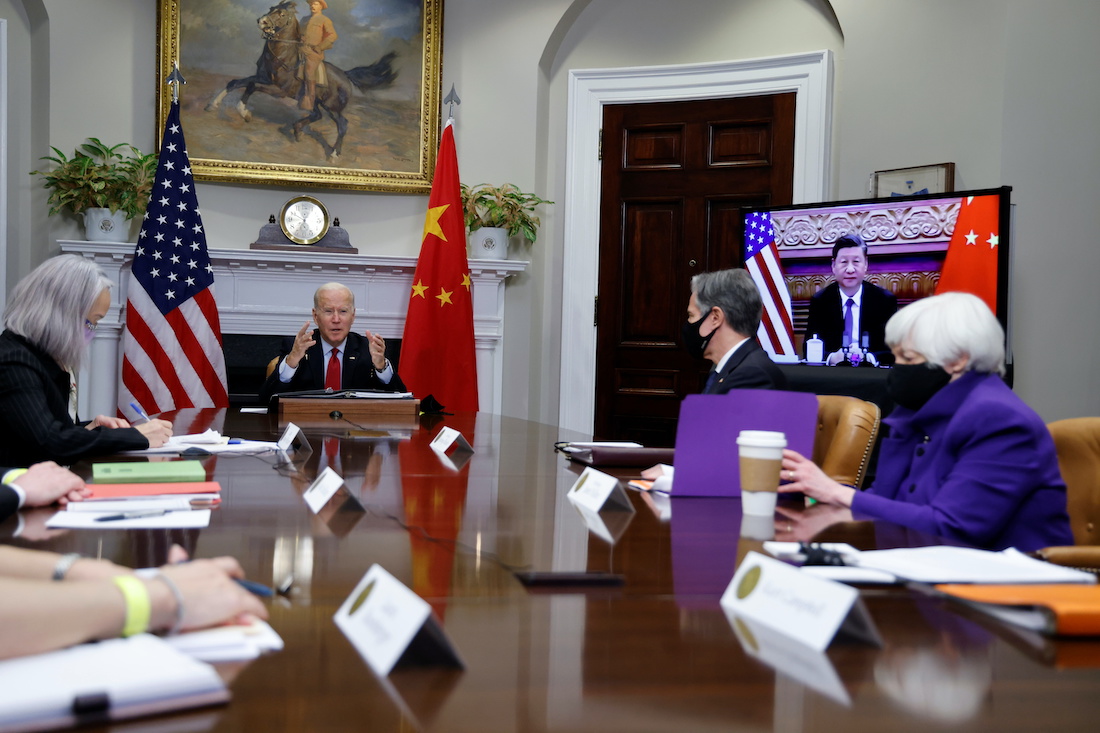

The positive tone of the Biden-Xi summit cooled some of the heat in US-China tensions and offered a slight boost to Asian shares on Tuesday, but this proved short-lived. Shares on most markets in Asia fell on Wednesday, dragged down by worries about Covid-19 and higher costs.

MSCI’s broadest index of Asia-Pacific shares outside Japan skidded 0.5% from Tuesday’s near three-week closing high, and was set for its biggest fall this month, snapping seven days of gains.

The Nikkei in Japan lost 0.3% on fears the strong dollar would mean higher costs for imported material for manufacturers.

South Korea’s KOSPI fell 1.2% after the country reported its the second-highest daily new coronavirus infections since the pandemic began.

Australian shares fell 0.7% weighed by Commonwealth Bank of Australia, the country’s largest bank, which slipped 8% after it flagged a hit to margins from the low interest rate environment and mortgage competition.

Chinese blue chips were steady and the Hong Kong benchmark slipped 0.4% – its first retreat in six days, as a short rally in developer and casino stocks ran out of steam.

Other markets in negative territory were Singapore, Mumbai, Manila and Wellington.

Shanghai and Taipei reversed early losses while there were mild gains in Bangkok and Jakarta. Paris and Frankfurt were flat in initial trade.

Analysts remain guardedly upbeat about the outlook for equities.

Hopes for Strong Holiday Season

“All signs are pointing to a very strong holiday season for retailers and that should help keep sending stocks higher,” OANDA’s Edward Moya said.

He added that markets were “fixated on inflation”, with an expectation that things can get “a little uglier over the next couple of months, before traders get unnerved.”

Oil prices slipped after data showed US gasoline inventories fell more than expected last week, heightening pressure on US authorities to release oil from emergency reserves.

Investors are waiting to see if President Joe Biden heeds calls to tap reserves to meet surging demand.

A report in Hong Kong’s South China Morning Post said the president had asked Chinese counterpart Xi Jinping in their virtual summit to join him in releasing extra crude into the market.

However, OANDA’s Moya said the market, which has been boosted by the global reopening, would likely remain elevated for some time.

“The oil market deficit seems likely to last a while longer as the Biden administration seems unwilling to ask US shale to increase production,” he said in a note.

OPEC, along with other major producers, “has the oil market right where it wants it and… will now likely benefit with $80 oil at the minimum over the next couple of years.”

Dollar Strong

The dollar strengthened through key resistance levels on Wednesday, propelled by better-than-expected US retail data. It reached a high of 114.97 yen in early Asian hours, its strongest since March 2017, while the euro fell to $1.1263 its lowest since July 2020.

The greenback was helped by data on Tuesday that showed US retail sales rose faster-than-expected in October, potentially encouraging the US Federal Reserve to accelerate the tapering of its asset purchase programme, as inflation remains stubbornly high.

These also weighed on US Treasuries with benchmark 10-year note yields reaching 1.649% in early Asia, a three-week high.

“The data backs up that sense that things are going pretty well, and the Fed can be a little more aggressive if it wants to be without completely causing the party to crash,” Rob Carnell, head of research for Asia Pacific at ING, said.

“Top of mind for everyone is inflation right now, it’s still an issue after the numbers we got from the US yesterday, and we’ve got a whole barrage of other inflation data coming today, particularly the UK and Canada,” he added.

Britain publishes its October inflation data later on Wednesday with a high print likely to add pressure on the Bank of England to raise rates in December after surprising markets by holding fire last month.

Spot gold rose 0.25% to $1,854 an ounce, climbing back towards the five-month high of $1,876.9 hit a day earlier on rising inflation concerns.

Rival inflation hedge bitcoin slipped 0.8% to $59,500 having shed 5% a day earlier.

Key figures around 0820 GMT

Tokyo – Nikkei 225: DOWN 0.4% at 29,688.33 (close)

Hong Kong – Hang Seng Index: DOWN 0.3% at 25,650.08 (close)

Shanghai – Composite: UP 0.4% at 3,537.37 (close)

New York – Dow: UP 0.2% to 36,142.22 (close)

• Reuters, AFP with additional editing by Jim Pollard

ALSO SEE:

Asian High-Yield Managers Close 2021 Books Amid China Woes

Chinese Premier Li Keqiang Calls for Small Business Help

WATCH MORE: