Vulcan Energy Resources, an Australian company that says it can produce lithium using a process that emits zero greenhouse gases, said on Tuesday it had started trading on the Frankfurt Stock Exchange (FSE).

The company’s stock rose more than 5% in their debut to 5.89 euros ($6.69), while its Australian Stock Exchange (ASX)-listed shares rose 3.5% to A$9.22 ($6.59) on Wednesday.

“Vulcan has become the first ASX-listed company to have a dual listing on the regulated market (Prime Standard) of the FSE,” the company said in a statement.

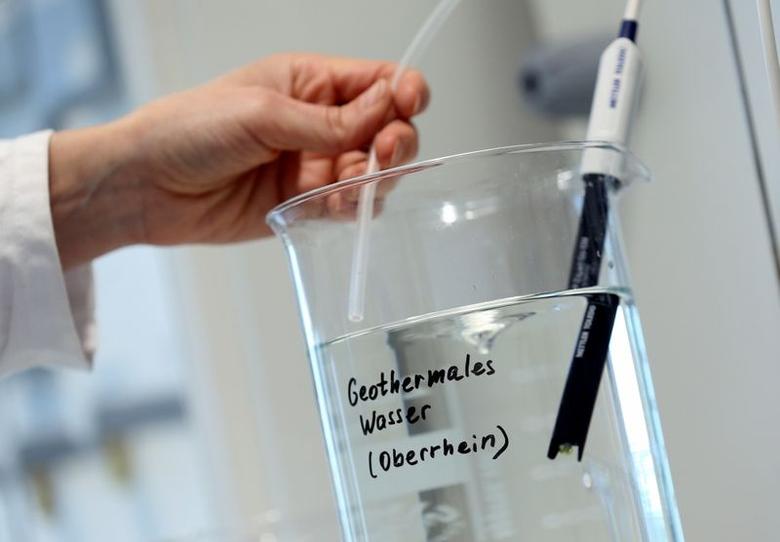

The company said it has developed a new method of producing lithium from brine extracted from geothermal waters located beneath the Upper Rhine Valley in Germany. The usual method is an energy-intensive “hard rock” process.

“The way hard rock lithium is produced is environmentally problematic,” Francis Wedin, Vulcan’s managing director and co-founder, said.

“Hard rock lithium, the type Australia has in generous supply, is carbon intensive due to the process of refining the resource into a usable, chemical product,” he said.

Decarbonised Lithium

“We intend to produce a battery-quality lithium hydroxide chemical product from our combined geothermal energy and lithium resource, which is Europe’s largest lithium resource, in Germany.”

Wedin said development of a decarbonised lithium product is crucial to powering Europe’s switch to a sustainable automotive industry, as new European Union regulations support responsible sourcing of lithium.

Vulcan also plans to use the geothermal energy to produce renewable electricity and heat, some of which it will use to power its operations, and some of which it will sell.

The project is in the pilot phase, and no lithium has yet been produced at commercial scale. But Vulcan has signed off-take agreements with Volkswagen, Stellantis and Renault as the European carmakers ramp up electric vehicle production.

The stock rose from 20 Australian cents in early 2020 to more than A$15 in September 2021 but a report by short-seller J Capital that questioned the company’s production estimates sent the price down.

The report was later retracted after Vulcan began legal proceedings.

- George Russell

READ MORE:

China’s Zijin to Invest $380m in Argentina Lithium Plant

Rio Tinto Shares Slide as Serbia Scraps $2.4bn Lithium Deal

BHP Cuts Output Guidance As Rio Delays Key Lithium Mine