As SoftBank-backed chip designer Arm Holdings heads for its blockbuster initial public offering (IPO) this week, anticipation is high in US markets which have largely seen two lacklustre years.

But retail traders looking to buy into Arm’s IPO should beware – individual investors usually end up getting burned when they jump on hot listings.

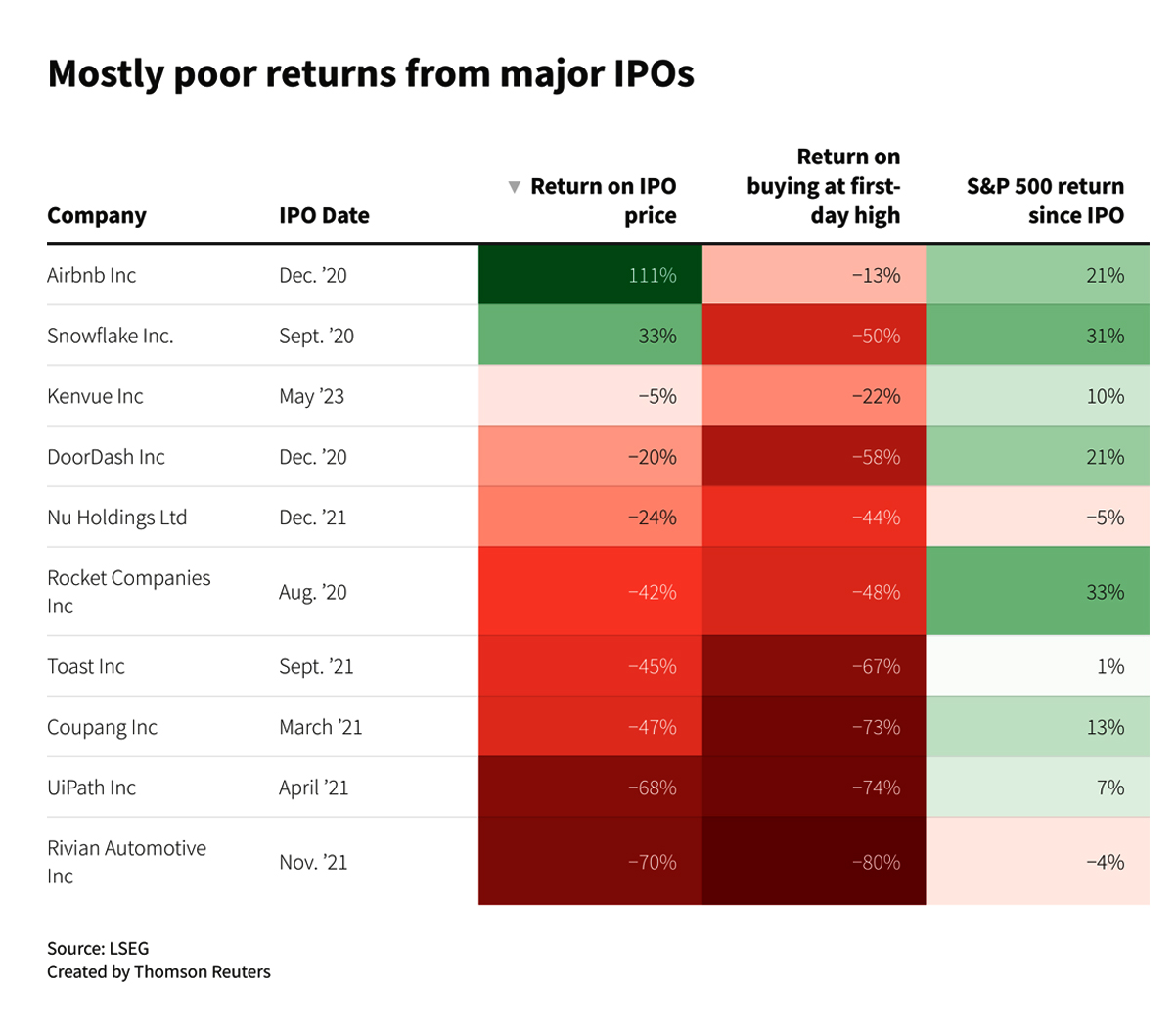

Arm’s goal of raising around $5 billion in New York in what might be the biggest IPO of 2023 follows other major listings in recent years whose returns have mostly disappointed.

