(ATF) Asian markets climbed Thursday on optimism of a steadier US economic policy after President-Elect Joe Biden won control of the Senate with victories in two senatorial run-offs in Georgia.

Biden’s so-called Blue Wave victory – he also won the lower chamber of Congress – means he secures control of the American legislative programme for at least the next two years, during which markets hope for an era of stimulus and stable economic management.

The rally came despite political turmoil in the US after a rightwing mob seized the US Capitol in Washington spurred on by outgoing president Donald Trump, who still insists without evidence that he won the November election.

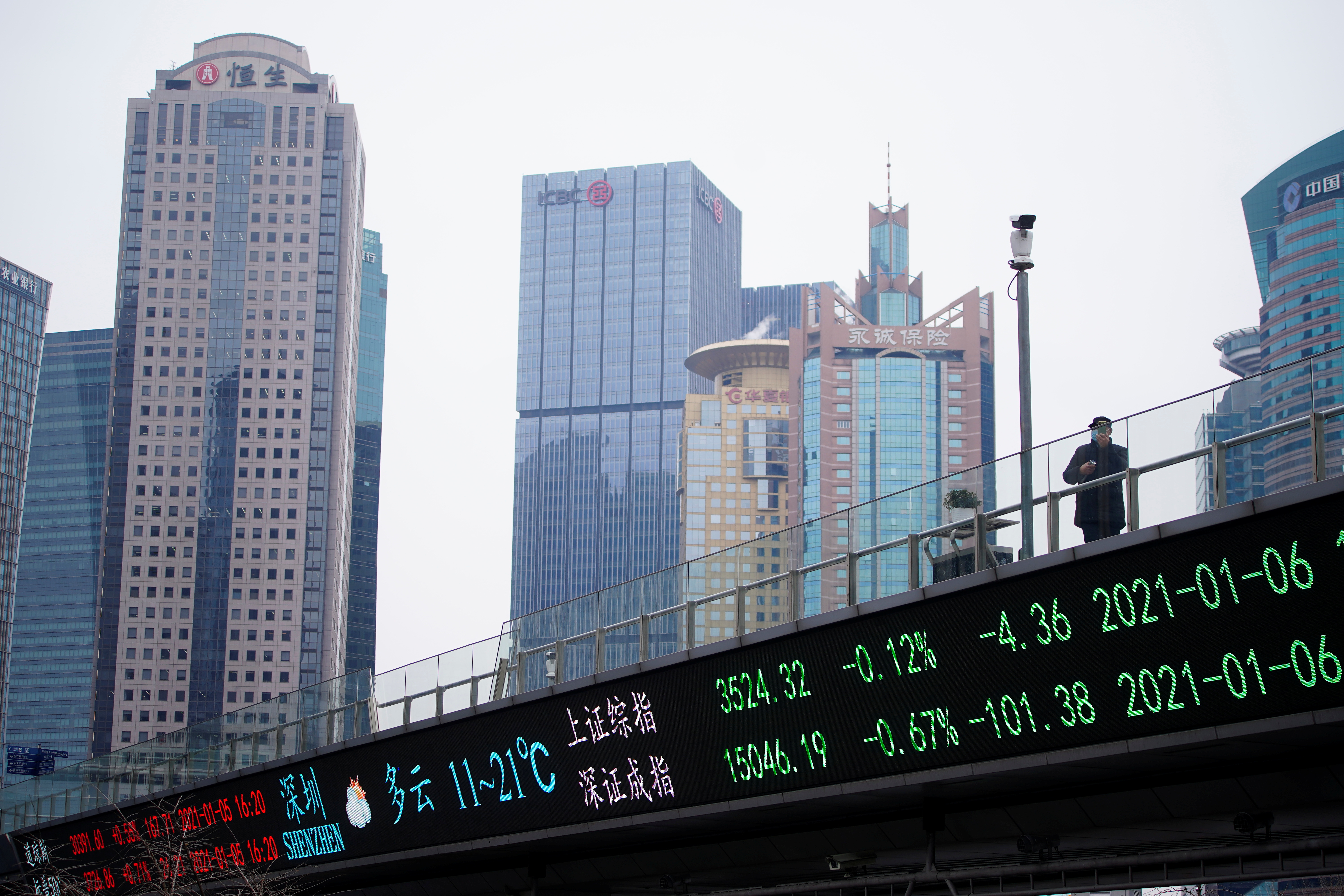

Japan’s Nikkei 225 index advanced 1.60%, Australia’s S&P ASX 200 jumped 1.59%, China’s CSI300 added 1.77% but Hong Kong’s Hang Seng index slumped 0.52% as tech and telecom heavyweights came under renewed pressure from the Trump administration.

Regionally the MSCI Asia Pacific index rose 1.43%.

“The Democrat Blue Wave has have finally come to the US via Georgia’s shore, giving President-elect Biden more firepower to push through his agenda,” said David Chao, Global Market Strategist, Asia Pacific (ex-Japan) at Invesco.

“A Democrat Sweep – which means additional fiscal stimulus – is good for Asia’s economies and markets,” Chao said. “The APAC region’s export-oriented economies are the most exposed to cyclical factors and will gain relative to global peers.”

Dollar gains

The US dollar edged up against a basket of currencies but remained below the 90 level and gold fell 0.5% to $1,912 per ounce as safe havens were shunned.

“The increase in spending and its positive impact on growth is however negative for the US dollar. With a Fed that is firmly standing still, the boost to growth is likely to lift inflation expectations and put downward pressure on real interest rates,” said BCA Research in a note.

US Treasuries were also weak with the 10-year yield rising two basis points to 1.05% and more weakness was in store according to analysts.

“The longer-term US Treasuries have generally lagged other asset classes in terms of factoring in the economic recovery from the Pandemic. There will be further catching up to do in the coming months,” said DBS strategists Philip Wee and Eugene Leow.

“We reiterate our view of neutral 10Y yields at 1.30%, a level that is likely to be more sustainable reached by vaccines become more widely disseminated in 2H21.”

Also on Asia Times Financial

- Washington chaos overshadows Georgia vote implications for markets

- Thinking the unthinkable

- NYSE China delisting fiasco shows risk to exchanges, index providers

- Top IMF economist calls for more stimulus to beat pandemic

- Marks and Spencer ban on Xinjiang cotton puts China stores on the spot

- Taipei’s foreign exchange reserves rise at a record monthly pace

- Korea’s SK Group takes $1.5 billion stake in US hydrogen company

Asia Stocks

- Japan’s Nikkei 225 index advanced 1.60%

- Australia’s S&P ASX 200 jumped 1.59%

- Hong Kong’s Hang Seng index slumped 0.52%

- China’s CSI300 added 1.77%

- The MSCI Asia Pacific index rose 1.43%.

Stock of the day

Telecom stocks China Unicom, China Telecom and China Mobile fell as much as 9% after the New York Stock Exchange confirmed the delisting of the three Chinese telcos. Alibaba and Tencent slumped about 5% following a report that the two would be subject to an executive order signed by Trump in November, which bans US investors from buying shares of the blacklisted firms starting November this year.