(ATF) While many US-listed Chinese companies are retreating to Hong Kong amid stricter accounting rules and the geopolitical tensions, China’s most popular fitness app Keep is weighing the US as its IPO destination, according to Chinese news portal Sina.

Keep, that was valued at $2 billion two months back in a SoftBank Group-led funding, is reportedly planning for the debut-listing as early as the second quarter of this year.

Founder and chief executive, Wang Ning, aims to take the company public this year, or next year the latest, Sina said, citing an internal source.

The company has appointed a chief financial officer and is searching for a director of investor relations through multiple channels, the source said.

Softbank backing

The Beijing-based company closed its series-F financing two months ago, raising $360 million that doubled its valuation in that eighth-round of financing since the app’s launch in 2015, pushing the total amount of funds raised to $600 million, according to 36Kr.

Keep’s owner, Beijing Calories Information Technology Co., said the series-F financing was led by SoftBank Group’s Vision Fund, drawing in further investment from Hillhouse Capital and Tencent Holdings, Coatue Management, GGV Capital, Bertelsmann Asia Investments, 5Y Capital and Hong Kong’s Jeneration Capital.

“After a large funding gap in 2019, Keep sought financing on the one hand, and restructured the organization on the other. Divisions that cannot bring in revenue, such as AI, have been eliminated. At the same time, the management team has urged employees to boost data such as daily active user (DAU) and monthly active user (MAU) in preparation for the IPO,” the source told Sina.

In the in E-round funding last May, the app secured $80 million led by Jeneration Capital.

High-growth business

Keep grabbed the opportunity of the boom in home-based workouts as the coronavirus prompted users to stay away from gyms.

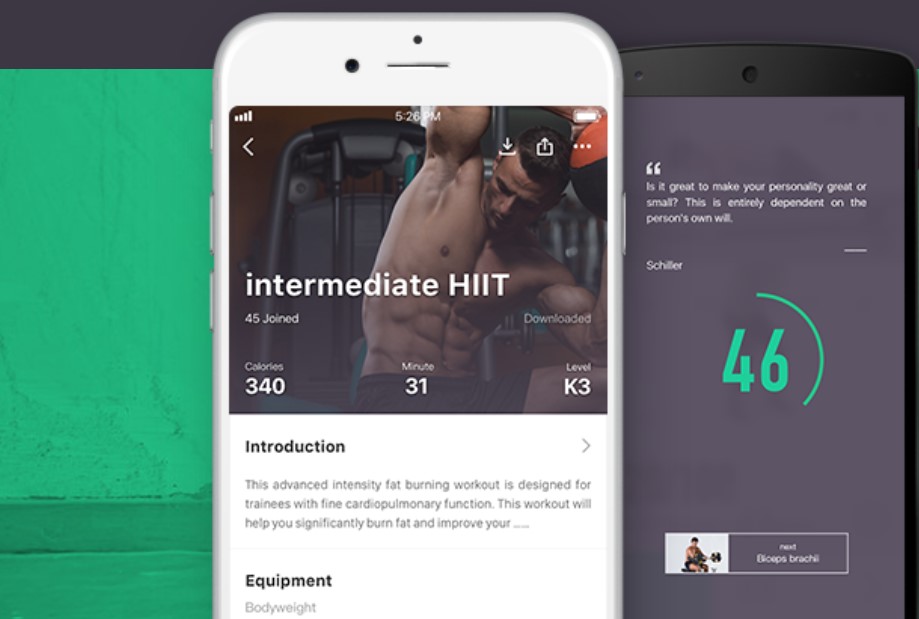

The app provides customized online fitness programs and a social networking platform for users to post their progress and share exercise routine and claims it has 300 million registered users with paying members exceeding 10 million.

Keep that opened its first offline gym, Keepland, in 2018 has seen the number of its monthly active users jump by 20% year-on-year since then, much of which was driven by the pandemic, according to a study by Deloitte.

Keep also poured in efforts to optimize its virtual fitness courses in 2020, introducing videos of online fitness stars Pamela Reif and Zoey Zhou.

With over 1,200 self-developed programs, it has a livestreaming team with nearly 100 employees including program designers, personal trainers and marketing staff.

Offline model

Keep that also launched self-branded treadmills and home exercise bikes in 2019, has been expanding its offline presence too by developing new revenue sources from selling fitness equipment, wearable devices and workout apparel.

Last year, the company launched an intelligent exercise bike with social features that can be used with the live fitness courses.

The bike is now used an average three times per week by users, which is increasing claims Keep, adding that it plans to launch more intelligent sports products this year for home use.

However, Keep has also been struggling to monetize its services since May last year, as online users started heading back to the gym after the country reopened the economy, which stagnated its growth.

Besides, although the app gained over $154.4 million in sales over the 12 months to June 30, 2020, some have witnessed compromised user experience too.

“It is getting more and more difficult to find the fitness programs that I need…There is already an online store in the app, why are there still ads in the workout plans? Every time I get ready to work out and take a deep breath, I get interrupted by the ad,” a user named Linlin said.

Still according to Pei Pei, a former chief analyst of the media and internet industry from Sinolink Securities, Keep’s live-streaming business has a high potential, and live classes from celebrity coaches may help the company gain sustainable revenues.

A live-streaming app for the fitness vertical is unlikely to be replaced by comprehensive short- video apps such as Kuaishou and Douyin, the Chinese version of TikTok, he said.

Peloton Interactive, an American unicorn company that Keep is believed to mimic, makes money from streaming live fitness courses, selling fitness equipment, as well as membership fees.

Peloton went public on Nasdaq in September of 2019. Its share price has surged over four times in the last 12 months, and the company now has a market cap of $30.8 billion.

READ MORE:

Philippines noodle maker set to launch a record-breaking IPO

JD.com to spin off logistics arm in third IPO in nine months