Larger Asia-Pacific emerging markets such as China and India tend to attract more than their fair share of venture capital (VC) funding, while Singapore punches above its weight, new data show.

Singapore is an investment hotspot, while Thailand and Malaysia have less VC competition and thus better potential returns, according to a report by Tellimer Research.

The US attracted the highest amount of VC investment with $269 billion logged from October 2020 to October 2021. China was second-placed with $61 billion.

“While India and China have been able to attract significant VC inflows, even despite the latter’s tech crackdown, other sizeable markets (like Indonesia) have also been able to attract more inflows than their income levels warrant,” Tellimer researchers said.

“We think this is because many VC investors are focused on identifying world-beaters, which may be more likely to emerge from the biggest individual markets.”

In contrast, South Korea’s VC inflows have been below what might be expected, given the high sophistication of this economy, the researchers added.

Singapore tops the global VC investment per capita table along with Israel and Estonia.

In contrast, most emerging markets are not attracting as much investment as they should, based on their income levels, the study found.

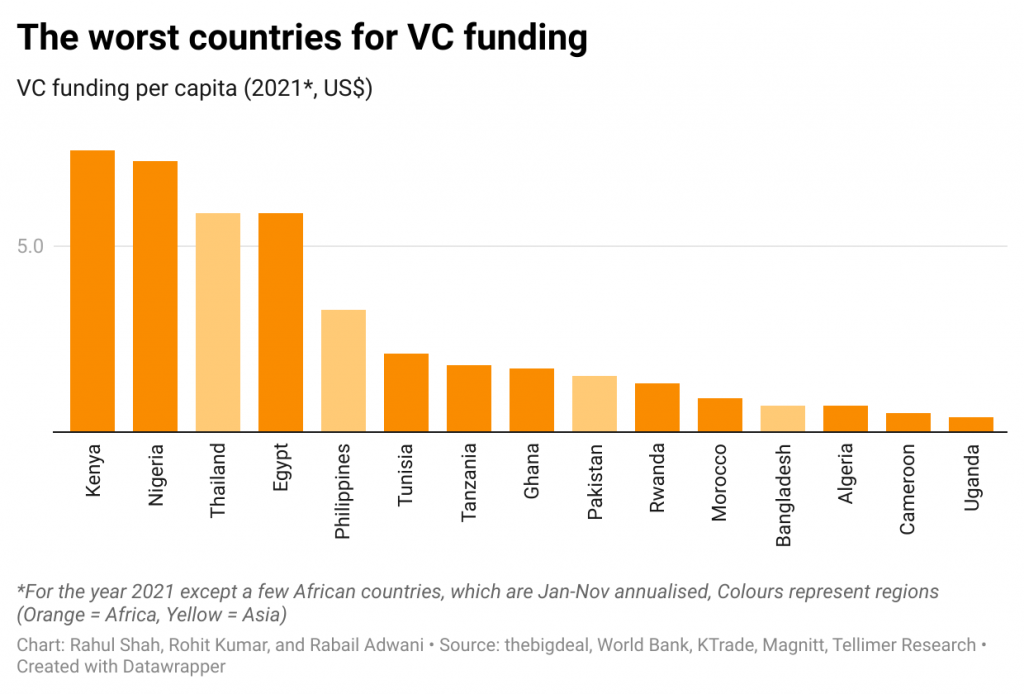

Many of these economies are small, but this is not universally the case. Other emerging markets with sizeable VC funding shortfalls of more than $1 billion include Thailand, Malaysia and Bangladesh.

As the accompanying chart shows, Thailand, Philippines, Pakistan and Bangladesh are among the worst countries for VC funding worldwide in terms of per capita spend.

“While many startups can now command $1 billion or more in valuations, for smaller funds, a focus on some of these underserved emerging markets could help to deliver outsized investment returns,” Tellimer concluded.

- George Russell

READ MORE:

Crypto Startups Moonlight as VC Investors – The Information

Accel Launches $650m VC Fund for India, Southeast Asia

China Tops Asia Pacific with $6.5bn in VC Funds in January