US President Donald Trump signed multiple deals this weekend for access to critical minerals and rare earths from Southeast Asia amid increasing uncertainty around supplies from China.

On Sunday, Trump inked two separate deals with Malaysia and Thailand seeking cooperation with the United States to diversify critical minerals supply chains.

The deals were part of Trump’s visit to Kuala Lumpur for the Association of South East Asian Nations (ASEAN) summits during which he signed a flurry of deals to address trade imbalances and diversify supply chains.

Also on AF: Rare earth and the US-China powerplay

Kuala Lumpur was his first stop in a five-day Asia tour that is expected to culminate on Thursday in a face-to-face meeting with his Chinese counterpart Xi Jinping in South Korea.

Malaysia agreed on Sunday to refrain from banning or imposing quotas on exports to the US of critical minerals or rare earth elements, the countries said in a statement.

Separately, the White House said Malaysia had committed to working with American firms to ramp up the development of its critical minerals and rare earths sectors. The move will include “granting extended operating licences to create certainty for businesses to increase production capacity”, the White House said.

Malaysia has some 16.1 million metric tons of rare earth deposits, according to government estimates, but lacks the technology to mine and process them. It has, however, banned the export of raw rare earths to prevent the loss of resources as it looks to develop its downstream sector.

Still, Malaysia is aiming to develop midstream processing capabilities in the sector and said earlier this month it was open to foreign companies establishing joint ventures with local firms to develop rare earths in the country.

Meanwhile, with Thailand, Trump signed a more comprehensive deal for “critical mineral resource exploration, extraction, processing and refining, and recycling and recovery”.

A memorandum of understanding between the two — shared by the White House — includes commitments for investment into Thailand. The investments would be aimed at supporting Thailand’s processing industries, “rather than solely exporting raw materials”, the White House statement said.

Thai media, however, have since reported some domestic pushback against the deal. Opposition parties have said the ruling Anutin Charnvirakul government did not need to sign the deal with the US and should have instead protected the country’s national resources.

They also warned the deal could potentially block Chinese access to Thailand’s critical minerals, which could upset Beijing. Thailand’s economy had a considerable dependence on China, they warned, according to a report by The Bangkok Post.

China’s rare earths war

The US is racing to establish a rare earth supply chain separate from China following Beijing’s increasingly aggressive moves to restrict its exports of rare earths to the country.

