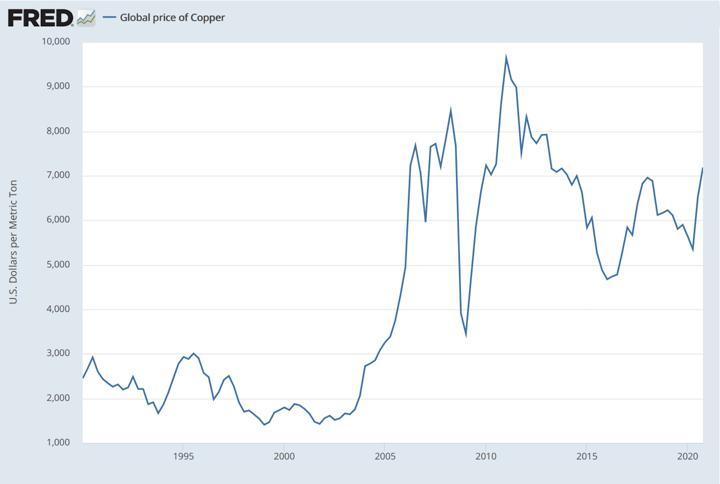

(ATF) Copper prices reached eight-year highs on February 10 as traders’ optimism rose against a backdrop of rising inflation, a falling dollar, historically low stocks and green stimulus plans unleashed to combat the economic shock of the coronavirus pandemic.

Benchmark copper on the London Metal Exchange (LME) closed at $8,279.50 a tonne after touching $8,302.50, a gain of nearly 90% since March 2020 and the highest since February 2013.

“February is typically the weakest point in any year for copper demand as the lunar new year holiday reduces demand from the world’s biggest consumer,” Ole Hansen, head of commodities strategy at Saxo Bank in Copenhagen, said.

“Yet almost all signals indicate a tightening market with the lack of mine supply growth pointing towards a looming deficit,” he said.

Copper inventories monitored by the three major exchanges in New York, London and Shanghai have fallen to a multi-year low at 215,000 tonnes, less than half of the 522,000-tonne average seen during the past five years.

FALLING INVENTORIES

Copper, already the most widely used industrial metal, has gained in recent years through its application in new technologies. An electric vehicle (EV) needs at least four times more wiring than a car with an internal-combustion engine, while solar panels and wind farms need as much as five times the amount of copper than what is needed for a coal-fired power station.

On February 5, LME copper stocks were down 31,000 tonnes since the start of the year, while Chicago-based CME Group’s COMEX stocks had reduced by 7,000 tonnes, according to Warren Patterson, chief commodities strategist at ING in Singapore. “Unusually, Shanghai Futures Exchange inventories are also down by 18,000 tonnes, and levels are far below those historically seen at this time of the year,” he added.

Traders are betting that as the Covid-19 pandemic recedes through increased vaccination, companies will renew green spending plans, sending the metal higher. However, while the price has rallied to a near decade high, speculators in futures have been more hesitant.

“Currently they hold a net-long of 78,000 lots, close to a three-year high but 38% below the record from September 2017,” said Hansen, citing COMEX data. “Furthermore, the position has stayed relatively constant since September. Another measure indicating a not yet stretched market is the long/short ratio. At 3.5 longs per one short, the ratio is well below the record 6.4 from 2017.”

Source: International Monetary Fund via Federal Reserve Bank of St Louis

Still, the recovery has been a boon for miners. Like many other globally traded commodities, copper experienced significant demand destruction in 2020 due to the pandemic, but stimulus programmes announced all around the world all have one common factor – they are all copper-intensive.

“Once demand returned after the initial shock, a tight supply-demand balance became evident in the latter part of 2020, supported by copper-friendly government economic stimulus policies,” said Jeremy Weir, chief executive of Trafigura, one of the world’s biggest copper traders – it sold more than 4 million tonnes in 2020, nearly one-sixth of global production.

“Trafigura’s newly integrated copper desk, with trading of concentrates, refined metal and derivatives united in one department, had an exceptional year, growing volumes and market share and recording a substantial profit,” Weir added.

The trader predicts growing demand for renewable infrastructure projects and EVs in particular should drive global consumption of refined copper to 33.3 million tonnes in 2030 from 23.4 million tonnes in 2020.

Refined copper production was about 23.8 million tonnes in 2020. Weir said the trading of byproducts of copper concentrates also experienced growth throughout the year.

ALSO SEE:

Silver shines in rare day trader rally

Massive beryllium find raises stakes in rare earth tensions

EU to tax Chinese metal imports