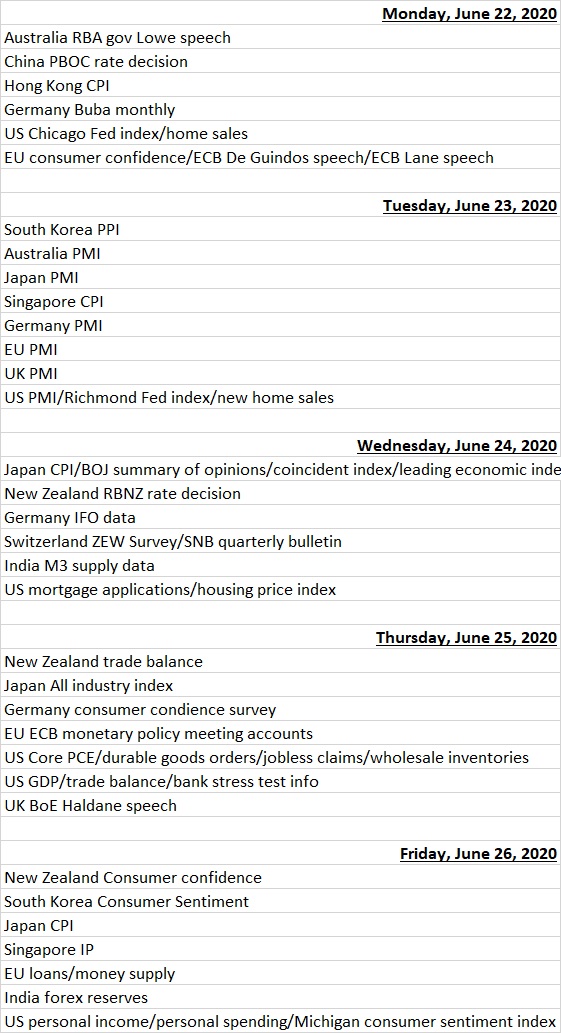

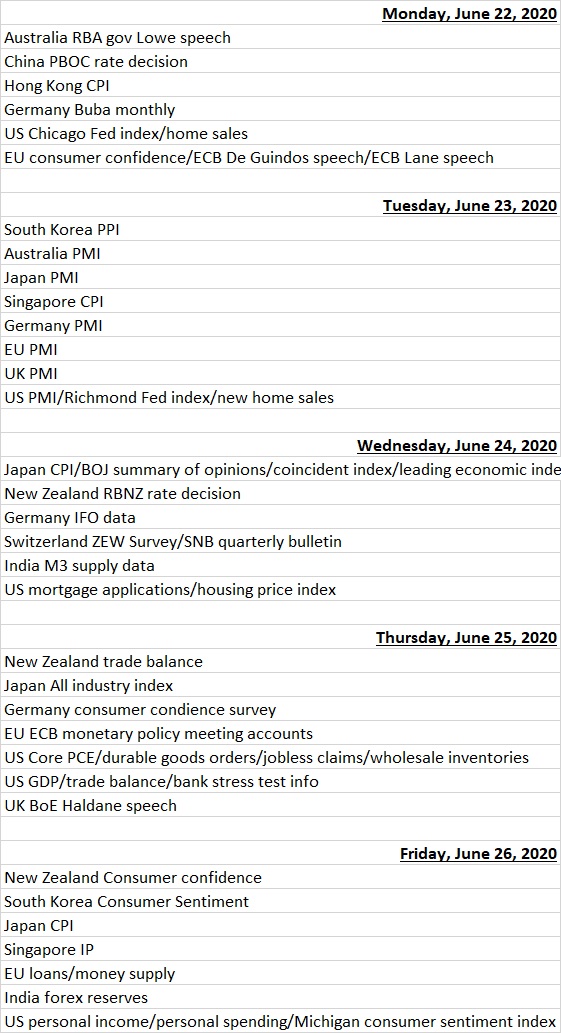

Economic data calendar

LAST WEEK’S RATING CHANGES