The pressing need to build climate resilient infrastructure, and the potential boost to economic growth from such an endeavour has made green infrastructure a priority for many Asian governments. At Eastspring Investments, we expect the Asian bond market to play a key role in helping to finance these investments, which will in turn create more diverse opportunities for bond investors.

Besides the need to build infrastructure that can withstand climate driven shocks in the future, the potential boost to economic growth and job creation from such activities also increases the appeal for governments to prioritise green infrastructure post the COVID-19 pandemic. The Asian bond market is expected to play a key role in helping to finance these investments.

Rising to the green challenge

The size, depth and liquidity of Asian’s bond markets have improved dramatically since the Asian Financial Crisis in 1997. The market capitalisation of Asia’s local and foreign currency bond markets currently stands at USD22 tr, accounting for 18% of the global bond market. A large and growing domestic investor base has also helped Asian economies not to be primarily dependent on foreign capital to fund investments and spending. Capital markets have increasingly liberalised to allow greater foreign participation which has in turn facilitated the inclusion of certain major local currency bond markets in global bond indices.

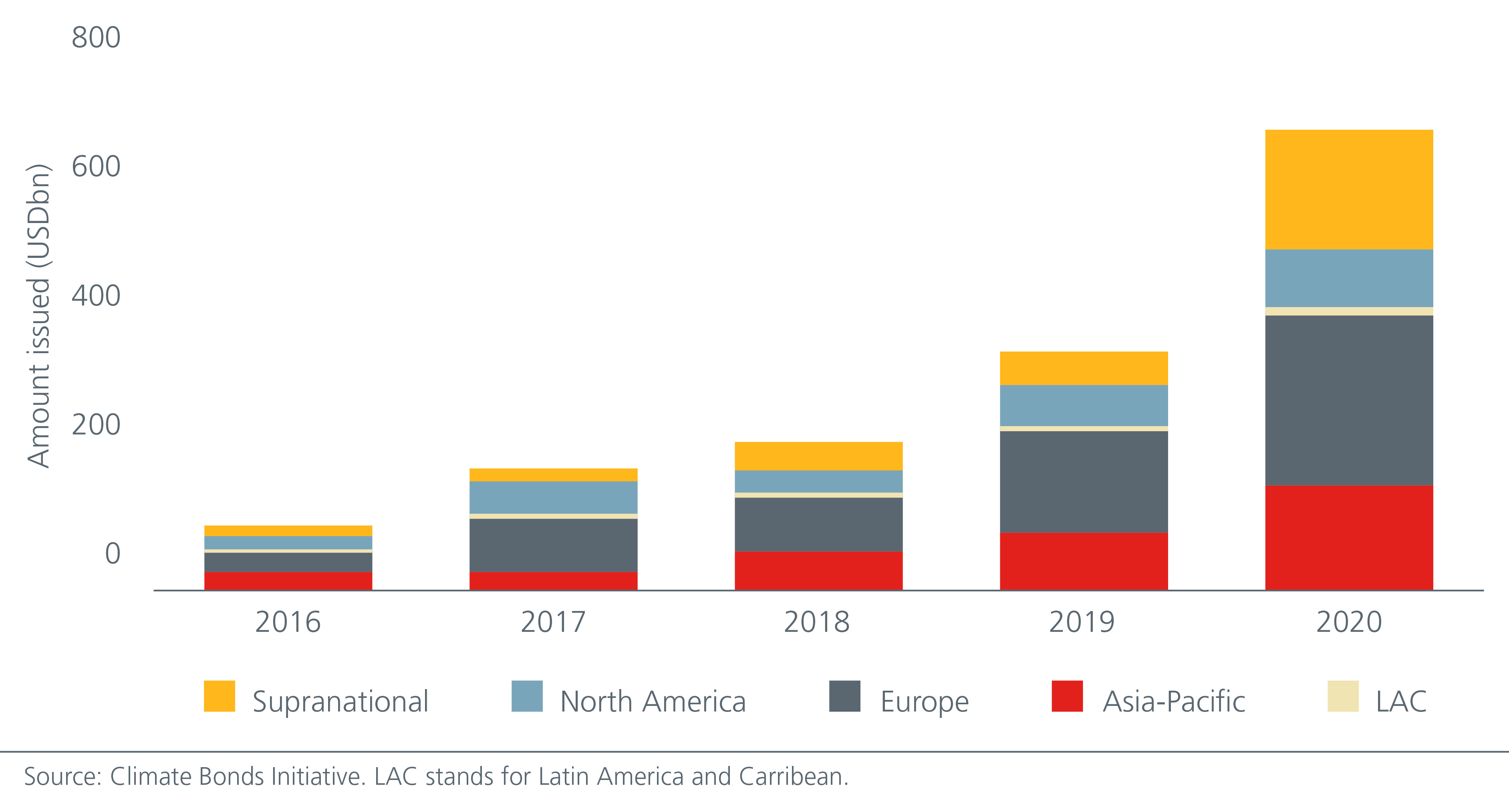

Asia’s sustainable bond market has an outstanding stock of USD301.3 bn at the end of March 2021, accounting for nearly 20% of the global sustainable bond market 2. In 2020, Asia Pacific’s issuance of Green, Social and Sustainable bonds made up 23% of global issuance. See Fig. 1.

