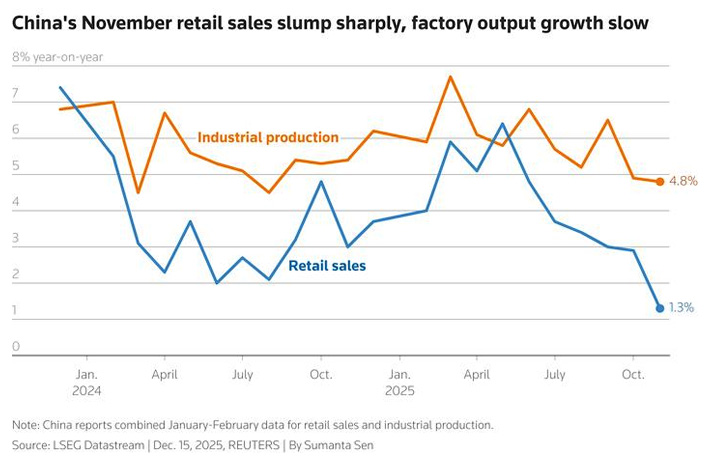

China’s latest economic data showed factory growth slumped to a 15-month low in November, while retail sales dropped to their worst since the end of the country’s draconian “zero-Covid” policy.

The latest figures from the National Bureau of Statistics on Monday highlight the urgent need for new growth drivers heading into 2026, as the prolonged property crisis weighs on household spending and Beijing’s consumer trade-in subsidies fade.

With industrial investment risking further deflation, officials have leaned on exports to support growth. But that strategy now looks increasingly unsustainable as trading partners around the world bristle at China’s $1 trillion trade surplus and look to erect import barriers.

ALSO SEE: Chinese Minister Pressing Gulf States to Sign Free-Trade Deal

Industrial output rose 4.8% year-on-year, the NBS data showed, which was the softest since August 2024, down from 4.9% in October.

Retail sales, a gauge of consumption, grew 1.3%, their weakest pace since December 2022, when the world’s second-largest economy ended pandemic restrictions, well below 2.9% in October and forecasts for a 2.8% gain.

“Strong exports limited the need to turbocharge domestic demand this year, and the trade-in subsidies have started to run out,” Xu Tianchen, a senior economist at the Economist Intelligence Unit, said.

“I think policymakers have turned their attention to 2026, since the around 5% growth target seems within reach for this year, so there’s little additional motivation for further stimulus.”

The weak data weighed on Chinese stocks, which were also hit by fresh real estate worries as property developer China Vanke scrambled to avoid debt default.

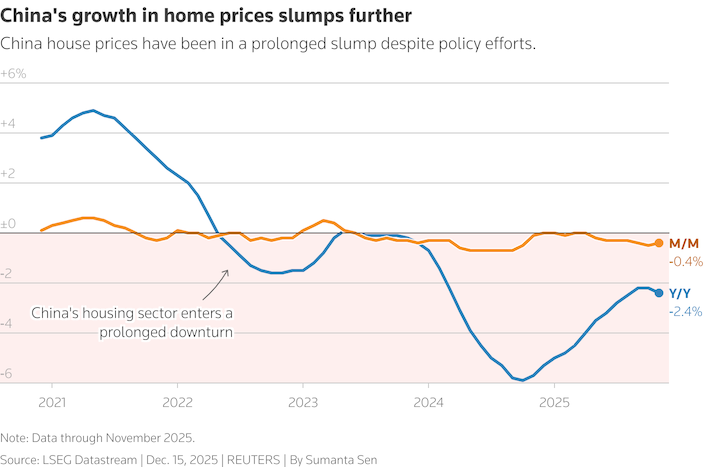

New home prices still falling

Economists say the economy has passed the point at which further stimulus would provide an effective fix.

The International Monetary Fund last week urged Beijing to speed up structural reform and act on the property sector, with some 70% of Chinese household wealth tied up in real estate.

Fixing the property pains within the next three years will cost the equivalent of 5% of GDP, the IMF estimates.

More needs to be done to boost household consumer confidence, Fu Linghui, a spokesperson for China’s customs administration, told a news conference after the data release.

China’s new home prices fell further in November.

Fu added that an annual 2.6% decline in fixed asset investment in January-November had largely been driven by a 15.9% drop in property investment over the same period. Developers are struggling to convince investors there are buyers for their apartments, which remain unsold even at discounted prices.

Vanke, one of China’s largest real estate developers, plans to convene a second bondholder meeting this week as it battles to avert default, after investors rejected a plan by the state-backed lender to push back repayment by a year.

The property sector once made up a quarter of China’s gross domestic product.

Car sales also down

In a sign of further strain, annual car sales slumped 8.5%, the steepest decline in 10 months, dimming hopes of a year-end rebound in an industry that typically sees strong sales in the final two months of a year.

“The economy slowed across the board in November, and weak retail sales were particularly noteworthy,” said Zhang Zhiwei, chief economist at Pinpoint Asset Management. “The recent contraction in investment and the continued decline in the property market have been transmitted to consumer confidence.”

Even the Singles’ Day shopping festival – which stretched to five weeks this year – failed to excite consumers.

Trade tension

Government advisers and analysts say China is likely to pursue its current annual growth target of around 5% next year, as it seeks to kick-start a new five-year plan on a strong footing.

But that could prove challenging, with both the World Bank and the IMF offering more conservative outlooks for China’s growth trajectory.

At a key economic meeting last week outlining next year’s policy agenda, Chinese leaders promised to maintain a “proactive” fiscal policy to spur consumption and investment, while acknowledging a “prominent” contradiction between strong domestic supply and weak demand.

Yet the dual focus on consumption and investment cements concerns that Beijing is not yet ready to ditch a production-driven economic model in favour of one that leans more on household spending.

World leaders look to be lining up to put the brakes on China’s exports.

French President Emmanuel Macron threatened Beijing with tariffs during his visit to China and called on the country to correct “unsustainable” global trade imbalances.

Mexico last week approved tariff hikes of up to 50% next year on imports from China and several other Asian countries, aiming to bolster local industry.

Chinese producers may struggle to find new domestic buyers if exports dry up.

“November data point to a broad-based weakness in domestic activity, largely due to a pull-back in fiscal spending,” Zichun Huang, China economist at Capital Economics, said.

“Policy support should help drive a partial recovery in the coming months, but this probably won’t avert China’s growth from remaining weak across 2026 as a whole.”

- Reuters with additional editing by Jim Pollard

ALSO SEE:

Mexico Approves Big Tariff Hikes on Chinese, Other Asian Imports

IMF Tells China: Cut Exports, Lift Consumption, ‘Let Zombies Go’

China’s ZTE Shares Sink on Report of $1bn Fine to US For Bribery

Foreign Firms Struggling Amid China’s Economic Slump, Trade War

Chinese Firms May Soon Need To Transfer Tech To Invest In Europe

Chinese EV Firms Invest More Abroad Than At Home For First Time

EU Set to ‘Hit China With 20 Anti-Dumping Probes’

Flood of Cheap Chinese EVs in Brazil Sparks a Backlash

US Tariff Pause Puts Heat on China+1 Trade Via SE Asia, Mexico

BYD Mexico Plant in Limbo as ‘China Fears EV Tech Leaking to US’