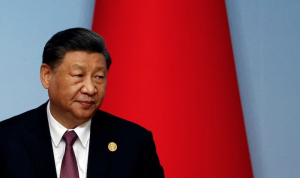

The International Monetary Fund is to warn China it needs to urgently address its troubled real estate sector, rein in local government debt and, most crucially, boost domestic consumption, to turn its economy around.

The IMF says China’s problems are dragging down both Chinese and global growth, its Managing Director Kristalina Georgieva cautioned, with the Fund set to strongly urge Beijing to shift its growth model away from debt-fuelled infrastructure investment and real estate.

“Our advice to China is use your policy space in a way that helps you shift your growth model towards more domestic consumption,” Georgieva said.

“Because the traditional way of infrastructure, pumping in more money, in this current environment is not going to be productive.”

Also on AF: SoftBank’s Arm Nets $65bn Valuation in Blockbuster Nasdaq Debut

Georgieva said in an exclusive interview the messages will be delivered to Chinese authorities in a forthcoming IMF “Article IV” review of China’s economic policies.

China’s ageing population and falling productivity were playing a “suppressing role” in its growth rate, along with companies in the United States and Europe shifting supply chains away from China.

China’s problems in the real estate sector have also caused consumers to rein in spending, Georgieva said.

“We actually project that without structural reforms, medium term growth in China can fall below 4%,” Georgieva said.

The IMF in July forecast China’s 2023 growth rate at 5.2% and 4.5% in 2024, but warned it could be lower given the contraction in real estate.

Georgieva also said it was important for China to address consumer confidence in its real estate sector by financing the completion of apartments that buyers have already paid for, rather than bailing out troubled developers.

The IMF is preparing to issue a new set of global growth forecasts ahead of IMF and World Bank annual meetings October 9-15. Georgieva said separately the institutions would decide on Monday whether to proceed with the meetings in earthquake-hit Morocco.

China Generates Third of Global Growth

The new forecasts are expected to reflect concerns about anaemic GDP growth around the world, as most large economies are still lagging pre-pandemic growth rates.

The United States is the only large economy to have recovered pre-pandemic growth, while China is four percentage points below pre-pandemic trends, Europe down two percentage points and the world down three percentage points.

With China generating about a third of global growth this year, its growth rate “matters to Asia, and it matters to the rest of the world,” Georgieva said.

Asked about US Commerce Secretary Gina Raimondo’s recent comment that some US firms viewed China as “uninvestible”, Georgieva said: “There is some outflow from China. It is a trend that we need to carefully monitor, how it evolves over time.”

She added there were some areas, including digital economy and green technologies, that remained attractive for investors.

She cautioned it was important to ensure China’s big push on electric vehicles was not done using subsidies in a way that created unfair competition.

- Reuters with additional editing by Sean O’Meara

Read more:

China Fiscal Revenue Slows as Big Banks Cut Growth Forecasts

China Sees the Dawn of a New Era of Slower Growth

China’s Economy Rebounding But Reforms Still Needed: IMF

China’s Weak 2nd Quarter Growth Shows Need for Support

China Must Ease Covid Rules to Revive Economy: IMF – SCMP