Also on AF: Arm Seen Signing Tech Giants for $50-55 Billion IPO

Since the chip designer is not well-known among consumers, it is focusing its IPO marketing efforts on institutional investors, people familiar with the deal said.

That leaves most Main Street investors to buy Arm shares at potentially higher prices once they begin trading. With retail investors holding individual stocks for less than a year on average, recent history suggests they could lose money, a Reuters analysis shows.

The 10 biggest US IPOs of the past four years are down an average of 47% from the closing price on their first day of trading, according to the analysis of LSEG data as of Friday.

Investors who bought at the top of an intra-day price surge that often occurs in high-profile listings would have fared even worse, with an average loss of 53%.

Buying at premium

While Arm is a business-to-business company with little consumer brand recognition, its IPO publicity is likely to attract retail interest, said analysts. Nvidia, the chipmaker at the centre of an artificial intelligence boom, has been a retail favourite this year.

Arm’s debut is also expected to rejuvenate the US IPO market which has slowed over the past two years due to volatility and economic uncertainty.

But dabbling in individual stocks is a notoriously risky business for amateur investors.

“If you’re buying in the market, on average, you’re buying at a premium to the offer price,” said Jay Ritter, a professor at the University of Florida who studies IPOs. “For almost all retail investors, buying and holding a low-cost index fund is the best strategy.”

Even institutional investors invited to buy into those 10 IPOs before trading would be down an average of 18%. That goes to show how perilous it can be to buy into blockbuster IPOs on Day One.

The S&P 500 has gained an average of 13% since each of those IPOs, nine of which happened in 2020 and 2021.

Tough years for US IPOs

Retail participation in US stocks surged in 2021, fuelled by low interest rates, zero-cost trading apps, and social media hype around GameStop and other so-called meme stocks.

But Main Street investors have become more cautious after last year’s stock market sell-off, said Marco Iachini, a senior vice president at Vanda Research, which tracks retail trades.

“Whatever comes out of the Arm IPO, you’ll see niches of the retail community trying to get in on it, but it’s not going to be at the levels we saw in some of the IPOs in 2021,” he said.

Arm is seeking up to $51 per share, potentially valuing it at more than $50 billion – which would make it the most valuable company to list in New York since electric carmaker Rivian Automotive debuted in 2021. But Rivian’s market value has collapsed by over $60 billion since it listed.

It has been a tough few years for IPOs. Wall Street’s steep sell-off in 2022, along with rising interest rates and fears of a potential US recession, have crushed valuations of companies that went public before they were profitable. But studies by Ritter and others have shown IPOs offer poor returns.

In the past four years, over 260 IPOs have debuted with stock market values above $1 billion, mostly in the technology, healthcare and consumer discretionary sectors, according to LSEG. They are down on average 29% from their offering prices and down 49% from their initial trading highs.

One standout among recent big IPOs is chipmaker GlobalFoundries, which has gained 23% since its 2021 listing, compared to the S&P 500’s 3% dip over that time.

- Reuters, with additional editing by Vishakha Saxena

Also read:

SoftBank’s Arm Stresses China ‘Risks’ in $60bn US IPO Filing

SoftBank Set to Finally See Green as Tech Valuations Jump

Intel Looking to Become Anchor Investor in SoftBank’s Arm IPO

AI Chip Gold Rush Pumps Up SoftBank Shares Ahead of Arm IPO

SoftBank to List Arm on Nasdaq, Despite British Appeals

SoftBank’s Arm Cannot Sell Cutting-Edge Chip Designs to China

VinFast US Shares Dive Nearly 60% in 3 Days After $85bn Listing