The move, backed by a forum of Asia’s central banks, is said to be part of a region-wide effort to develop local currency-denominated bond markets

The Bank of Japan is to look at buying green bonds, it’s claimed, as part of a joint effort among Asian central banks to promote the region’s bond market.

The BoJ will make the purchases through the ‘Asian Bond Fund’, which was created in 2005 by a forum for the region’s central banks dubbed the Executives’ Meeting of East Asia-Pacific Central Banks (EMEAP), the source said.

Also on AF: Big Chinese cities driving urban CO2 emissions, global study finds

The move would be separate from another BoJ plan, announced last month, to create a scheme that offers cheap funds to financial institutions that lend to or invest in activities aimed at combatting climate change.

It will likely be part of an Asia-wide effort to support the region’s development of local currency-denominated bond markets.

In a statement issued on Monday, EMEAP said its members have agreed to promote investment in green bonds through the fund and requested IHS Markit to review the rule of its iBoxx ABF Index – an index designed to reflect the performance of local currency denominated debt – to promote the inclusion of green bonds.

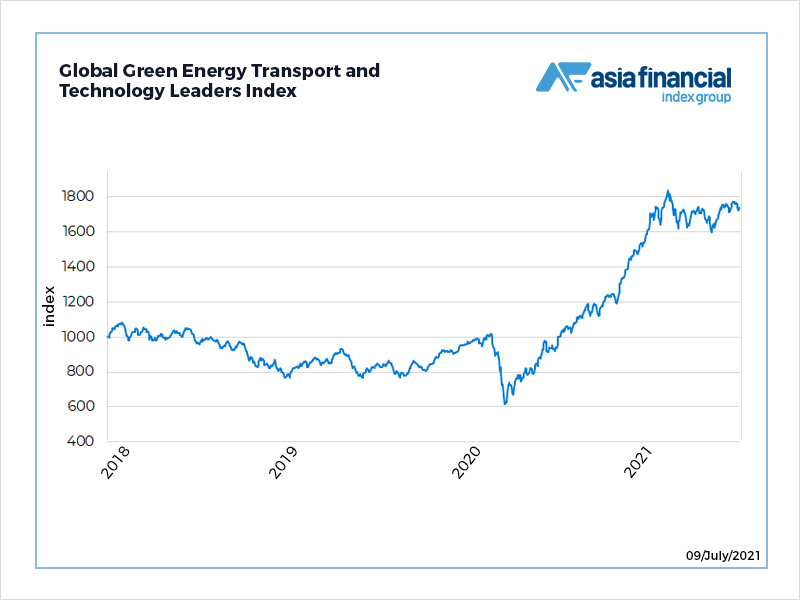

The AF Global Green Energy Transport and Technology Leaders Index selects leading companies that have business involvement in the development, use or investment in new energy vehicles, autonomously driven vehicles, battery technology, renewable energy and energy storage.

“This is aimed at helping to catalyse further deepening of local currency-denominated green bond markets in the region,” EMEAP said in the statement.

The BoJ is expected to announce a range of measures it will take to combat climate change as early as this month.

Global ESG assets are on track to exceed $53 trillion by 2025, representing more than a third of the $140.5 trillion in projected total assets under management.

Reporting by Reuters

Read more:

Global Bond Funds Swell as Investors Spot Cracks in Recovery

China SOEs Push Corporate Bond Defaults to a Record High