China’s economy continued to show weakness with the producer price index (PPI) – a key metric – rising 6.4% year-on-year in May, its slowest monthly pace in more than a year, data showed.

The rise in official producer price index followed a 8.0% increase in April, and was in line with forecasts in a Reuters poll. It was the weakest reading since March 2021.

The weaker figure was attributed to China’s economy slowing, with demand for steel, aluminium and other key industrial commodities reduced due to tight Covid-19 curbs.

The consumer price index (CPI) gained 2.1% from a year earlier in May, in line with April’s growth. In a Reuters poll, the CPI was expected to rise 2.2%.

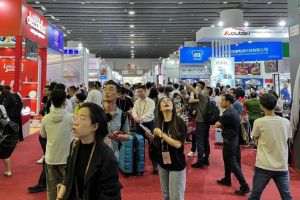

China’s economy has slowed significantly in recent months, hit by strict pandemic controls, disrupting supply chains and jolting production and consumption.

China’s cabinet in late May announced a package of 33 measures covering fiscal, financial, investment and industrial policies to revive its economy.

Beijing has taken a series of measures from cutting benchmark lending rates to allowing delays on loan repayments to arrest the economic slowdown.

Goldman Sachs last month lowered its 2022 growth forecast to 4% from 4.5%, below China’s official target of 5.5%.

- Reuters, with additional editing by George Russell

READ MORE:

Cutting China Tariffs Easier Than Fighting Inflation, USTR Says

CPI surge reopens US vs China global inflation debate

Asia Factory Activity Falls as China Lockdowns Hit Supply Chains