China’s steel exports are set to plunge in coming months and worsen a serious domestic oversupply that has already caused the loss of tens of thousands of jobs.

Analysts and traders say the trade war – including tariffs by the US on multiple countries – and a wave of global protectionism has crushed export markets.

Second-quarter shipments from the world’s largest steel producer and exporter are forecast to fall by up to 20% from the first quarter, according to eight analysts and traders, who also expect exports to worsen further later in the year. That means second-quarter shipments will be lower than in the same period in 2024.

ALSO SEE: BYD Plants Seen Generating Big Sales in Europe, South America

Steel exports have been hit by a double blow as Washington’s tariffs choke off the trans-shipment trade, where third countries resell Chinese steel to the US, and top customers like South Korea and Vietnam impose their own duties to avoid steel then being rerouted and dumped in their markets.

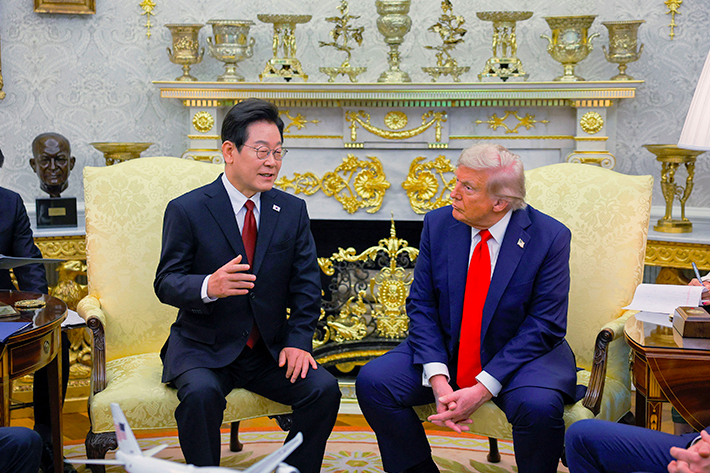

A multi-billion-dollar supply chain that moves steel from China to the US via third countries was disrupted by a 25% tariff imposed by President Trump that went into force early in March.

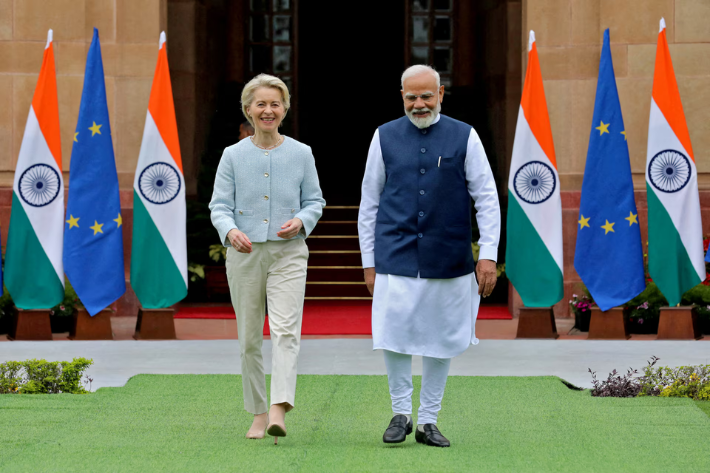

Brazil, Canada, Indonesia and Turkey hiked tariffs on Chinese steel over the past year, then Vietnam and South Korea announced new duties against some Chinese steel products in the weeks after Trump’s announcement. India and the European Union were also considering new tariffs and protections.

“It’s certain that total exports will slide in Q2,” a Chinese steel trader said on condition of anonymity, as they are not authorised to speak to media.

“One can look at Middle East, Africa and South America as alternative outlets but the problem is no country can absorb such a huge capacity.”

China’s rising steel exports have helped partly offset weak demand from the battered property sector and any decline will redirect steel back home, depressing prices, eroding steelmaker profitability and denting their appetite for inputs like iron ore.

Orders down by 20-30%

First-quarter exports hit the highest level since 2016 as mills rushed to get steel out of the country before the then-rumoured tariffs were announced.

While the steel industry has long expected near-record exports to ultimately trigger some backlash, the magnitude of protectionism unleashed by the trade war between Washington and Beijing has surprised many.

The Chairman of China’s largest listed steelmaker, Baosteel, said late last month the sector’s exports faced “unprecedented” pressure and more steel left at home would intensify oversupply.

Overseas orders for a large Chinese exporter fell between 20% and 30% last month versus the month before, according to an April survey compiled by consultancy Mysteel.

There are also concerns the trade war could spill over into products heavily reliant on steel, like electric vehicles or home appliances, weakening the other major source of steel demand outside the property sector, Ge Xin, deputy director at consultancy Lange Steel, said.

“It takes time for that impact to permeate through into the upstream steel market, likely reflected in data in the second quarter when home demand seasonally slowed, aggravating the supply glut situation.”

- Reuters with additional input and editing by Jim Pollard

ALSO SEE:

Trump’s Steel Tariff to Hit Chinese Supply Lines via Other Nations

Trump’s ‘No Exemption’ Tariffs Rattle Chinese Steelmakers

Chinese Ships May Face a Hefty Fee to Enter US Ports

China, Asian Markets Fall After Trump’s Latest China Curbs

US-China Trade War Goes Into Gear as Beijing’s Tariffs Kick In

US Probe Shows China Unfairly Dominates Shipbuilding: Sources

China’s Cosco Shipping, Fortescue Eyeing Ammonia-Fuelled Ships