Big business in China appears to be back in business. But it might be short-lived.

On Tuesday, the National Bureau of Statistics released data showing that factory activity unexpectedly bounced back in March from record lows after being crippled by the Covid-19 pandemic.

Yet just hours earlier, the World Bank warned that the world’s second-largest economy could skid to a “halt.”

“The virus [is causing] an unprecedented global shock, which could bring growth to a halt and could increase poverty across the region,” Aaditya Mattoo, the World Bank chief economist for East Asia and the Pacific, said in a statement with the report adding: “Developing economies in [the region], recovering from trade tensions and struggling with Covid-19, now face the prospect of a global financial shock and recession.”

Already fears of a “deep” worldwide downturn have been brought into sharp focus by the International Monetary Fund.

“It is now clear that we have entered a recession as bad or worse than in 2009 [and it will be] quite deep. The human costs of the coronavirus pandemic are already immeasurable and all countries need to work together to protect people and limit the economic damage,” Kristalina Georgieva, the managing director of the IMF, told a media briefing last week.

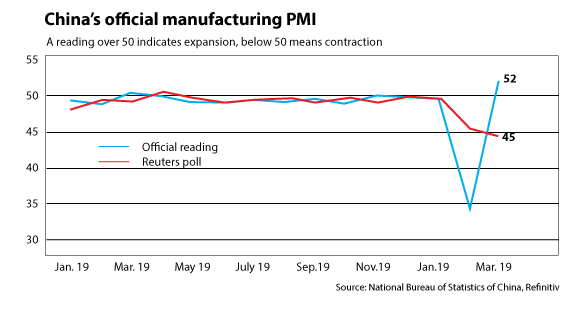

As for the figures, China’s Purchasing Managers’ Index pierced months of gloom despite skepticism from economists and analysts.

The official PMI of large and state-owned companies revealed that manufacturing activity jumped to 52.0 in March compared to 35.7 last month. Indeed, the February figure was a historic low. Of course, a reading above 50 suggests growth in the sector. Below is a contraction.

Non-manufacturing PMI also increased to 52.3 compared to 29.6 last month “as services rose from 30.1 to 51.8 and construction jumped from 26.6 to 55.1.”

“This does not mean that output is now back to its pre-virus trend. Instead, it simply suggests that economic activity improved modestly relative to February’s dismal showing, but remains well below pre-virus levels,” Julian Evans-Pritchard, the senior China economist at research consultancy Capital Economics, said in a briefing.

“A full recovery will take much longer given the deepening slump in foreign demand and the deterioration in the labor market – the employment components of the PMIs rose last month but still point to continued layoffs,” he added.

Tommy Xie, the head of Greater China Research at OCBC Bank in Singapore, was just as guarded in his assessment.

“We shouldn’t read too much into this sharp rebound. February was really a bad month for China,” he said.

Morgan Stanley, the multinational investment bank, was also cautious, pointing to “uncertainty surrounding readings” in the “coming months.”

Even Zhao Qinghe, the senior statistician at the National Bureau of Statistics, was circumspect in his comments.

“There remains relatively large pressure on enterprises’ production and operations [with a larger proportion of firms] facing tight funding and insufficient market demand,” Zhao said, adding that “new severe challenges” lay ahead as the Covid-19 pandemic sweeps across the planet.

Two weeks ago, NBS data for January and February showed industrial production dropped by 13.5% for the first two months of the year. Retail sales also plunged by 20.5% while urban unemployment increased to 6.2% last month from 5.3% in January. The record-breaking fall continued when it came to fixed asset investment, which plummeted by 24.5%.

To complete an appalling set of figures, profits at industrial firms during the same period slumped 38.3% from a year earlier to 410.7 billion yuan, or $58.15 billion. Moreover, that was the lowest level recorded in a decade.

“There’s no evidence of (or logic behind) the household side being much healthier than the corporate side . For Q1 as a whole, a 10-11% GDP contraction is not unreasonable . not that the [National Bureau of Statistics] will say so,” China Beige Book, an independent research firm, stated.

Exports also look certain to take a massive hit amid shrinking demand as Europe, the United States and the Asia-Pacific region cope with the aftershocks of this new coronavirus strain. The 27 European Union countries are still grappling with the outbreak and are in different stages of lockdown.

Hot spots include Italy, Spain, France and Brexit Britain. For the US, infected cases have soared to more than 164,000. Overall, the global total has surged past 786,000 with the death toll spiraling to nearly 38,000.

As for East Asia, the tremors could leave 11 million more people in poverty. “The pandemic is profoundly affecting the region’s economies, but the depth and duration of the shock are unusually uncertain,” the World Bank report said.

Numbers to make you weep.