(ATF) China corporate and municipal bonds fell Wednesday as the fallout from the Huarong crisis spread across credit markets.

The returns-focused ATF China Bond 50 Index fell the most in there weeks, also dragged down by a coupon payment on a bond of China Cinda Asset Management.

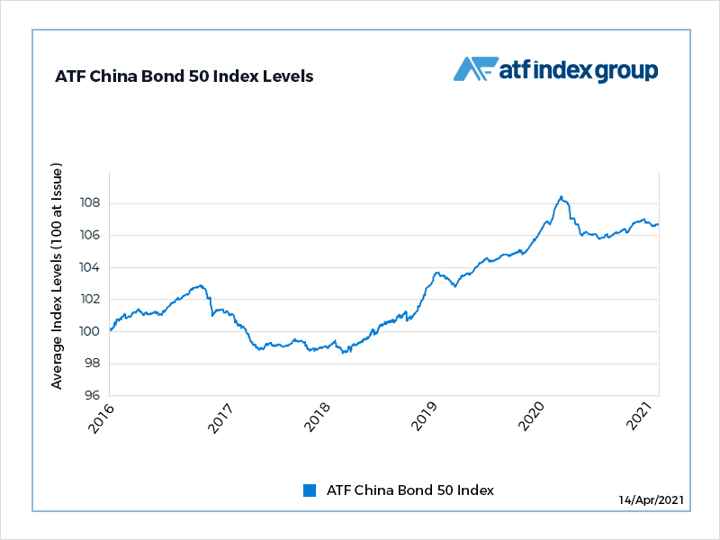

The ATF CB50 slid 0.06% to 106.69. The gauge has climbed this month after a steep drop in March amid inflation fears and as the more than a dozen issuers made coupon payments on their bonds.

Also on ATF

- Huarong panic may spur China sovereign wealth fund move

- Crypto sector tops $2 trillion in value despite scepticism

- Huawei says its first self-driving car ‘HI’ surpasses Tesla

A bond’s price tends to fall after a coupon payment because they reduce the fixed pool of interest the security pays over its remaining lifetime.

Huarong’s bonds have slumped since the bad loans manager said it would not report its results on time due a “relevant transaction”. It gave no details of the transaction but the announcement follows the January execution of its former chairman Lai Xiaomin for fraud and bigamy.

Trade in its shares were frozen in Hong Kong and ratings agencies downgraded the company’s debt. Speculation has also arisen that China’s wealth fund will step in.

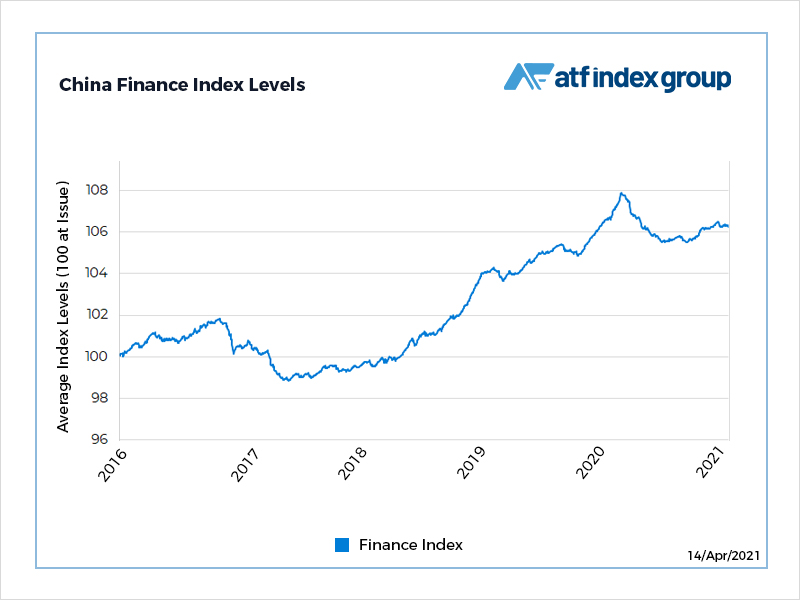

Concern that the contagion would spread to other bond issues sent the ATF Financials sub-index 0.08% lower. Declines were exacerbated by China Cinda’s coupon payment on its 4.75% bond due in March 2027.