The world’s most indebted developer, China Evergrande Group, is racing to unveil some debt restructuring terms before its next winding-up court hearing on March 20, two sources with knowledge of the matter said.

Evergrande, which will seek another adjournment at the hearing this month, has been trying to reach agreements with major offshore bondholders on terms including swapping part of its debt into equity, the sources and two other people said.

The embattled Chinese developer has more than $300 billion in liabilities, of which $22.7 billion is offshore debt.

Also on AF: China Evergrande Auditor PwC Quits Over 2021 Audit Disputes

It began one of China’s biggest debt-restructuring processes early last year but has yet to reach agreements with bondholders on the details.

Once China’s top-selling developer, Evergrande has been at the centre of a property debt crisis that has seen multiple developers default on offshore debt obligations over the past years, forcing many to enter into debt restructuring talks.

Debt swap price, ratio in focus

Evergrande is due to appear in a Hong Kong court on March 20 for hearing on a winding up petition filed by a creditor.

In the last November hearing, the judge ordered Evergrande to achieve some “concrete” progress on the debt revamp process and provide a progress report 14 days ahead of the next hearing, or by around March 6.

The developer told the court at that time it aimed to win creditors’ approval for its debt restructuring proposals by as early as the end of February.

The negotiations with bondholders are still ongoing, the four sources said. Three of the sources said the latest discussion is focusing on the price and ratio of swapping some debt into equity of Evergrande’s two listed units in Hong Kong.

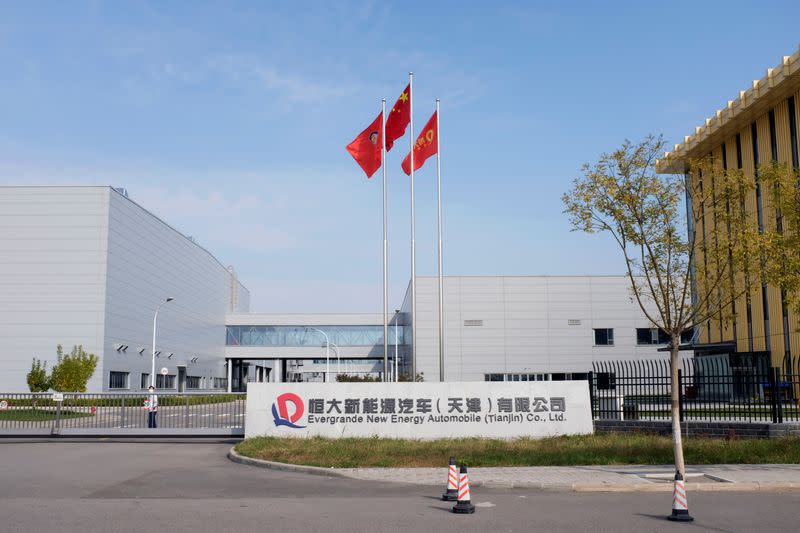

The developer’s two Hong Kong-listed units are Evergrande Property Services Group and Evergrande New Energy Vehicle Group.

Hui Ka Yan asked to pay from pocket

The debt-to-equity swap plan was suggested by Evergrande as a core part of its restructuring plan. However, bondholders have been pushing for better terms, three of the sources said.

One of them said Evergrande has made “some compromise”, but there was still a mismatch in expectations.

Bondholders have also been pushing Evergrande Chairman Hui Ka Yan to put in more of his own money to repay debt, the person added.

In July, the developer said it would offer its offshore creditors asset packages that may include shares in two overseas-listed units. It was later said to be considering onshore assets as sweeteners for the restructuring plan.

The developer sat down with some offshore bondholders in-person in Hong Kong for the first time in January after they started official negotiations on the restructuring terms in a virtual meeting in December, sources told Reuters.

- Reuters, with additional editing by Vishakha Saxena

Also read:

Sale of China Evergrande’s Hong Kong Head Office Fails Again

China Evergrande HQ Land in Shenzhen up For Sale at $1 Billion

China Authorities Seize Evergrande’s Island Resort Towers

Evergrande Chairman’s $89m Hong Kong Mansion Seized

Evergrande Chief Voice Clip Put on WeChat Amid Suicide Rumour – SCMP