Samsung Electronics is tipped to reveal a 160% jump in its fourth-quarter operating profit this week – which stems from a big semiconductor shortage that has caused the price of memory chips to soar.

Chip prices have shot up recently because customers have been rushing to supply the boom in demand for artificial intelligence.

The chip sector’s focus on the shift to AI-related chips has hit production for traditional memory chips, while demand has surged for both conventional and advanced chips to train and run AI models.

ALSO SEE: Trump’s Venezuela Strike ‘May Embolden China’s Territorial Claims’

Samsung is likely to estimate an operating profit of 16.9 trillion won ($11.7 billion) for the October-to-December period, according to LSEG SmartEstimate from 31 analysts, which is weighted toward those who are more consistently accurate.

This compares with 6.49 trillion won from a year earlier and would mark the highest quarterly profit since the third quarter of 2018, which was a record high of 17.6 trillion won.

Some analysts have in recent weeks raised their estimates for Samsung’s fourth-quarter operating profit to more than 20 trillion won on the back of stronger-than-expected prices of traditional chips.

The world’s top memory chip maker is set to release its estimates for revenue and operating profit on Thursday.

Memory chip prices skyrocket

Prices for a type of DDR5 DRAM chip jumped 314% in the fourth quarter from a year earlier, according to data from market researcher TrendForce.

It expects conventional DRAM contract prices to rise 55% to 60% in the current quarter, from the October-to-December period.

“As conventional DRAM prices continue to surge, Samsung – whose production capacity is largely concentrated in this segment – stands to gain relatively more from the current price upcycle,” TrendForce analyst Avril Wu said.

DRAM chips are used in servers, computers and smartphones to temporarily store data and help run programmes and applications smoothly and swiftly. DDR5 DRAM, a conventional chip, is faster and more efficient than its predecessor.

In December, Micron Technology forecast second-quarter adjusted profit at nearly double Wall Street estimates. Micron CEO Sanjay Mehrotra said he expects memory markets to remain tight past 2026 and that in the medium term, it expects to meet only half to two-thirds of demand from several key customers.

Shares soar

Samsung’s booming profit marks a dramatic turnaround, just over a year after CEO Jun Young-hyun apologised for the company’s disappointing earnings and performance as it lagged its cross-town rival SK Hynix in supplying high-end chips to Nvidia, the dominant maker of AI processors.

Samsung shares jumped 125% last year, marking their biggest annual percentage gain in 26 years. They fell 2.1% on Tuesday morning in a wider market that was down 0.2%, taking a breather after their recent rally.

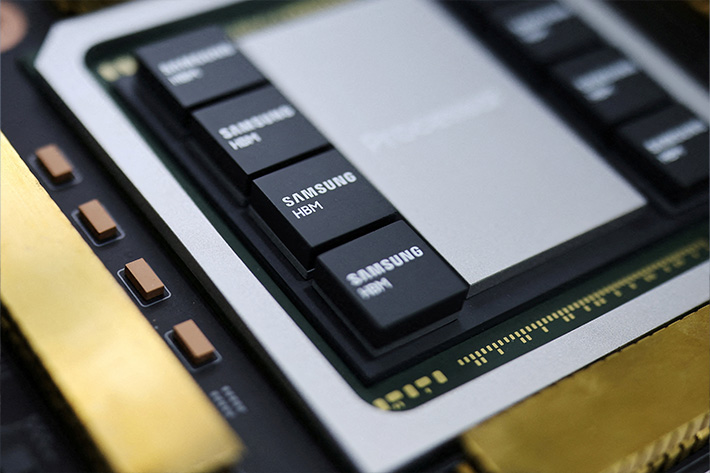

On Friday, Jun said Samsung customers have praised the competitive edge of its next-generation high-bandwidth memory (HBM) chips, or HBM4, quoting them as saying, “Samsung is back,” which helped extend a rally in Samsung’s shares to record highs in recent sessions.

He did not elaborate on those customers, but analysts said Samsung is making progress supplying chips to Nvidia, potentially gaining share against SK Hynix and Micron.

Nvidia CEO Jensen Huang said on Monday the company’s next generation of chips is in full production. The Vera Rubin platform, which will incorporate HBM4 chips, is on track to arrive later this year, Nvidia said.

Analysts said Samsung’s operating profit is expected to more than double this year to over 100 trillion won as the chip price rally would more than offset slowing profit for its mobile business.

‘Risk of demand slowdown’

Lee Min-hee, an analyst at BNK Investment & Securities, said he was wary of Samsung’s valuations, as surging chip prices may sap demand for PCs and smartphones, and cited “risks of a demand slowdown” for AI data centres increasingly relying on debt to finance investments.

While the global shortage of memory chips is a boon to Samsung’s mainstay semiconductor business, soaring chip prices are squeezing margins in its smartphone division, its second-largest revenue source.

“As this situation is unprecedented, no company is immune to its impact,” Samsung co-CEO TM Roh, who oversees Samsung’s mobile, TV and home appliance businesses, told Reuters, adding it is trying to minimise the impact, which looks “inevitable.

Device output ‘to double’

Meanwhile, Samsung plans to double the number of its mobile devices with “Galaxy AI” features this year, which are largely powered by Google’s Gemini, its co-CEO said. That would give the US firm an edge over rivals as the global race in artificial intelligence heats up.

The South Korean tech giant, which rolled out Gemini-backed AI features on about 400 million smartphones and tablets last year, plans to boost that figure to 800 million in 2026.

“We will apply AI to all products, all functions, and all services as quickly as possible,” TM Roh told Reuters.

The plan by the world’s largest backer of Google’s Android mobile platform is set to give a major boost to Google, which is locked in a race with OpenAI and others to attract more consumer users to their AI model.

Samsung seeks to reclaim its lost crown from Apple in the smartphone market and fend off competition from Chinese rivals not only in mobile telephones, but televisions and home appliances, all overseen by Roh.

It will offer integrated AI services across consumer products to widen its lead over Apple in such features, though the latter was set to be the top smartphone maker last year, according to market researcher Counterpoint.

Gemini 3 leading AI Race

Alphabet’s Google launched the latest version of Gemini in November, highlighting Gemini 3’s lead on several popular industry measures of AI model performance.

In response to Gemini 3, OpenAI CEO Sam Altman reportedly issued an internal “code red,” pausing non-core projects and redirecting teams to accelerate development. The ChatGPT maker launched its GPT-5.2 AI model a few weeks later.

Roh expects the adoption of AI to accelerate, as Samsung’s surveys on awareness of its Galaxy AI brand jumped to a level of 80% from about 30% in just one year.

“Even though the AI technology might seem a bit doubtful right now, within six months to a year, these technologies will become more widespread,” he said.

While search is the most used AI feature on phones, consumers also frequently use a range of generative AI editing and productivity tools for images and others, as well as translation and summary features, he said.

Galaxy AI is Samsung’s term for its suite of AI features, including those powered by both Google’s Gemini model and Samsung’s own Bixby for different tasks.

- Reuters with additional links and editing by Jim Pollard

ALSO SEE:

Continuing AI Demand Lifts Asian Stocks to Five-Year Highs

Korea, China Shares Post Highest Gains in Years Amid AI Frenzy

TSMC, Korean Firms ‘Can Send Chipmaking Tools to China Plants’

Seoul Accuses Ex-Samsung Staff of Leaking DRAM Tech to China

China Now Requires Chipmakers to Use At Least 50% Local Equipment

China’s Big Tech Secret: Lab Copied Dutch Chipmaking Machine

China Firms Lobby For Nvidia’s H200 But Local Chips Remain