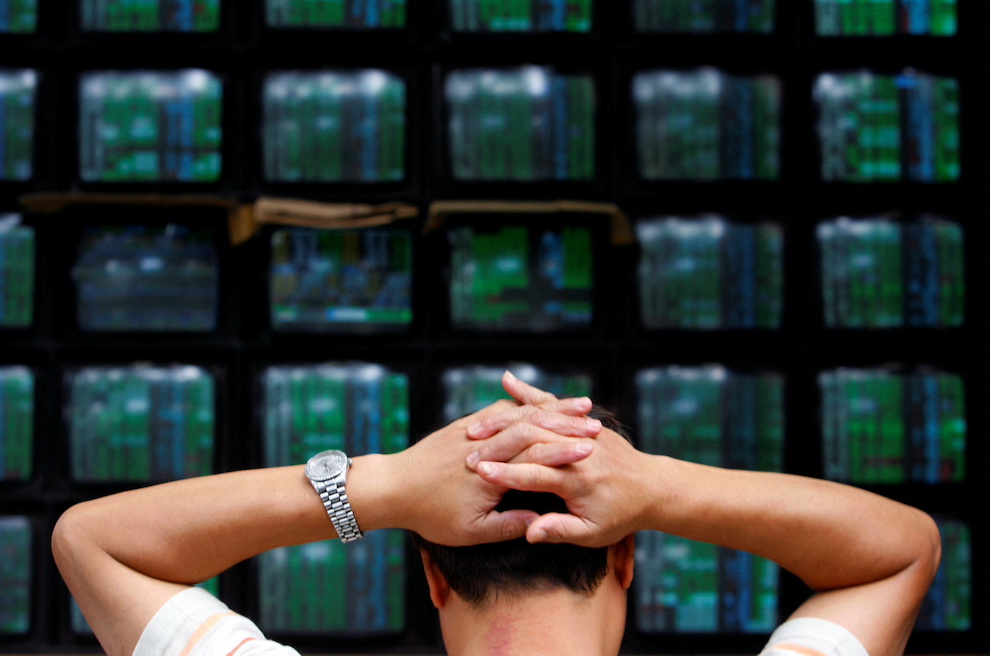

Asian stocks were in full retreat on Thursday as higher-than-expected US inflation figures sparked a Wall Street slump with investors fearing the economic toll of aggressive interest rate hikes to tackle it.

Traders had been hoping the April US consumer price report would reduce the pressure on the Federal Reserve to hike interest rates, but the rise of 8.3% sent a shockwave across global markets.

That shockwave hit Asia and Tokyo, Hong Kong, Sydney and Seoul were negative all day. In Europe, London plunged 2% at the open.

Also on AF: Foxconn Sees 5% Profit Rise Despite Lockdowns, Weak Demand

The benchmark Nikkei 225 index fell 1.77%, or 464.92 points, to end at 25,748.72, while the broader Topix index gave up 1.19%, or 21.97 points, to 1,829.18.

In Hong Kong, the Hang Seng Index dropped 2.24%, 444.23 points, to 19,380.34 with tech firms leading the plunge. The Hang Seng Tech Index was down nearly 4% – and has fallen by more than 30% this year – with JD.com dropping 7.8%, Alibaba falling over 6% and Baidu sliding 5.2%.

Mainland China stocks suffered lower too in volatile trade, with the US inflation news overshadowing falling Covid-19 cases and Beijing’s repeated vows to support the economy.

Nomura estimated this week that 41 Chinese cities are in full or partial lockdowns, making up 30% of the country’s GDP.

Heavyweight property developer Sunac said it missed a bond interest payment and will miss more as China’s real estate sector remains in the grip of a credit crunch.

The blue-chip CSI300 index fell 0.4% to 3,958.74, after rising as much as 0.2% in early afternoon trade, while the Shanghai Composite Index dropped 0.12%, or 3.71 points, to 3,054.99. The Shenzhen Composite Index on China’s second exchange rose 0.16%, or 3.14 points, to 1,921.66.

The yuan fell to a 19-month low of 6.7631 and has dropped almost 6% in under a month.

Indian stocks felt the pain too with Mumbai’s signature Nifty 50 index down 2.55%, or 412.50 points, at 15,754.60.

Dollar Soaring, Crypto Plunging

Globally, the picture was just as grim with world markets dropping to an 18-month low, the dollar soaring and cryptocurrencies plummeting.

The dollar hit its highest in two decades, as fears grew that fast-rising inflation will drive a sharp rise in interest rates that will bring the global economy to a standstill.

Those nerves and the still-escalating war in Ukraine took Europe’s main markets down more than 2% in early trade and left MSCI’s top index of world shares at its lowest since late 2020 and down nearly 20% for the year.

Nearly all the main volatility gauges were signalling danger. Bitcoin was caught in the fire-sale of risky crypto assets as it fell another 8% to $26,570, having been near $40,000 just a week ago and almost $70,000 just last November.

In commodity trade, oil wound back a bit of Wednesday’s surge on growth worries.

Brent crude futures fell 2.3% to $104.93 a barrel, while highly growth-sensitive metals copper and tin slumped over 3.5% and 9% respectively. That marked copper’s lowest level since October.

Key figures at 0720GMT

Tokyo – Nikkei 225 > DOWN 1.8% at 25,748.72 (close)

Hong Kong – Hang Seng Index > DOWN 2.2% at 19,354.39 (close)

Shanghai – Composite > DOWN 0.1% at 3,054.99 (close)

London – FTSE 100: DOWN 2.3% at 7,176.43

West Texas Intermediate > DOWN 2.4% at $103.21 per barrel

Brent North Sea crude > DOWN 2.1% at $105.24 per barrel

New York – Dow > DOWN 1.0% at 31,834.11 (Wednesday close)

- Reuters with additional editing by Sean O’Meara

Read more:

SoftBank Posts $13bn Loss as Tech Stocks Portfolio Slumps

Hong Kong Props Up Local Currency Amid Capital Outflows

China’s Currency Falls to 19-Month Low Against Dollar