Senior US and Chinese officials began high-stakes trade negotiations in London on Monday that seek to ease their bilateral trade dispute.

The trade war sparked by US President Donald Trump’s imposition of tariffs in early April widened in recent weeks beyond soaring tit-for-tat tariffs to export controls that Beijing imposed on rare earths, which are critical to supply chains for autos and many other sectors.

Officials from the two superpowers met at the ornate Lancaster House to try to get back on track with a preliminary agreement struck last month in Geneva that briefly lowered the temperature between Washington and Beijing.

ALSO SEE: China’s Exports to US Plunge, as Deflation Hits Two-Year High

The talks, which started around 1130 GMT, come at a crucial time for both economies, with investors looking for some relief from Trump’s cascade of tariff orders since his return to the White House in January.

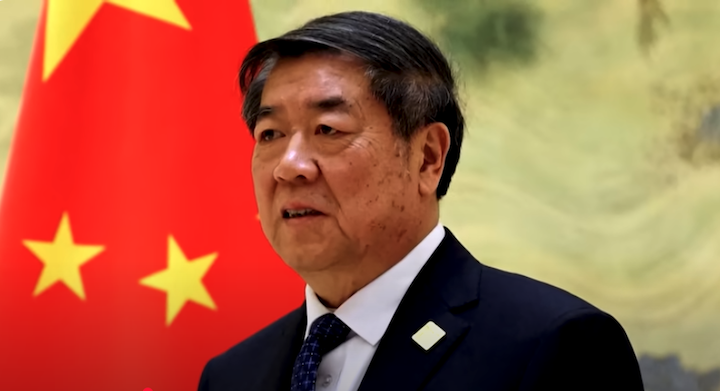

The US delegation is led by Treasury Secretary Scott Bessent, Commerce Secretary Howard Lutnick and Trade Representative Jamieson Greer, while the Chinese contingent is helmed by Vice Premier He Lifeng.

A British government spokesperson said on Sunday: “The next round of trade talks between the US and China will be held in the UK on Monday. We are a nation that champions free trade and have always been clear that a trade war is in nobody’s interests, so we welcome these talks.”

A month ago, the two sides agreed in Geneva to reduce steep import taxes on each other’s goods that had had the effect of erecting a trade embargo between the world’s No-1 and 2 economies, but US officials in recent weeks accused China of slow-walking on its commitments, particularly in relation to shipments of processed rare earth elements.

The inclusion of Lutnick, whose agency oversees export controls for the US, is one indication of how central rare earths has become. He did not attend the Geneva talks, where the countries struck a 90-day deal to roll back some of the triple-digit tariffs they had placed on each other.

Trump-Xi phone call

The second round of meetings comes four days after Trump and Chinese leader Xi Jinping spoke by phone, their first direct interaction since Trump’s January 20 inauguration.

During the more than one-hour-long call, Xi told Trump to back down from trade measures that roiled the global economy and warned him against threatening steps on Taiwan, according to a Chinese government summary.

But Trump said on social media the talks focused primarily on trade led to “a very positive conclusion,” setting the stage for Monday’s meeting in London.

The next day, Trump said Xi had agreed to resume shipments to the US of rare earths minerals and magnets.

China’s decision in April to suspend exports of a wide range of critical minerals and magnets upended the supply chains central to automakers, aerospace manufacturers, semiconductor companies and military contractors around the world.

“We want China and the United States to continue moving forward with the agreement that was struck in Geneva,” White House spokeswoman Karoline Leavitt told the Fox News program “Sunday Morning Futures” on Sunday.

“The administration has been monitoring China’s compliance with the deal, and we hope that this will move forward to have more comprehensive trade talks.”

The preliminary deal in Geneva sparked a global relief rally in stock markets, and US indexes that had been in or near bear market levels have recouped the lion’s share of their losses.

The S&P 500 Index, which at its lowest point in early April was down nearly 18% after Trump unveiled his sweeping “Liberation Day” tariffs on goods from across the globe, is now only about 2% below its record high from mid-February. The final third of that rally followed the US-China truce struck in Geneva.

Still, that temporary deal did not address broader concerns that strain the bilateral relationship, from the illicit fentanyl trade to the status of democratically governed Taiwan and US complaints about China’s state-dominated, export-driven economic model.

UK to have separate talks with Chinese team

While the UK government will provide a venue for Monday’s discussions, it will not be party to them but will have separate talks later in the week with the Chinese delegation.

The dollar slipped against all major currencies on Monday as investors waited for news, while oil prices were little changed.

Trump has repeatedly threatened an array of punitive measures on trading partners, only to revoke some of them at the last minute. The on-again, off-again approach has baffled world leaders and spooked business executives.

China sees mineral exports as a source of leverage. Halting those exports could put domestic political pressure on the Republican US president if economic growth sags because companies cannot make mineral-powered products.

However, China has reportedly vowed to increase supplies of rare earth elements since President Xi spoke with his US counterpart late last week.

- Reuters with additional editing by Jim Pollard

ALSO SEE:

China Export Curbs on Rare Earth Magnets: a Trade War Weapon

Trump Call to Xi Eases Fear US-China Trade Deal May Unravel

China Sets up Tracking System to Trace Its Rare Earth Magnets

Cloud on US-China Ties: Trump Says Xi ‘Hard to Make a Deal With’

Carmakers Stressed by China’s Curbs on Critical Mineral Exports

Shipments of US Ethane to China Face Export Licence Uncertainty

US Blocks Chip Design Software, Chemical Shipments to China

Beijing Says Latest US Chip Warning Puts Trade Truce at Risk

Mass Layoffs Avoided in China, But Export Sector Badly Shaken

Asian Markets Rise After US, China Agree to Cut Majority of Tariffs