Fig. 1 Asia-Pacific’s Green, Social and Sustainable bond issuances continue to grow

Green bonds make up almost 75% of the region’s total sustainable bonds outstanding, reflecting the ongoing commitment from various stakeholders to mitigate climate change risks. It also helps that Green bonds have a longer history, existing frameworks and an accreditation process.

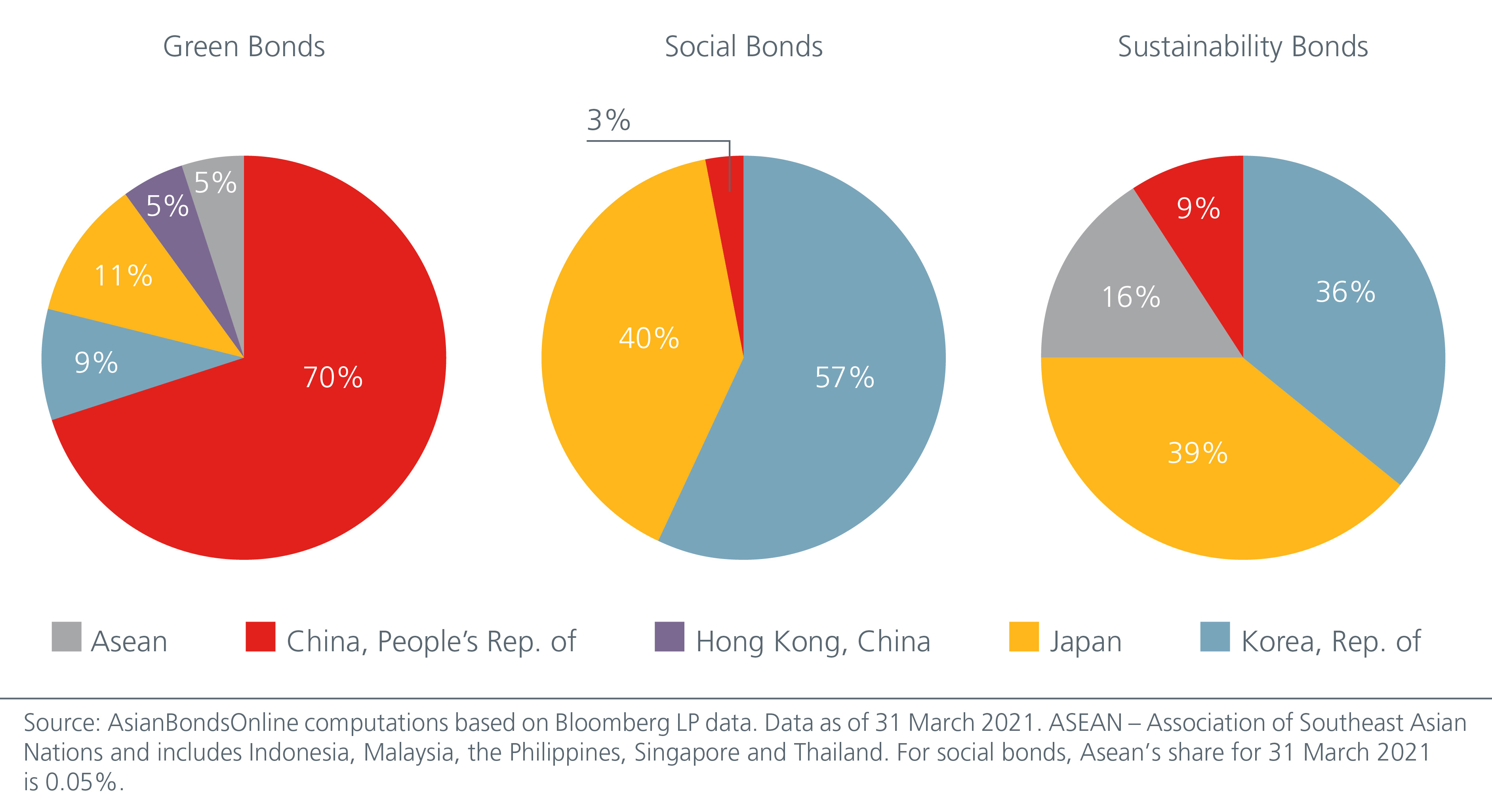

Asia has a big role in decarbonising the global economy. With China alone contributing 30% of global carbon emissions, it is not surprising that China accounts for 70% of the region’s green bond issuance followed by Japan (10.8%) and Korea (9.3%). See Fig. 2. China already accounts for one-third of global investments in decarbonisation although the path towards carbon neutrality will be challenging as much of its existing energy infrastructure is heavily reliant on coal. China’s efforts to build green financing channels to fund the massive investments required to build a green infrastructure will probably be accompanied by carbon credit offsets.

