Several Chinese exporters exhibiting their products at the country’s largest trade fair said they feared having to freeze investments and cut jobs in the year ahead, with the weak global economy hurting their businesses.

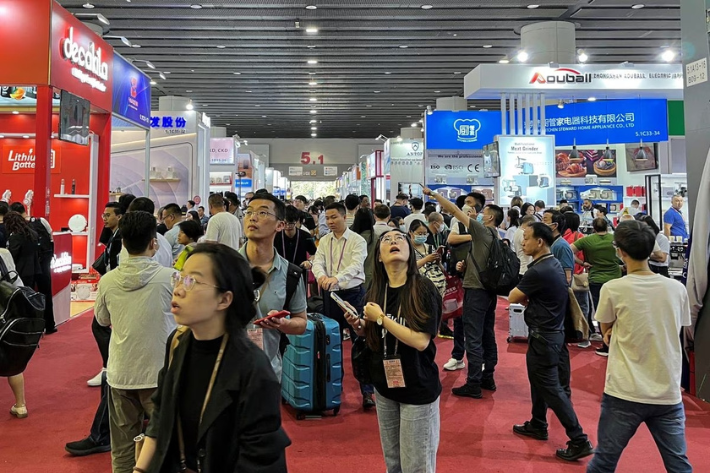

The subdued mood at the first major trade event since China abruptly dropped its Covid restrictions and re-opened its borders points to challenges facing the world’s second largest economy in its push to bring growth back on track.

It also suggests China’s unexpected jump in exports in March may have reflected exporters catching up with orders delayed last year by Covid curbs rather than renewed economic strength.

Also on AF: China’s New Home Prices Rise at Quickest Pace in 21 Months

Exhibitors at the Canton Fair, being held in the southern city of Guangzhou, reported sharp drops in orders, echoing the fall in demand for Chinese-made goods across the world.

Kris Lin, a representative from Christmas light producer Taizhou Hangjie Lamps, said this year’s orders so far are down 30% from last year.

“The difficulties last year came from logistics and production disruptions but the local government helped solve the problems. That’s an internal issue. Now we have external problems. We can’t solve those,” Lin said.

“This year will be the hardest for us,” he said, with higher electricity costs caused by the war in Ukraine reducing demand for his decorations even further.

Cutting labour costs

Lin said the company cannot afford to sell at lower prices, but it may look to reduce labour costs. The firm relies on contract workers who get released in September to October after the delivery of Christmas orders.

“If orders are weak this year, I will set my workers free earlier.”

The worsening outlook for workers in the manufacturing industries will raise concerns among Chinese policymakers, who target 12 million new jobs across the country this year, up from last year’s goal of 11 million.

A producer of shaving devices from the eastern city of Ningbo, who asked to remain anonymous to unveil future plans, said his firm had already laid off workers and will lower prices in coming months if orders don’t improve.

Huang Qinqin, sales director at Zhong Shan Shi Limaton Electronics, a producer of exhaust fans, expressed similar thoughts on cutting costs after orders halved in the first quarter.

“In our factory, workers come to work when there are orders,” Huang said. This used to mean working overtime even on weekends, but it is more common this year for workers to take weekends off, she said.

‘No new investments’

Dozens of Chinese suppliers also said they did not intend to spend much on improving production lines this year given the weak demand.

“We have no plan to increase investment,” said Luna Hou, sales representative at Topgrill, which makes outdoor grills and has cut prices by 5% to lure buyers.

Vicky Chen, foreign trade manager at socket producer Qinjia Electric, said she did not expect a big sales boost at the fair, which runs until May 5.

“The whole global economy is fairing poorly at the moment, and the fair won’t change that.”

- Reuters, with additional editing by Vishakha Saxena

Also read:

China GDP Seen Growing 4% in Q1, Likely to Hit 5.4% in 2023

China Exports Surge Stems From Covid Disruptions, Say Analysts

Consumer and Factory Prices Drop in China as Demand Sinks

China Envoys ‘Grab’ Billions in Unprecedented Push for Deals

Record Inflows to Emerging Market Funds After China Reopening