The United States could consider extending a 90-day tariff truce it reached with China if Beijing delays its new curbs on rare earth elements and magnets, US Treasury Secretary Scott Bessent said on Wednesday.

“Right now we are currently in a 90-day roll on the tariffs. So, is it possible that we could go to a longer roll in return for a delay? Perhaps, but you know, all that’s going to be negotiated in the coming weeks,” Bessent said at a press conference in Washington.

Bessent added that the negotiations would be held before US President Donald Trump and his Chinese counterpart Xi Jinping hold a planned meeting on the sidelines of the APEC Summit in South Korea.

Also on AF: Apple Looks To Boost China, India Investment Despite Trump Pressure

Last week, China dramatically expanded its rare earth export controls by adding five new elements and extra scrutiny for semiconductor users. Less expansive rules China imposed months earlier brought global automakers to their knees within weeks.

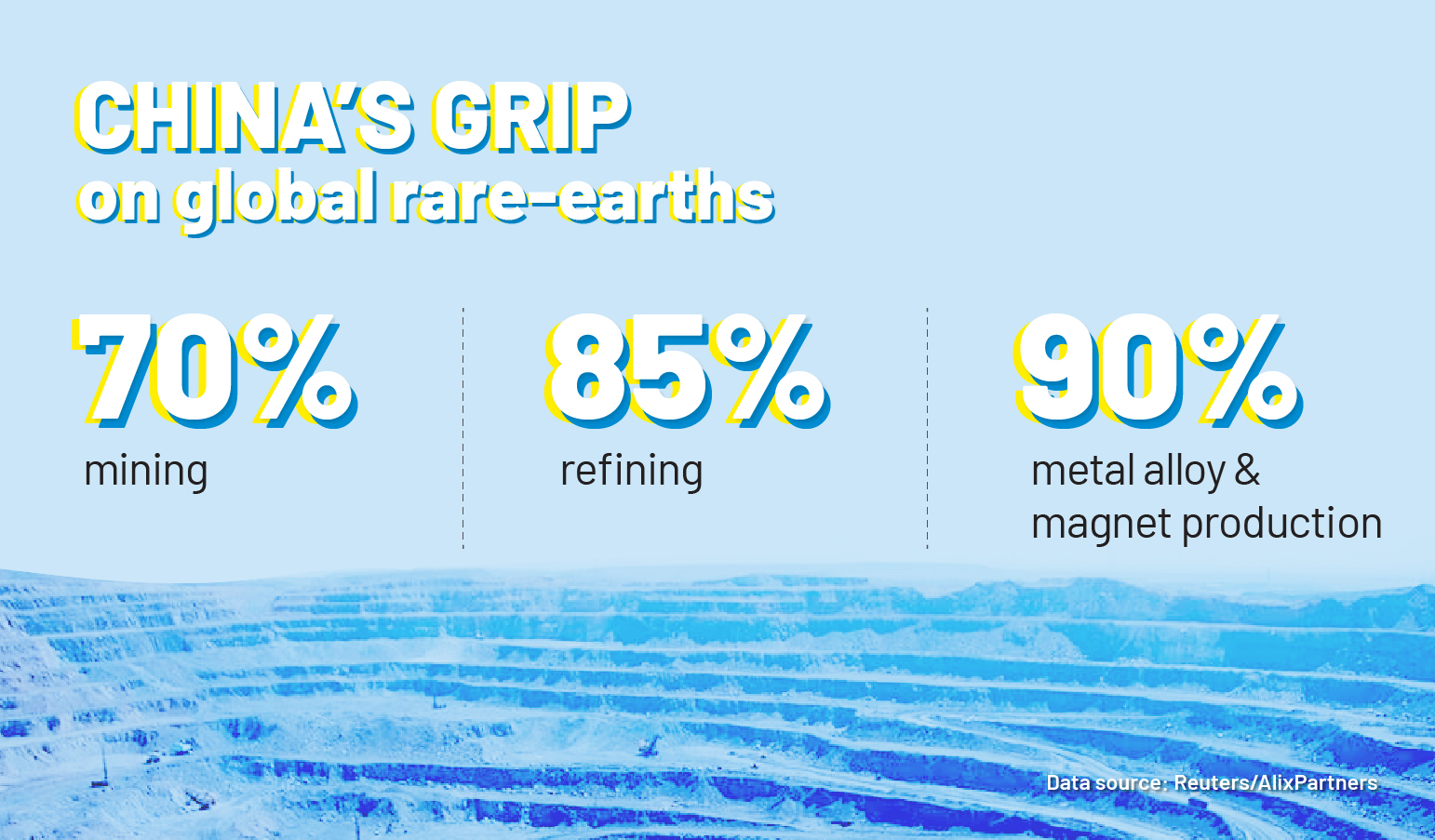

China produces over 90% of the world’s processed rare earths and rare earth magnets. There are 17 rare earths that are vital materials in products ranging from electric vehicles to aircraft engines and military radars. Exports of 12 of them are now restricted.

Foreign companies producing some of the rare earths and related magnets on the list will now also need a Chinese export licence if the final product contains or is made with Chinese equipment or material. This applies even if the transaction includes no Chinese companies.

The regulations mimic rules the US has implemented to restrict other countries’ exports of semiconductor-related products to China.

US ‘constantly focused on China’s rare earth chokehold’

Speaking before Bessent, US Trade Representative Jamieson Greer described the expanded curbs as a complete repudiation of US-Chinese trade agreements over the past six months.

“To be clear, this is not just about the United States. These actions, if implemented, would apply to the entire world… It is an exercise in economic coercion on every country in the world,” Greer said.

“At its core, China’s new measures include a rule saying that any product of which more than 0.1% of minerals consist of minerals mined or processed in China, one must seek approval from the Chinese government before trading it. Since many important semiconductors, for example, have these critical minerals and semiconductors are in nearly everything… this rule gives China control over basically the entire global economy and the technology supply chain,” he said.

