US aircraft giant is facing political headwinds in China over returning its troubled narrow-bodied jet to the skies

(AF) Six months after the US and Europe lifted an almost two-year flight ban on the Boeing 737 MAX airliner, there is no clear end in sight for the crisis surrounding the US manufacturer’s fastest-selling jet in China.

The company had hoped for China to approve the MAX to return to the sky by the end of last year. In January, Boeing said it expected approval from regulators everywhere by the end of June.

Now, with help from US President Joe Biden’s administration, Boeing is stepping up efforts to convince China the plane is safe and reset its most strategic partnership as airlines start to recover from the Covid-19 pandemic.

China was the first nation to ground the MAX in 2019 after two deadly crashes in five months.

Now the company still faces regulatory and political obstacles, David Calhoun, Boeing chief executive, said. “I do know that if it goes on for too long, I pay a price,” he told a Bernstein conference this month, referring to China’s recertification.

GROWTH MARKET

“I pay a price because they’re (China) the biggest part of the growth of the industry in the world,” he added.

Because of the China uncertainty, Boeing is not confident it can raise production beyond the 31 MAX planes per month level it expects to hit by early 2022, Calhoun said.

The company has been all but shut out of new orders in the world’s biggest aircraft market since 2017, which contributed to its decision to cut production of its long-haul 787 model.

Boeing has had a tough two years. The plane manufacturer reported a net loss of $561 million on revenue of $15.2 billion in the first quarter of this year, 10% lower than last year but slightly ahead of analysts’ estimates.

Boeing’s New York-listed shares held steady on Wednesday, edging down less than 0.1% to $243.57.

CASH BURN

But Boeing’s cash burn was much worse than expected on struggles with a slow resumption of the 737 MAX services and delays linked to its 787 Dreamliner.

The company also took a $318-million loss that stemmed from problems at a supplier in the programme to replace Air Force One jets.

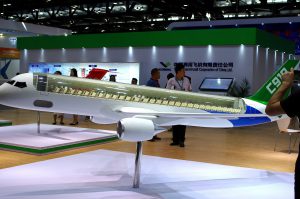

Meanwhile, China hopes to compete with its C919, a direct rival to the MAX and other narrow-bodied jets such as the Airbus A320.

Its manufacturer, state-owned Commercial Aircraft Corporation of China, is aiming for local approval of the C919 by year-end, and is ultimately seeking international certification.

In 2020 rival Airbus delivered almost 400 more aircraft than Boeing, amounting to 566 and 157 respectively.

With reporting by Reuters