(ATF) As any PR person will tell you, governments that slaughter their own citizens will struggle when it comes to doing business. Very few companies will tolerate being linked to gross human rights abuses, and that appears to be the case with the Tatmadaw – as the notorious Myanmar military is known.

More foreign companies are feeling uncomfortable about their ties with companies that fund an army shooting hundreds of citizens dead, including dozens of children – incidents that have been filmed and seen by people on social media all around the world.

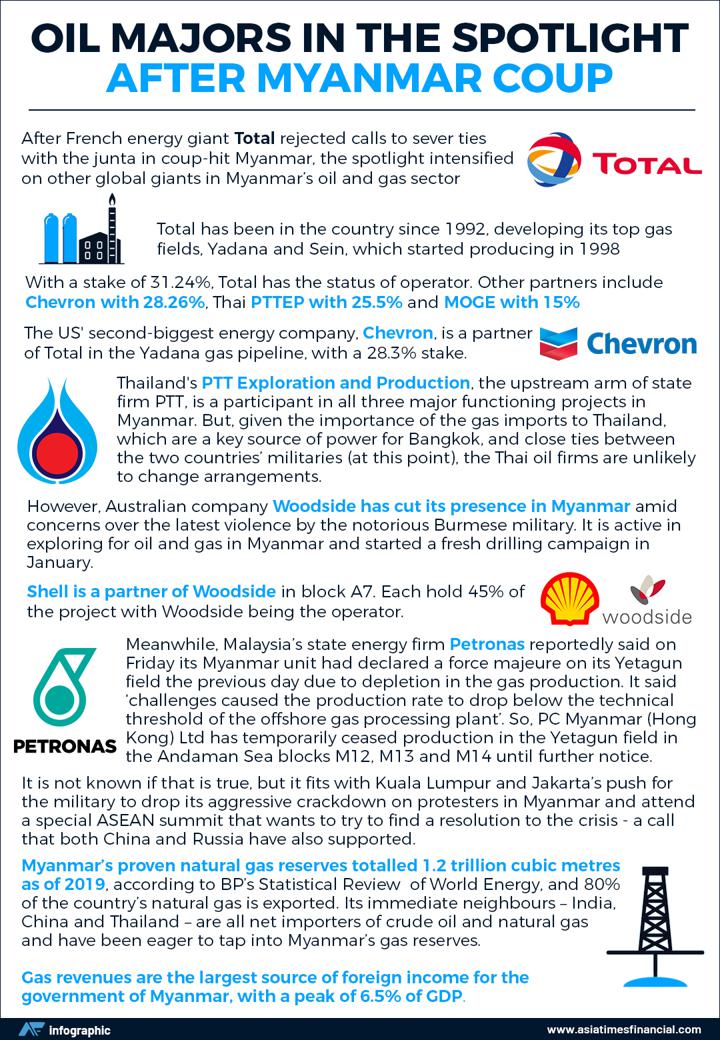

Kirin, the Japanese beer giant, was one of the first to cut ties with the Myanmar military several days after the government led by Aung San Suu Kyi was ousted at the beginning of February. And a range of others such as Woodside, the Australian oil and gas major, along with Amata, the Thai operator of industrial parks, and the French energy giant EDF, have suspended ties.

Now, two more companies have signalled they want out or to reduce tieswant out – Petronas, the Malaysian state energy firm, and Posco, the South Korean conglomerate with divisions in steelmaking and gas ventures.

Malaysia’s state energy firm Petronas said on Friday that its Myanmar unit had declared “force majeure” on its Yetagun gas field – offshore in the Andaman Sea – on Thursday due to depletion of gas production.

The decision came after challenges that resulted in the production rate dropping below the technical threshold of the offshore gas processing plant, Petronas said in a statement. It said the unit, PC Myanmar (Hong Kong) Ltd (PCML), stopped production until further notice at the Yetagun field in Blocks M12, M13 and M14.

The news came shortly after Malaysian Foreign Minister Hishammuddin Hussein met his Chinese counterpart Wang Yi in Nanping, in Fujian Province, on April 1. Indeed, Hishammuddin was one of four foreign ministers from ASEAN who Wang Yi held one-on-one talks with last week – the four Southeast Asian nations that have been most vocal about Myanmar’s political crisis, the South China Morning Post noted.

The others were Singapore’s Vivian Balakrishnan, who met Wang in Fujian province on Wednesday, before Hishammuddin on Thursday, Indonesia’s Retno Marsudi on Friday morning and Teddy Locsin Jnr from the Philippines on Friday afternoon.

