(ATF) China’s central bank chief said he would save the economy in 18 words.

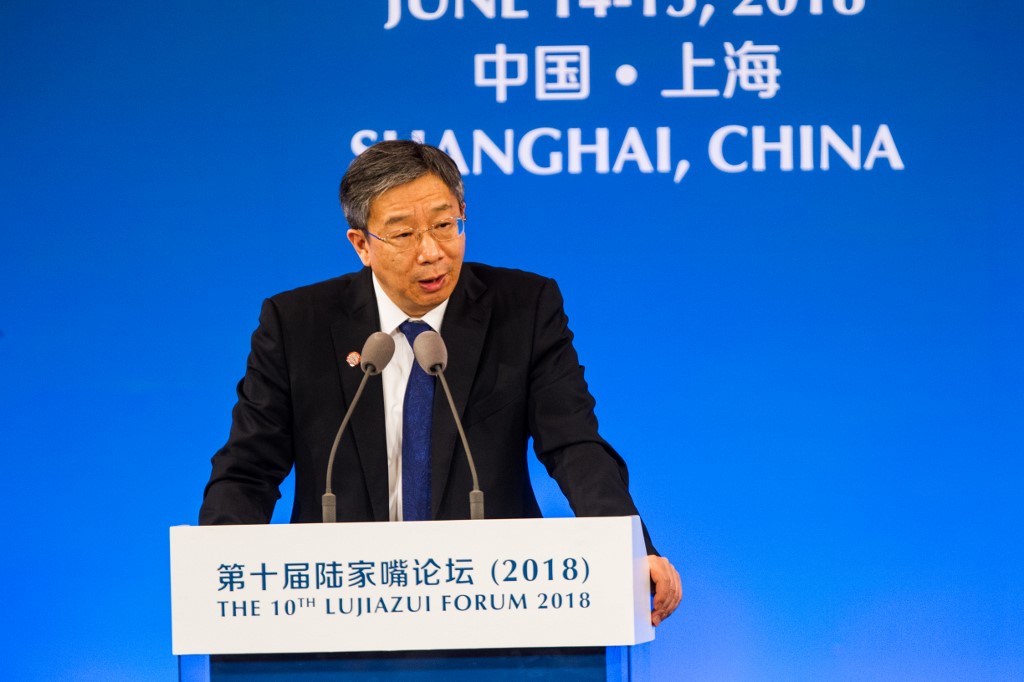

In his latest commentary on monetary policy, People’s Bank of China (PBoC) governor Yi Gang said policymakers’ approach to maintaining recovery from the coronavirus downturn would be summed up in one phrase.

“Expansion of the total amount, supply, promote growth, reduce interest rates, adjust the structure, protect the main body,” he was cited as saying in an interview with Shanghai Observer.

PBoC officials are weighing how to keep the nascent recovery in motion without adding to its own balance sheet with broad-based stimulus measures. It’s also keen not to stifle outside investment by lowering borrowing costs to unattractive levels. Instead it’s opted to focus on targeted measures that benefit specific recovery projects and smaller business, as well as managing short-term interest rates.

So far the recovery has been patchy, with faster improvements in export industries and infrastructure projects. But smaller firms are suffering and as they provide employment for about 80% of urban populations, the government is keen to get its stimulus money through to them in the most effective way. This has been hampered so far by banks buying up government-issued recovery debt, repackaging it and selling it on to bolster their own cash piles.

READ MORE: Special bonds issuance likely peak in August-Sept

“In the face of the impact of the epidemic, the People’s Bank of China decisively increased monetary policy counter-cyclical adjustment efforts used, innovative monetary policy tools,” Yi said in the interview.

Yi explained how the PBoC reacted to the first shock of the Corona epidemic.

“During the Spring Festival holiday period, we urgently issued 300 billion yuan of special re-loans, and achieved positive supply-guaranteed results, firmly supported the financial market on February 3 after the Spring Festival, as scheduled, and exceeded expectations of short-term liquidity of 1.7 trillion yuan,” he boasted.

“The reserve requirement ratio was lowered by 0.5 percentage points, and the cumulative long-term funds were 1.75 trillion yuan.”

He said funds were channeled to market-oriented operations: “Commercial banks use these tools of the central bank for the real economy to provide low-cost loans, strong support for stable enterprises to protect employment.”

Commenting on the first half of 2020 he said, the macro-financial data shows that the PBoC’s prudent monetary policy had been effectively implemented. From the macro total, the financial indicators are significantly higher than last year.

At the end of June, M2 money supply, the broadest measure of cash in circulation, grew 11%, social financing grew 13% and new loans in the first-half of the year amounted to 12tn yuan, an increase of 2.4tn yuan over the same period last year.

In terms of prices, the PBoC has focused on guiding interest rates down in major markets, Yi said. The open market’s seven-day counter-repo bid rate fell 30bps to 2.2%, the medium-term lending facility winning bid rate fell 30bps to 2.95%, the one-year loan market quote rate fell 30bps to 3.85% and the re-lending rate was cut by 50bps, Yi said.