Asian shares were stuck at two-year lows on Thursday as news of soaring inflation in the US raised the spectre of more rate hikes in the months ahead.

Japan’s Nikkei scratched out some gains off the back of the plunging yen as the dollar continued its relentless surge on rising bets of aggressive interest rate hikes in the United States but stocks in Hong King and mainland China suffered.

Wednesday’s data showed US consumer prices jumped 9.1% year-on-year in June, up from May’s 8.6% rise.

Also on AF: Lithium Miner Lake Resources Hits Back at Short-Seller Criticism

That saw Japanese shares jump as chip and automakers gained from a drop in yen to a 24-year low as the greenback strengthened.

The Nikkei share average closed 0.62% higher following the afternoon session. The broader Topix gained 0.23%.

Semiconductor and electrical components companies led the Nikkei, tracking overnight gains made by the Philadelphia SE Semiconductor index. Keyence Corp added 3.48%, while Tokyo Electron added 3.33 and Fujikura rose 2.18%.

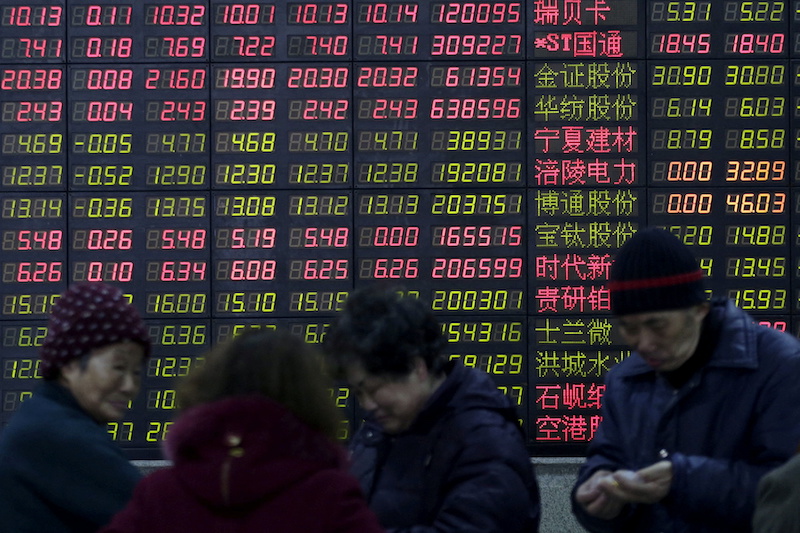

Positive news about a recovery in factory output in China was overshadowed by a slump in Chinese real estate and bank stocks amid fears that debt troubles in the property sector will hit lenders as more homebuyers threatened to halt mortgage payments.

A growing number of homebuyers have recently threatened to stop making mortgage payments if property developers do not resume construction of pre-sold homes, according to official media.

The CSI300 Bank index fell as much as 3.3% in early trading, hitting its lowest level since March 2020.

The Shanghai Composite Index dipped 0.08%, or 2.55 points, to 3,281.74, while the Shenzhen Composite Index on China’s second exchange rose 0.79%, or 17.11 points, to 2,192.70.

The Hang Seng Index dropped 0.22%, or 46.74 points, to 20,751.21.

Safe Haven Dollar Surging

Elsewhere across the region, stocks in Singapore fell 1% and Philippine shares declined 0.1%. Indian stocks were down with Mumbai’s signature Nifty 50 index falling back 0.40%, or 64.60 points, at 15,902.05.

Globally, European shares dropped in early trading on Thursday and the safe-haven dollar was up after the latest red-hot US inflation reading.

The data was seen as firming the case for the Federal Reserve to raise rates aggressively. Policymakers might consider a 100 basis point increase at the July meeting, Atlanta Federal Reserve Bank President Raphael Bostic said.

The dollar index measuring its performance against a basket of currencies was up 0.2% at 108.43, while the dollar was up 1.1% against the yen, at its strongest since 1998.

The US 10-year yield was up around 7 basis points at 2.9817%. The 2-year, 10-year part of the Treasury yield curve is at its most inverted it has been at any point in this cycle, according to Deutsche Bank.

Yield curve inversion – which is when short-dated interest rates are higher than longer ones – is commonly seen as an indicator that markets are anticipating a recession.

Oil prices fell as traders saw a large US rate hike possibly reducing crude demand.

Key figures

Tokyo – Nikkei 225 > UP 0.62% at 26,643.39 (close)

Hong Kong – Hang Seng Index < DOWN 0.22% at 20,751.21 (close)

Shanghai – Composite < DOWN 0.08% at 3,281.74 (close)

New York – Dow < DOWN 0.67% at 30,772.79 (Wednesday close)

- Reuters with additional editing by Sean O’Meara

Read more:

China Stocks Plunge as Homebuyers Refuse to Repay Loans

China’s Fiscal Revenue Growth Booms as Economy Revives