Singapore’s foreign ministry issued a statement on Thursday saying Balakrishnan and Wang discussed the “tragic situation” in Myanmar and voiced “alarm” over the Myanmar military’s continued use of lethal force. “The ministers called for a de-escalation of the situation, a cessation of violence and the commencement of constructive dialogue among all sides,” it said.

It is not known if Petronas’ move to suspend operations in Myanmar is linked to Hishammuddin’s visit to China, but Malaysian Prime Minister Muhyiddin Yassin on Friday expressed support for Indonesian President Joko Widodo’s call to hold an emergency ASEAN summit to address the situation in Myanmar.

Muhyiddin described the persistent use of live ammunition against unarmed civilians in peaceful protests was “unacceptable”.

POSCO REVIEWING ITS OPTIONS

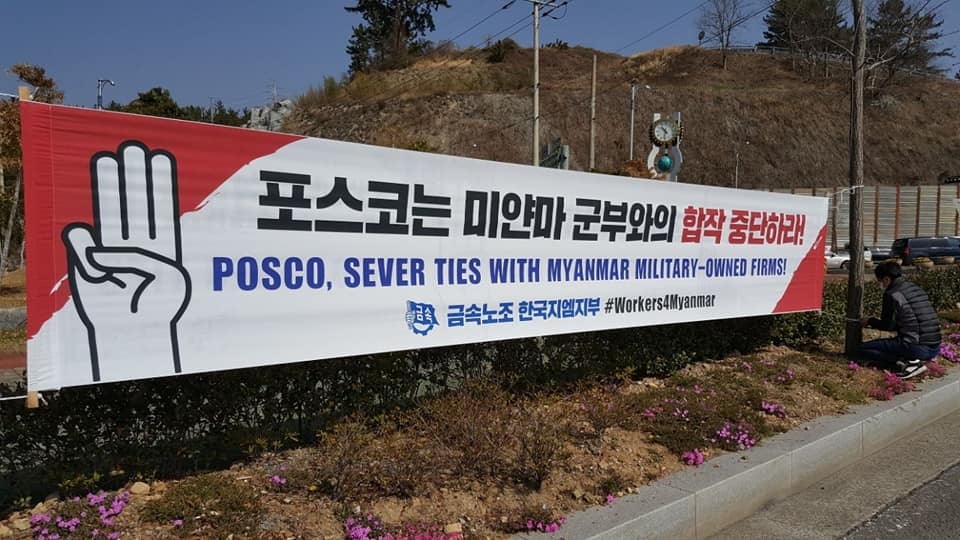

Meanwhile, Posco has begun reviewing how it might end a joint venture with a firm controlled by the Myanmar military, according to a report by Reuters on Monday April 5, which quoted “two people with first-hand knowledge of the matter”.

The people said the Korean parent’s Posco C&C arm is looking into either selling its 70% stake in the venture with Myanmar Economic Holdings Ltd (MEHL), or buying out its partner’s stake. It wasn’t immediately clear how much the 30% holding might be worth.

The internal discussions come amid growing scrutiny from shareholders and rights activists on international businesses still operating partnerships in Myanmar.

MEHL is among Myanmar military entities recently sanctioned by the United States and Britain. Posco C&C has repeatedly said it hasn’t paid dividends to MEHL since the 2017 Rohingya crisis drew international criticism of Myanmar’s military.

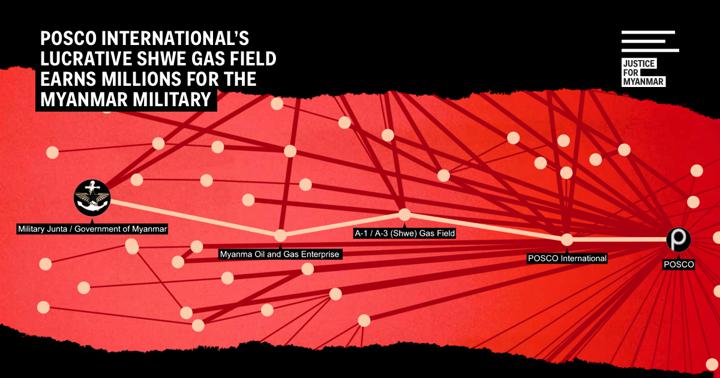

But those with knowledge of the matter say Posco is wary of an abrupt steel exit because it could jeopardise hundreds of millions of dollars earned from more lucrative gas projects operated jointly with another Myanmar state firm by an affiliate, Posco International.