“This will impact artificial intelligence systems and high-tech products, but even regular consumer items like cars, smartphones, and potentially even household appliances could be affected. It would also apply to many items that are necessary for defence purposes. And again, it covers the whole world,” Greer added.

Referring to comparisons with US chip controls, Greer said China’s latest controls were “wildly out of proportion to any targeted actions by the United States or its allies over the past few months.”

Greer added that the US was constantly focused on China’s choke-hold on rare earth supplies. Washington wants any negotiations with Beijing on the matter to be “the last time we talk about rare earths with China,” he said.

China ‘can’t be trusted’

Meanwhile, Bessent also told journalists on Wednesday that it remains unclear if China’s recent restrictions on exports of rare earth minerals represent a split politically inside its trade negotiating team.

“It’s very difficult to know,” Bessent said on the sidelines of the annual meetings of the International Monetary Fund and World Bank.

He said a Chinese official “showed up uninvited in Washington and said, quote, ‘China will cause global chaos if the port shipping fees go through’.” “I don’t believe China wants to be an agent of chaos,” Bessent said.

But he later added that China “can’t be trusted with the global supply chain”.

- Vishakha Saxena

Also read:

China Making Exports Of Rare Earth Magnets ‘Increasingly Difficult’

China Starts Collecting Tit-For-Tat Port Fees On US-Owned Ships

Lessons From Japan on Tackling China’s Rare Earth Dominance

China Steps up Checks on Nvidia AI Chips at Major Ports

Trade Deal Signed, But China Still Slow to Release Rare Earths

China Stops Most Antimony Exports But Rare Earth Sales to US Soar

China Did Not Agree to Military Use of Rare Earths, US Says

Korea’s Hyundai Has Rare Earths Stockpile That Can Last A Year

China Plays Rare Earths Card in EV Tariff Negotiations With EU

Carmakers Stressed by China’s Curbs on Critical Mineral Exports

China Export Curbs on Rare Earth Magnets: a Trade War Weapon

China Sets up Tracking System to Trace Its Rare Earth Magnets

China’s Critical Minerals Blockade Risks Global Chip Shortage

China’s Gallium Curbs a Headache for EV Carmakers

Western Firms Struggling to Break China’s Grip on Rare Earths