Tianqi Lithium Corp, a company based in Chengdu in mainland China, is looking to raise about $1 billion from a listing on the Hong Kong Stock Exchange in what could be the biggest initial public offering this year, the Wall Street Journal reported.

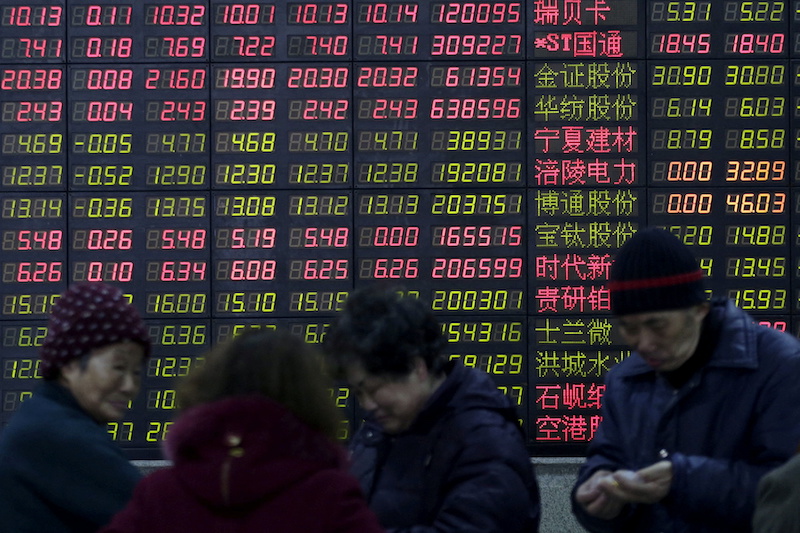

The plans for an IPO by Tianqi, one of China’s top lithium producers, comes when Russia’s invasion of Ukraine, spiralling inflation, plus Covid outbreaks and lockdowns in China have roiled global markets and crimped demand for new stock issuances, the report added.

Read the full report: The Wall Street Journal.

ALSO READ:

Covid-19 Outbreaks Stall Shanghai, Shenzhen IPOs Worth $9bn

China-Owned Lanvin Hopes to Put US IPOs Back in Fashion

Hong Kong Market, IPOs Hurt by Geopolitics, Bourse CEO Says