“We won’t want to run the business like we do now, and we are reviewing restructuring our Myanmar operation,” one of the two sources with knowledge of the discussions told Reuters. The people declined to be identified citing internal company policy.

“This doesn’t mean we are rushing to make any decision, but two options that could potentially take place include selling our stake or buying out their (MEHL’s) stake.”

Posco C&C previously said its business would not be hit by sanctions, and that it will only take action if it finds that MEHL is directly involved in the coup. MEHL didn’t respond to Reuters’ request for comment.

The profits that Posco makes from the Myanmar steel business – about 2 billion won ($1.77 million) last year – are dwarfed by earnings from Myanmar gas projects.

About two thirds of the operating profit at Posco International came from latter last year – around 300 billion won ($265.5 million) – in partnership with local state energy firm Myanmar Oil and Gas Enterprise (MOGE).

“Relatively speaking, (the) steel sheets business isn’t making big bucks. And its ownership structure is much simpler than some of Posco’s other businesses in Myanmar,” the second source at the company said. “But if we exit, it would be important to say ‘bye’ on good terms.”

Total of France and US-based Chevron have also worked for decades with MOGE, which is yet to come under sanctions, although the UN’s human rights investigator last month called for coordinated sanctions.

Exiting steel rather than gas would also be simpler due to a more complex ownership structure in the latter venture, the sources said.

While Posco International controls the gas projects via its 51% stake, India’s Oil and Natural Gas Corp (ONGC) and GAIL own 17% and 8.5% stakes respectively.

PRESSURE BUILDING

International pressure against the military and companies that have ties with it has ramped up since February, with death toll close to 550 in the two months since the generals overthrew Suu Kyi’s elected government, just hours before they were due to start a second term.

Shin Mee-jee at South Korea’s People’s Solidarity for Participatory Democracy was among those at pressure groups who said the country’s huge national pension fund – the National Pension Service (NPS) – should exert pressure on Posco to cut ties with Myanmar’s military. NPS is the largest shareholder in Posco, with an 11.1% stake worth $2.42 billion, and the world’s third-biggest pension fund overall with nearly $1 trillion in assets.

“What a nonsense, to see our taxpayers’ money being channeled to kill the people of Myanmar through the (pension) … The government also needs to be more responsible about where the pension fund’s money is going,” Shin said.

Investors in Europe, meanwhile, are taking greater interest in Posco’s plans for Myanmar. Sweden’s public pension fund, which owns Posco shares, told Reuters it has quizzed the company over its Myanmar investments as it is concerned about human rights issues in the country. And Nordic investor Nordea told the Swedish arm of the Fair Finance network, initiated by Oxfam, it had put Posco “in quarantine until further notice” regarding its Myanmar plans.

Other large companies – such as DHL, the global courier firm owned by Germany’s Deutsche Post DHL, and Total are getting lobbied to end their business dealings in Myanmar by the Committee Representing Pyidaungsu Hluttaw (elected NLD MPs ousted by the military) and groups such as Justice For Myanmar.

Patrick Pouyanne, the CEO of Total, the French energy giant, has said his conglomerate will not leave, because it does not want to endanger its employees or the Burmese who work with them. However, he has allegedly undertaken to pay human rights organisations the equivalent of the taxes that his company will pay.

Meanwhile, Justice For Myanmar has called on Dutch pension funds ABP and PFZW, which reportedly hold $2.3 billion in shares in 20 multinational companies linked to Myanmar’s military, to divest from firms that have longstanding ties to the military and demand that other companies stop financially enabling them.

Yadanar Maung spokesperson of Justice For Myanmar said: “It is shocking that while the Dutch government supports Gambia’s complaint against Myanmar for the crime of genocide at the International Court of Justice, Dutch pension funds are profiting from the Myanmar military’s crimes against humanity and abhorrent violence against the people.

“Dutch pension funds must immediately divest from companies that have direct links to the Myanmar military. The more than $2 billion invested in companies with links to the military is helping to sustain their brutal oppression of the people of Myanmar.

“Rather than helping the Myanmar military to commit grave crimes against its people, the Dutch government can ensure that the EU impose immediate targeted sanctions against the Myanmar military and their businesses and partners, while also supporting a global arms embargo. This is an opportunity for the Dutch government to demonstrate that it stands with the people of Myanmar, not the murderous Myanmar military.”

The pension funds were unavailable for comment at time of going to press.

With reporting by Reuters