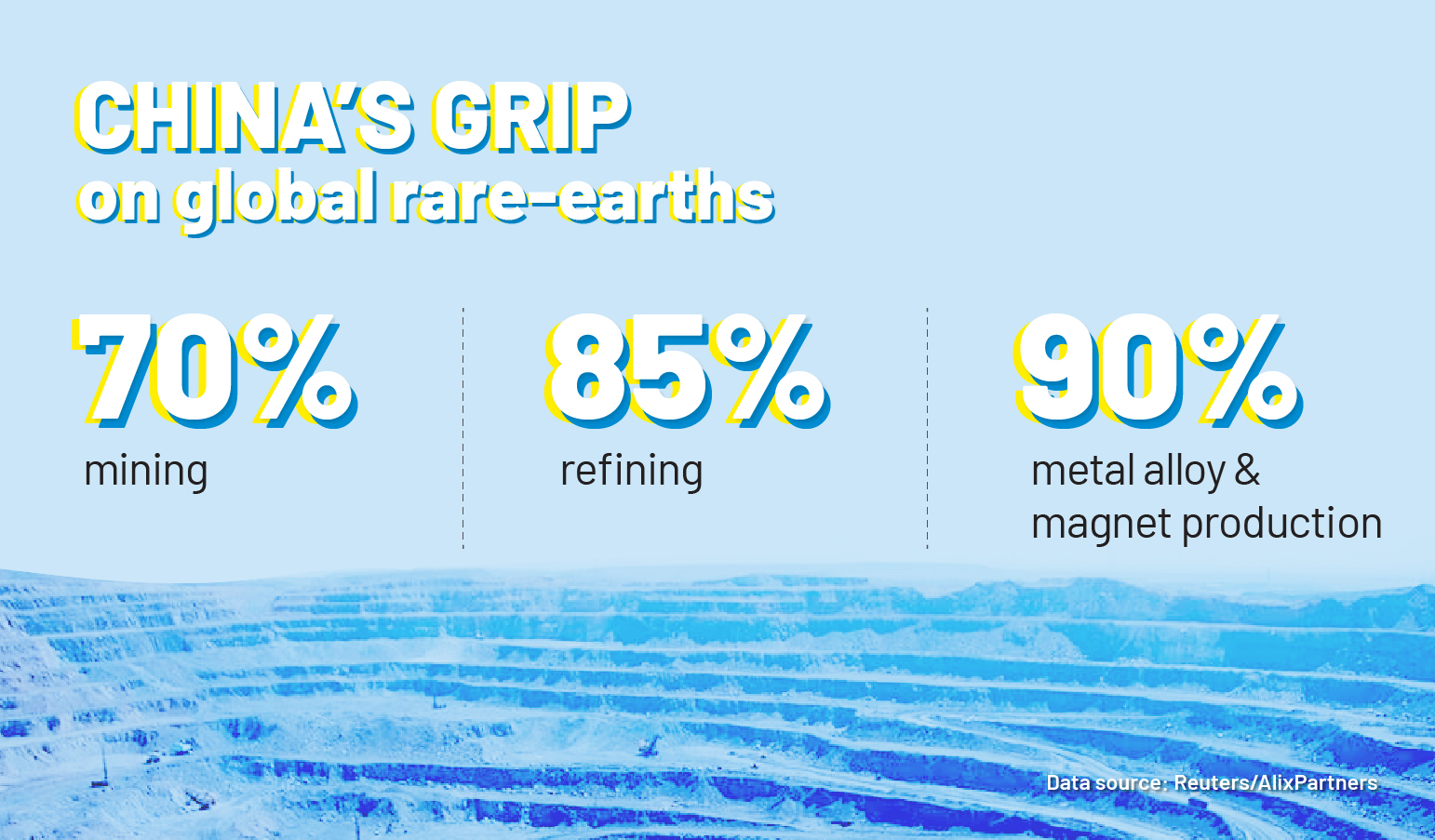

China dominates the processing and refining of rare earths, and the development of magnets made from them, both of which are critical to key industries like consumer electronics, military hardware, medical imaging, electric vehicles, or other green technologies. Currently, the country processes more than 90% of the world’s rare earths and magnets.

Beijing is also looking to develop rare earth supply chains beyond what it produces at home. It is in talks with Malaysia for a project to process that country’s rare earths, while at least half of its raw materials are currently sourced from northern Myanmar.

But Beijing has now also responded to an intensifying ‘chip war’ with the US by imposing restrictions on exports of rare earths and magnets similar to those imposed by the US on exports of advanced semiconductors and chipmaking tools.

Early this month, Beijing significantly ramped its restrictions, with rules that would effectively tighten its oversight of foreign producers that rely on Chinese materials. Top US officials have aggressively pushed back against the new rules, calling them a “power grab” that pit China against the world.

On Sunday, however, negotiators from the two countries hashed out a framework for a deal to delay the new Chinese export controls in exchange for cuts to American tariffs, US officials said. The news sent Asian stocks soaring to record peaks.

US Treasury Secretary Scott Bessent said talks on the sidelines of the ASEAN Summit in Kuala Lumpur had eliminated the threat of Trump’s 100% tariffs on Chinese imports starting November 1. Bessent also said he expects China to delay implementation of its rare earth minerals and magnets licensing regime by a year while the policy is reconsidered.

Chinese officials were more circumspect about the talks and offered no details about the outcome of the meetings.

Trump and Xi are due to meet on Thursday on the sidelines of the Asia-Pacific Economic Cooperation (APEC) summit in Gyeongju, South Korea, to sign off on the terms. While the White House has officially announced the highly anticipated Trump-Xi talks, China has yet to confirm that the two leaders will meet.

Before leaving for his Asia trip, Trump indicated he was considering making concessions to China to ease trade tensions.

On Monday, before landing in the Japanese capital Tokyo, Trump told reporters on Air Force One: “I’ve got a lot of respect for President Xi and I think we’re going to come away with a deal.”

- Vishakha Saxena

Also read:

Trade Deal Optimism Lifts North Asian Stocks to Fresh Peaks

US, Australia Sign $8.5bn Deal on Rare Earth, Gallium Projects

Trump Admits Threat of 100% Tariffs on China is ‘Not Sustainable’

China Making Exports Of Rare Earth Magnets ‘Increasingly Difficult’

US May ‘Extend Tariff Truce’ If China Delays New Rare Earth Rule

China Stops Most Antimony Exports But Rare Earth Sales to US Soar

China Did Not Agree to Military Use of Rare Earths, US Says

Carmakers Stressed by China’s Curbs on Critical Mineral Exports

China Export Curbs on Rare Earth Magnets: a Trade War Weapon

China Sets up Tracking System to Trace Its Rare Earth Magnets

China’s Critical Minerals Blockade Risks Global Chip Shortage

China’s Gallium Curbs a Headache for EV Carmakers

Western Firms Struggling to Break China’s Grip on Rare Earths

Lessons From Japan on Tackling China’s Rare Earth Dominance