Economic data released by China on Tuesday suggests industrial activity swung back to growth in January, despite a massive Covid wave in the lead-up to the Lunar New Year break.

The first broad data points to domestic orders and consumption driving output higher, and that China is quickly recovering from the dramatic Covid wave that may have killed a million or more people after its tough ‘zero-Covid’ restrictions were dropped early last month.

The official purchasing managers’ index (PMI), which measures manufacturing activity, rose to 50.1 in January from 47.0 in December, the National Bureau of Statistics (NBS) said on Tuesday.

Economists in a Reuters poll had predicted the PMI to come in at 48.0. Since the result was above 50.0, it implied growth.

Recently, there has been scepticism about data from China, given its official Covid statistics, which critics said was unreliable and lacked credibility, as well as long-term concerns about ‘management’ of the country’s economic figures.

Responses to the latest data have been cool. Most analysts have warned that the economy faces persistent weakness in external demand.

ALSO SEE:

US Blocking Export of 4G Chips, Items for China’s Huawei

‘Unexpected’ rebound

The rebound in non-manufacturing activity was more decisive than expected by economists, but helped by a seasonal surge in spending for the Lunar New Year holiday. That index, which covers services, leapt to 54.4, from 41.6 in December.

Both indexes had previously shown the economy to be contracting since September.

“The PMI data showed that confidence in production, operation, and the state of the market has improved significantly,” Bruce Pang, chief economist at Jones Lang Lasalle, wrote in a note, while pointing to the level of a sub-index for new export orders, just 46.1, as cause for concern.

As foreign economies have weakened under pressure from rising interest rates, so has demand for China’s exports, which last month were 9.9% lower than a year earlier.

January’s rebound in activity “is a bit unexpected as everyone is still quite cautious,” said Dan Wang, chief economist at Hang Seng Bank China. “It’s difficult for PMI to pick up in the same month as the Chinese New Year, as workers normally have two weeks off.”

“All the other real indicators – employment, inventory and delivery times – got worse …. Export orders went down, so that means domestic orders must have gone way up,” she added.

Surge of holiday trips

Yet the speed of recovery in activity corresponds to what is increasingly understood to have been an infection wave that came very quickly, disrupting work and consumer demand, then also faded very quickly, leaving factory managers to get production on line again and retailers to welcome back customers.

Some 80% percent of people in China had already been infected with Covid-19 before the Lunar New Year festivities began, according to the country’s chief epidemiologist.

Still, strong holiday consumption has flattered the January PMI report. Lunar New Year consumption had already been reported as 12.2% higher than in last year’s holiday period, while holiday trips inside China for the same period surged 74%, as people headed out to celebrate for the first time in three years without Covid restrictions.

After almost three years of following a zero-Covid strategy, China eased pandemic controls in November then dropped them almost completely in early December.

For the festive period, factories tried to make up ground lost to last year’s disruptions. Kevin Whyte, who sources homewares in China for a major Britain-based retailer, said his partner factory in China had offered bonuses to workers to shorten their vacations over the New Year period.

The cabinet said on Saturday it would promote a recovery in consumption as the major driver of the economy and also aim at helping importers.

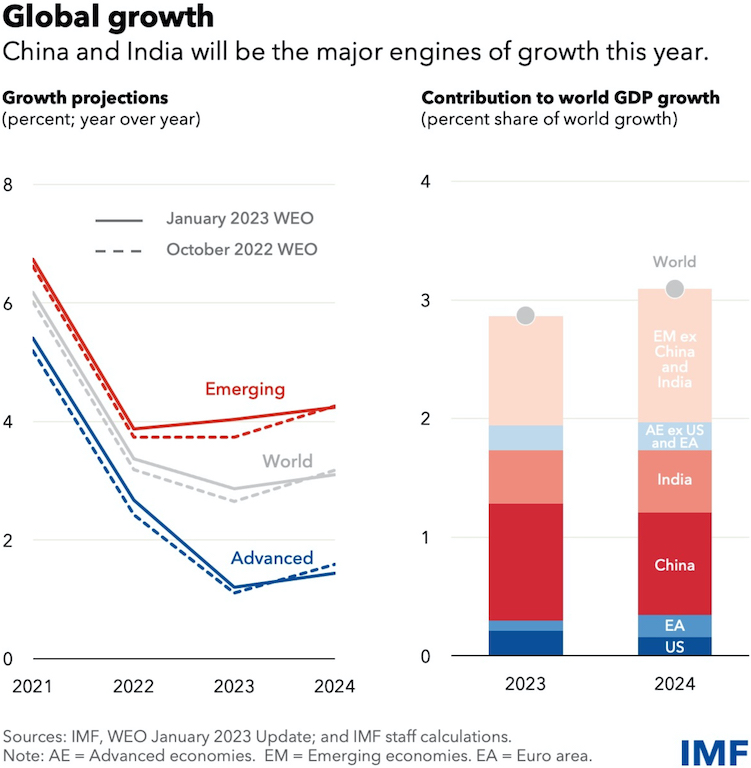

The IMF on Tuesday also addressed the speed of China’s economic recovery. The boost from renewed mobility would be short lived, it said.

The international agency revised up its outlook for 2023 expansion in gross domestic product to 5.3%, from the 4.4% it estimated in October, but warned growth would likely fall again to 4.5% in 2024.

The official composite PMI, which combines manufacturing and services, rose to 52.9 from 42.6 in December.

The private sector Caixin manufacturing PMI, which focuses more on small firms and coastal regions, will be published on Wednesday February 1. Analysts polled by Reuters expect a headline reading of 49.5, up from 49.0 in December.

- Reuters with additional editing by Jim Pollard

NOTE: This report was amended on January 31, 2023 to add the IMF graph on sources of growth seen in 2023.

ALSO SEE:

China’s Factory Downturn Slows in Upbeat Sign For Economy

Steps Made Towards Deal on Fresh China Chip Curbs: ASML

Tourists Flock Back to Macau over Lunar New Year Break