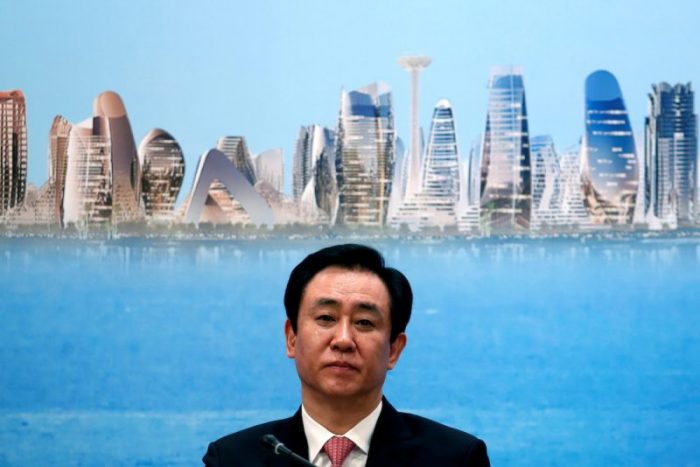

A creditor of the Evergrande Group has seized two luxury mansions belonging to the company’s chairman Hui Ka Yan, local media outlet HK01 reported on Wednesday.

The properties, located in The Peak, one of the most prestigious neighbourhoods in Hong Kong, are valued at more than HK$1.5 billion ($192 million). They will be formally taken over by the creditor within days.

An unidentified creditor submitted relevant documents on Tuesday, the media report said, without specifying the source of its information.

Also on AF: China ‘Not Doing Enough’ to Spark Property Turnaround

The luxury homes were pledged to Orix Asia Capital Ltd in November 2021 for undisclosed amounts, according to the Land Registry.

Orix’s spokesperson did not immediately respond to phone and email queries from Reuters, and Evergrande did not immediately reply to a request for comment.

Another of Hui’s homes next to the two mansions was seized by China Construction Bank (Asia) in November last year.

Evergrande is fighting a winding-up petition and has until December 4 to unveil a concrete new restructuring proposal to avoid liquidation.

The group’s main assets in Hong Kong – its headquarters and a vast plot of rural land – were seized by creditors last year, after the company defaulted on public debts due to a cash crunch.

- Reuters, with additional editing by Vishakha Saxena

Also read:

Beijing Seen Taking Over China Evergrande’s Debt Revamp

China Evergrande Chairman ‘Suspected of Crimes’, Company Says

Hui Ka Yan and The Rise and Fall of China Evergrande

Country Garden ‘Aiming for $11bn Offshore Debt Plan by Year-End’

HSBC Says Worst Over For China Property Despite $500m Hit

China’s Property Sector Will Remain Weak For Years: Goldman

Country Garden Defaults on Bond, Sparks Contagion Fears – FT