As bitcoin rapidly approaches its mining rewards halving, the top crypto is exhibiting unprecedented signs of both technical and fundamental strength.

Not only has the benchmark crypto been able to post a major rebound from its mid-March lows of $3,800, but it has also been able to form greater fundamental strength – as seen by its hash rate reaching fresh all-time highs, Cryptoslate reported.

Further adding to the growing list of factors counting in the bulls’ favor is the fact that investors are continuing their “flight to safety” as the Covid-19 pandemic shows few signs of subsiding anytime soon.

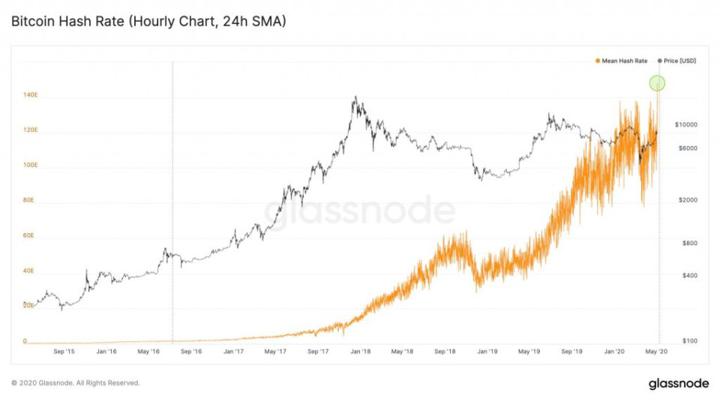

Bitcoin’s hash rate just hit a fresh all-time high, coinciding closely with its extremely bullish price action in the period following its mid-March meltdown.

Research and analytics platform Glassnode spoke about this key network metric’s growth in a recent tweet, offering a chart showing the tremendous growth it has seen in recent times.

It is important to keep in mind that the halving will lead to a temporary decline in hash rate due to its catalyzing capitulation amongst miners.

Smaller operations that rely solely on their minted BTC to fund their operations will be particularly impacted by this event, as its impact on their profitability will be quite significant.

For the larger miners that continue supporting the cryptocurrency’s network after this event takes place, the reduction in block mining rewards will likely incentivise them to hold their crypto until BTC’s price climbs higher, thus alleviating some of the selling pressure placed on bitcoin in the near-term.

In the long-term, its bullishness stems primarily from the reduction in new supply hitting the market each year.

Bitcoin’s over 130% climb from its year-to-date lows means it has significantly outperformed virtually all major traditional markets, including safe-haven commodities and equities.

‘Flight to safety’

This strength comes as investors take “flight to safety” due to concerns regarding the global macro-economic outlook.

Popular on-chain analyst and Hypersheet co-founder Willy Woo spoke about this trend in a tweet a few weeks ago, explaining that this is the environment Bitcoin was built for: “We are undergoing flight to safety right now, BTC is looking for its bottom. But know that once the bottom is in there are strong bullish pressures ahead. It’s this economic environment in the years ahead that Bitcoin was built for.”

The confluence of bitcoin’s bull-favoring technical outlook coupled with its growing fundamental strength suggest that the days and weeks ahead may be quite favorable for BTC investors.

But how will the halving affect miners?

Speaking to Cointelegraph, Johnson Xu, the head of research and analytics at TokenInsight, predicted that “a large percentage of older generation miners such as S9s will be shut down” shortly after the halving transpires.

Despite the disruptions the event has on the mining sector, Johnson describes the halving as “a healthy rebalance to force the network to re-adjust itself into an efficient network where miners can make sufficient margin.”

“The bitcoin halving will result in short-term [network] chaos. However, once the difficulty adjustment kicks in and self-adjusts to an equilibrium state, we will see the bitcoin network back to a stable position quickly,” Johnson added.