(ATF) The ATF index gauges were stable on Monday, as the People’s Bank of China (PBoC) injected 200 billion yuan ($28bn) into the market via medium-term lending facility (MLF).

The MLF, which will mature in one year at an interest rate of 2.95%, is a tool that was introduced in 2014 to help commercial and policy banks maintain liquidity by allowing them to borrow from the central bank using securities as collateral.

The move is in addition to the PBoC’s seven reverse repo open market operations since June 3 totalling 650 billion yuan ($92bn) in a bid to stabilise liquidity.

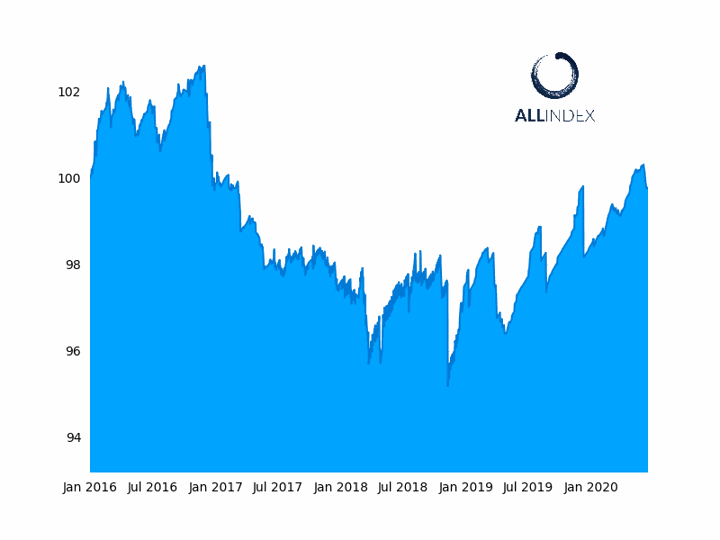

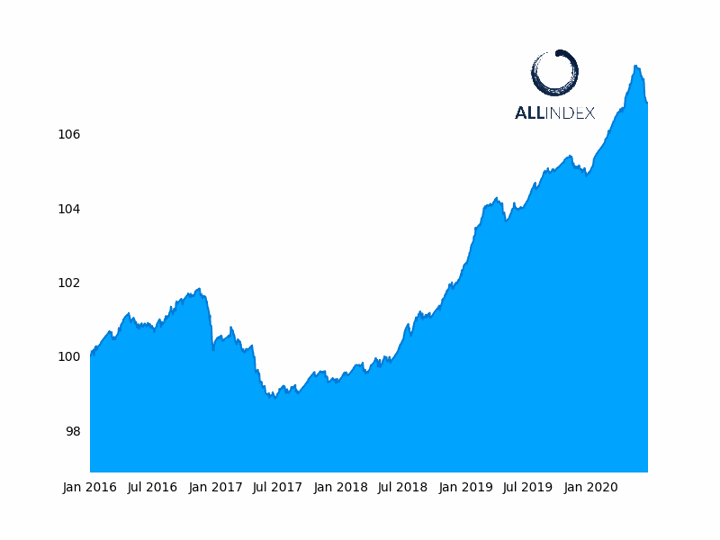

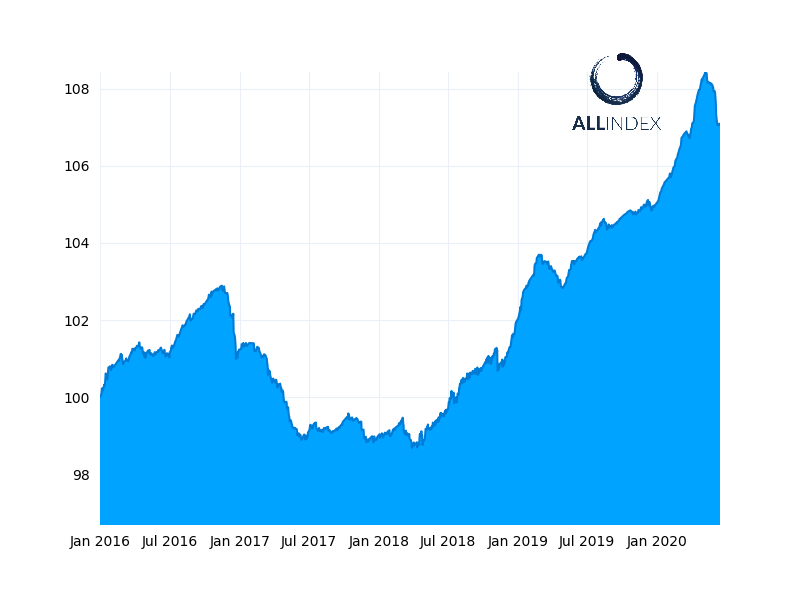

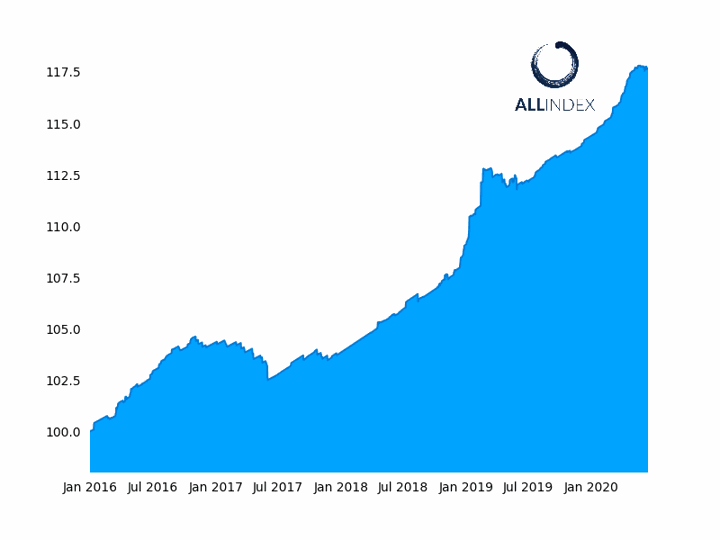

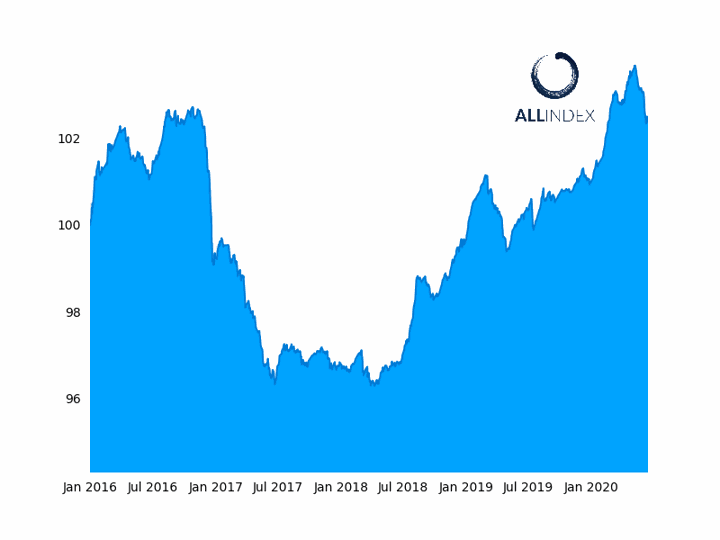

The China Bond 50 Index, the flagship index, gained 0.03% and closed at 107.09. The ATF ALLINDEX Local Governments also closed in positive territory, gaining 0.02%, while the ATF ALLINDEX Financial closed flat at 106.84. Meanwhile, the ATF ALLINDEX Corporates and Enterprise gauges retreated 0.02% and 0.11%, respectively.

Amon Enterprise index constituents, Datong Coal Mine Group bonds lost 6.43% to close at 103.89, which substantially dragged down the index.

China is tipped to make a muted recovery in 2020, with real GDP expected to grow by 2%, according to a DBS research report. This is in contrast to the US, where the economy is expected to contract.

However, a second wave of coronavirus, which until now China has contained with some success, and trade tensions with the US, may constrain the pace of any recovery. As a result, DBS anticipates that monetary policy will ease further, and the PBoC has room to cut rates: the yield spread between China’s 10-year government bond and the US 10-year Treasury rose to more than 200 basis points from 120 basis points recently.

The Singaporean bank projects a 30 basis point rate cut in the one-year Loan Prime Rate and a 150 basis point cut in the Reserve Requirement Ratio for 2020.