India has become the top exporter of smartphones to the United States, surpassing China amid trade uncertainty exacerbated by US tariffs, according to research firm Canalys.

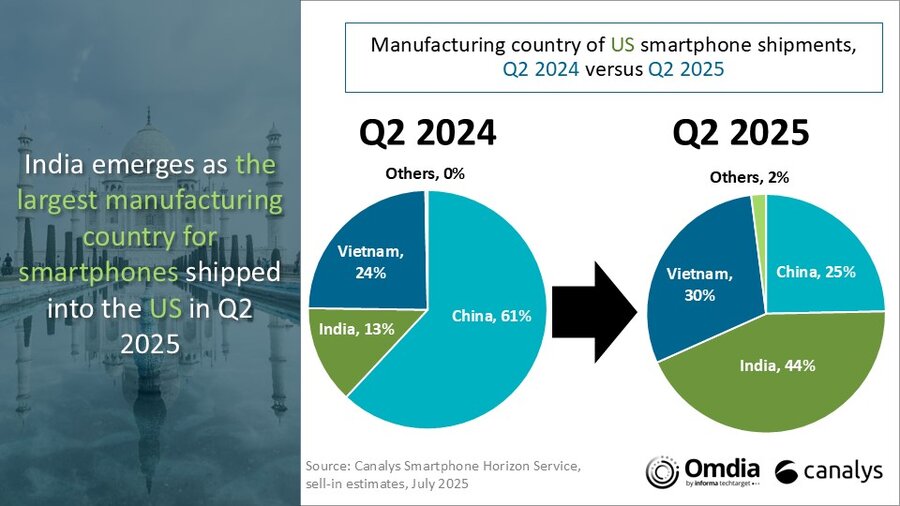

Smartphones assembled in India accounted for 44% of US imports in the second quarter – a big rise from just 13% in the same quarter last year, a report by Canalys said, with the volume of phones made in India soaring by 240%.

Vietnam’s share of smartphone exports to the US was also greater in the quarter ending in June than those exported from China, it said, totalling 30%, compared to China’s 25% share, which was less than half the 61% of smartphones it exported in 2024.

ALSO SEE: Chinese AI Firms, Chipmakers Form Alliance To Ditch Foreign Tech

Canalys, which is now part of Omdia, said smartphone shipments rose by 1% in the second quarter as vendors continued to frontload device inventories because of concerns about US tariffs, which soared to triple-digit levels in April before US and Chinese officials negotiated a trade truce in mid-May.

“The uncertain outcome of [tariff] negotiations with China has accelerated supply chain reorientation,” it said, adding that most of China’s share of shipments “has been picked up by India.”

“India became the leading manufacturing hub for smartphones sold in the US for the very first time in Q2 2025, largely driven by Apple’s accelerated supply chain shift to India amid an uncertain trade landscape between the US and China,” Sanyam Chaurasia, principal analyst at Canalys, said.

“Apple has scaled up its production capacity in India over the last several years as a part of its ‘China Plus One’ strategy and has opted to dedicate most of its export capacity in India to supply the US market so far in 2025,” he said.

Apple had begun to make and assemble Pro models of the iPhone 16 series in India, but the company was “still dependent on established manufacturing bases in China for the scaled supply needed for Pro models in the US,” Chaurasia added.

The US tech giant has ramped up production of iPhones to be sold in the US in India, amid a goal of making about a quarter off all iPhones there in coming years, although US President Donald Trump has been pressing CEO Tim Cook to manufacture more iPhones in the US.

Core Apple products such as iPhones and Mac laptops are exempt from Trump’s tariffs, but there is uncertainty on how long that exemption will last.

Meanwhile, other phone makers such as Samsung and Motorola have also been getting phones made in India, or Vietnam.

“Samsung and Motorola have also increased their share of US-targeted supply from India, although their shifts are significantly slower and smaller in scale than Apple’s, Chaurasia said.

“Motorola, similar to Apple, has its core manufacturing hub in China, whereas Samsung relies mainly upon producing its smartphones in Vietnam.”

While vendors were ‘frontloading’ devices to maintain high inventory levels in the US to counter the impact of US tariffs the market only grew by 1%, Canalys senior analyst Runar Bjorhovde said, which indicated “tepid demand in an increasingly pressured economic environment.”

He noted that new requirements for local operations and uncertain tariff policies meant it was “becoming less attractive for mid-to-small size vendors to operate in the US,” as exemplified by HMD’s move to scale back operations.

- Jim Pollard

ALSO SEE:

Price Cuts Help Apple Win Top Phone Sales Spot in China in May

Apple Sales in China Plunge 50%, Huawei Back on Top – Fortune

Apple Will Shift Production of US iPhones to India, FT Says

China’s Huawei ‘Hoping Its New AI Chip Can Outpower Nvidia’

Apple Stock Soars as iPhones Airlifted From India ‘to Beat Tariffs’

Apple Taps Alibaba to Bring AI to Chinese iPhones

Huawei Looks to Steal Apple’s Tech Crown With Tri-Fold Phone

Apple Offers Big iPhone Discounts in China Amid Sales Slump

Apple to Focus on China, Roll Out AI iPhones to Revive Sales

China’s Ban on iPhone Use Expands to Local and State Entities