Fig. 2. Outstanding Green, Social and Sustainability bonds in Asia

There has also been growing investor interest and issuance in social and sustainability bonds in Asia to help finance health services and poverty alleviation projects post the COVID-19 pandemic. Sustainability bonds are appealing because proceeds can be used for both environmental and social objectives, giving the issuer greater flexibility. On the other hand, there is less clarity surrounding how to measure and assess the impact of social bonds. The total amount of social and sustainability bonds outstanding in Asia is USD 35.4 bn and USD 41.1 bn respectively, with Japan and Korea being the biggest issuers of such bonds. The Asian Development Bank is seeking to accelerate the development of the social bond market. The expanded scope of social projects to include pandemic support spending under the Social Bond Principle (SCP) framework will help to grow this market.

A concerted effort needed

Corporates are the key issuers of green and sustainability bonds in Asia while governments have dominated the social bond market to date. In recent years, we have seen a strong increase in issuances from renewable energy companies and property developers. Going forward, we are likely to see a highly diverse mix of green bond issuances from China as the government’s net carbon neutrality target gets cascaded down to the companies.

To grow Asia’s sustainability bond market, governments will need to deepen the liquidity of the market as well as roll out policies that will encourage corporate issuers. More also needs to be done to encourage greater issuances from the lower income economies in Asia.

The Singapore government has recently identified up to USD19 billion of public sector green projects which would be funded by Green Bond issuances. In 2021, the Hong Kong Monetary Authority announced that it will provide subsidies for eligible bond issuers and loan borrowers to cover expenses related to bond issuance and external review services. Meanwhile, the latest Green Bond Guidelines published by the People’s Bank of China have reduced the gap with international standards on eligible projects, by no longer allowing green bonds to fund clean coal projects. This could potentially make Chinese green bonds more compatible to foreign investors’ internal ESG policies and increase their appeal. The establishment of the Asean Green Bond Framework will also help to catalyse growth of the Green Bond market in the region.

Rising investor interest has also resulted in the emergence of other ESG-related leveraged instruments. For example, Indonesia, Malaysia, the Philippines, Singapore and Thailand have introduced policies and initiatives to promote Sustainability-linked loans (SLLs) and Sustainability-linked bonds (SLBs).

SLLs and SLBs offer an alternative for companies in sectors that currently lack clear definitions of green or companies that do not have specific green assets and projects but want to decrease their carbon footprint. If issuers do not achieve the Sustainability Performance Targets which they have set out, investors get compensated through higher coupons for the “incremental risk” they are taking. While we appreciate this feature, we note that restrictions within certain legal frameworks may prevent issuers from stepping up their coupon payments. At the same time, compared to bonds, SLLs are private assets which may carry fewer disclosures.

We expect to see more innovative financing instruments emerge. For example, transition bonds can help carbon-intensive sectors which have significant stranded assets transition to a net-zero carbon economy. Transition bonds are likely to become increasingly important for the fossil energy sector as acceptable transition parameters are established.

A rewarding venture for investors

There is an opportunity for investors to do well while doing good. The cost of debt between the best and worse rated ESG bonds in Asia is 26 basis points. The gap in Europe is 53 basis points, suggesting that the yield differential in Asia could widen in the future, making investments in Asia’s sustainable bond market a potentially rewarding venture for early investors.

As policymakers in the region look to make infrastructure more climate resilient and companies continue their decarbonisation journey in the new post pandemic world, Asian bond markets will play a critical role in helping to finance these initiatives.

Leveraging on international standards and working with reputable international agencies including the International Capital Market Association and the International Finance Corporation will help accelerate the development of the sustainable bond market in Asia, providing investors with greater diversity and opportunities. This will be an evolutionary process as Asian policy makers continue to make incremental changes to regulations in response to Asia’s unique considerations. Given Asia’s later start, the path to net zero is likely to be steeper and more ambitious than Europe’s. However, this also suggests that the potential impact could be greater.

*The views expressed on Industry Announcements are not necessarily the views of

Asia Financial.

*To contribute press releases, research or commentaries, please send an email to

[email protected]