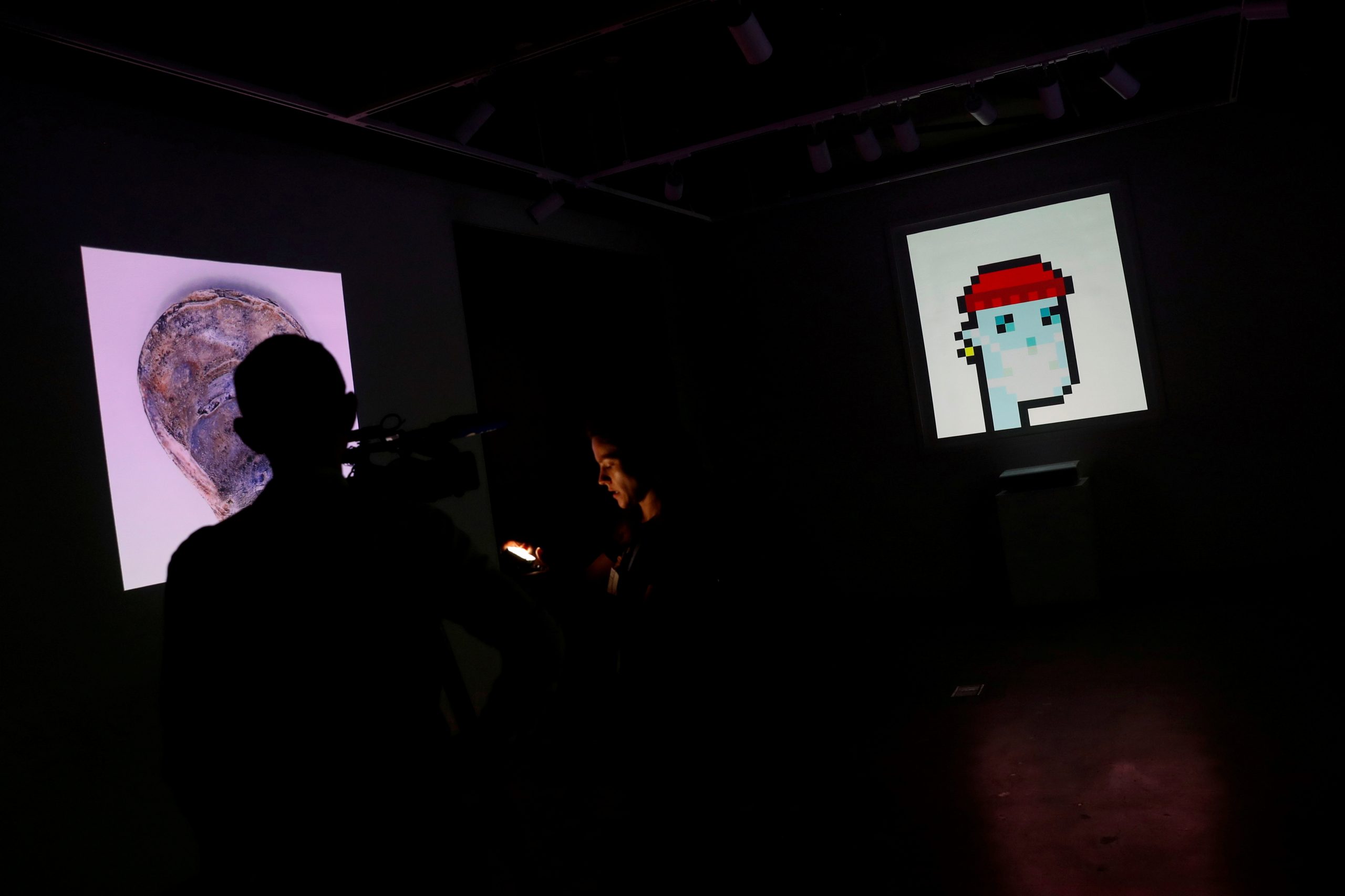

From a cartoon penguin and ape to a collage of electronic images, sales of crypto art and other digital collectibles have surged. But experts warn the sharply rising popularity of the assets could be fuelling a new bubble.

Non-fungible token (NFT) sales surged in August, according to the largest platform for the burgeoning asset class. Speculators are betting that growing interest across the art, sport and media worlds will keep prices rising. They are pushing up valuations by on-selling the assets at much higher prices.

Among the highest profile flips was an NFT representing an image of a cartoon ape that was sold on OpenSea for 39 ETH – the cryptocurrency ether – last week. That’s equivalent to $124,205 at time of purchase. The buyer had snapped it up for 22.5 ETH two weeks earlier, according to analytics platform Etherscan. An NFT of an abstract digital artwork sold for 1,000 ETH on Monday having been sold for 0.58 ETH in June.

The Don’t Exist

The niche crypto asset, which is a blockchain-based record of ownership of a digital item such as an image or a video, exploded in popularity in early 2021, leaving many confused as to why so much money was being spent on items that don’t physically exist.

The frenzy has now reached new highs. Sales volumes recorded on the largest NFT trading platform, OpenSea, have hit $1.9 billion this month, more than 10 times March’s $148 million. In January 2021, the monthly volume recorded on the platform was just over $8m.

The jump was driven by secondary market sales, OpenSea said.

“What we have seen are a few NFT collections popping up in the last few weeks that have been very successful at launch and sold out. That activity has then filtered over to OpenSea where buyers look to flip their NFTs for a higher price,” said Ian Kane, a spokesman for DappRadar, which tracks the market.

Crypto Wealth

NFT market data varies depending on providers’ methodology, but DappRadar recorded 32 known NFT sales above $1 million in the past 30 days.

MichaelK, a 30-year-old NFT buyer who asked not to give his full name, said he has spent about $250,000 on NFTs since September. He said he keeps 90% of his wealth in cryptocurrencies and NFTs.

Earlier this month, he bought an NFT of a cartoon penguin for around $139 worth of ether, then sold it on four days later for around $3,956, according to Etherscan.

Other instances of high-return flips are visible on his OpenSea account, including a cartoon squiggle NFT bought for 0.01 ETH, and sold for 1.5 ETH within seven hours.

‘Bubblicious Stupidity’

MichaelK said the US Federal Reserve’s ability to control the money supply played a role in his decision to speculate on largely unregulated crypto assets.

“When people hear these statistics they might think that I’m completely crazy… I look back at them and I say, you’re holding a currency that’s printed daily, to me you’re crazy.”

He said Covid-19 forcing people to spend more time at home, online, helped NFTs take off.

“I don’t want to look at it as a bubble. I want to look at it as something new that’s going to be a big wave,” he added.

Rising cryptocurrency prices may have also played a role in the surge. NFTs are often valued in ether, which has risen around 23% this month.

Rabobank’s head of financial markets research for Asia-Pacific, Michael Every, said that he was “gobsmacked” by the “bubblicious stupidity” of the NFT market.

He said that he saw the appeal of high returns for young people who would otherwise struggle to build wealth or get on the housing ladder, but compared it with buying a lottery ticket.

Every said NFTs were a bubble that would “absolutely” pop.

- Reuters and Mark McCord

Also on AF

The Disruptive Strategist – crypto, NFTs and blockchain

First ever tweet already has $2.5 million worth of likes