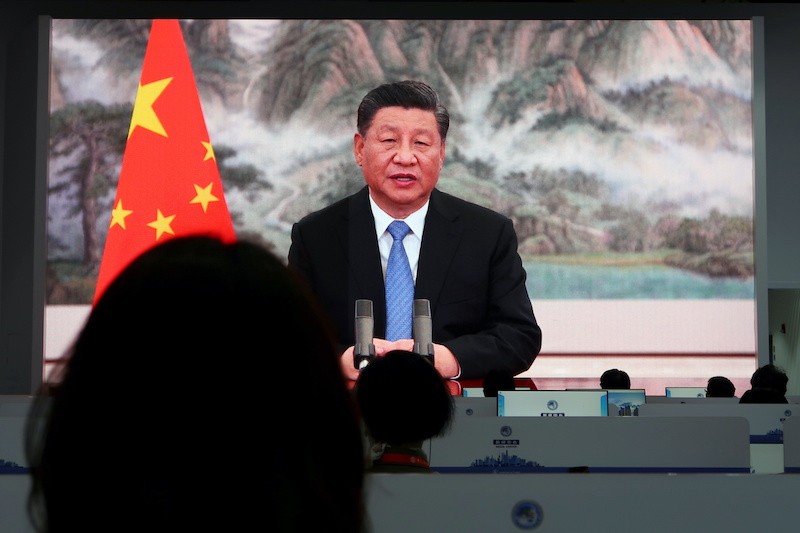

China’s President Xi Jinping and other top leaders began a key summit on Monday to chart out growth targets for the world’s second-largest economy in 2024.

The closed-door annual meeting, dubbed the Central Economic Work Conference, is closely watched by investors looking to gauge China’s policy and reform agenda.

Leaders at this year’s meeting are also likely to map out stimulus plans for 2024, four sources familiar with the matter said.

Also on AF: China Consumer Prices Fall Fastest in 3 Years, Alarming Beijing

The meeting is likely to end on Tuesday, the sources said.

It comes amid a shaky post-pandemic recovery in China’s economy, local government debt concerns and a deepening real-estate crisis that is threatening to engulf the financial sector as well.

Last week, ratings agency Moody’s slapped a downgrade warning on China’s credit rating, saying costs to bail out debt-laden local governments and state firms and control its property crisis would weigh on the growth outlook of the economy.

The Politburo, a top decision-making body of the ruling Communist Party, said on Friday that fiscal policy would be moderately strengthened.

Policy will be “flexible, moderate, precise, and effective”, to help spur the economic recovery, it said.

A flurry of policy support measures over the past few months have proven only modestly beneficial, raising pressure on authorities to roll out more stimulus.

View this post on Instagram

Steady growth target

The meeting is likely to set key economic targets for China, but they will not be announced publicly until an annual parliament meeting that is usually held in March.

China’s government advisers told Reuters that they would recommend economic growth targets ranging from 4.5% to 5.5% for 2024.

The majority favour a target of around 5% – the same as this year. Most analysts believe China’s growth is on track to hit that target this year.

“We are likely to set a growth target of around 5%,” said a policy insider who spoke on condition of anonymity. “We need to step up policy support for the economy.”

Fiscal policy in focus

Analysts at UBS expect China to set a fiscal deficit target of 3.5%-3.8% of gross domestic product, and a special local government bond quota of around 4 trillion yuan ($560 billion) for 2024, versus this year’s 3.8 trillion yuan.

“There is no doubt fiscal policy will take a leading role in 2024,” Bruce Pang, chief economist at Jones Lang Lasalle, said.

Analysts at Citi also expect China to set a fiscal deficit target of 3.8% of gross domestic product, or 3% of GDP on top of 1 trillion yuan ($139.32 billion) in special treasury bonds, and a special local government bond quota of 3.8 trillion yuan.

In October, China unveiled a plan to issue 1 trillion yuan in sovereign bonds by the end of the year, raising the 2023 budget deficit target to 3.8% of gross domestic product (GDP) from the original 3%.

- Reuters, with additional editing by Vishakha Saxena

Also read:

China’s Stock Index Near 5-Year Low After Moody’s Outlook Cut

Second Shadow Bank Rocked by China’s Property Crisis

China’s Property Sector Will Remain Weak For Years: Goldman

India to Overtake China to Become Global IPO Leader

Emerging Asia Sees Largest Outflows as Funds Stay Cold on China

China Sees First-Ever Foreign Investment Deficit in July-Sept

Moody’s Told China Staff to Stay Home Ahead of Rating Cut – FT