China’s company earnings for the first quarter have fleshed out greater detail about the country’s economic recovery after it ended its three years of tough Covid restrictions.

People spent freely in the first quarter on dining, domestic travel and some luxury goods, but purchases of consumer items have been lopsided, suggesting people are still wary about the economic outlook.

There was a broad bounce in earnings after China ended its zero-Covid policy involving city-wide lockdowns and extensive quarantine in December, but consumer caution over global growth and job prospects have dented confidence and overall demand.

China A-shares posted 3.2% growth in earnings in the first three months from a year earlier, rebounding from a 5.7% drop in the fourth quarter of 2022, BofA Securities estimates.

ALSO SEE:

China’s Lead Role in Euro Battery Sector After Green Shift

Restaurants, tourism bounce back

The benefits to companies, however, varied widely even though the economy grew faster than expected in the first quarter.

Restaurants and tourism businesses recovered, with travel-related consumer services sector earnings surging 155%, data from China International Capital Corp (CICC) showed. Food-and-beverage sector earnings jumped 18% and automobiles were up a smaller 8%.

In contrast, both home furnishings and apparel firms’ earnings declined 9%.

Sub-sector results further highlight the divergence in consumer behavior.

Major jewelry brands Lao Feng Xiang and Chow Tai Seng saw double-digit growth in earnings, while leading cosmetics firm Bloomage Biotechnology posted a 17% decline in its net profit due to lukewarm online sales.

Gradual return of confidence expected

Norman Villamin, group chief strategist at UBP, said consumer confidence will be restored gradually and over time.

“When you’re a little bit nervous, you may spend a little bit for ‘a one-off transaction’. Maybe nobody gets on the 4-hour plane ride, but they’ll ride the train for an hour. You eat out, but maybe you won’t watch the movie. You start slowly, but then as you get more comfortable throughout the year, you start to do a little bit more,” he said.

Several analysts believe the first quarter will be the low point for 2023 and full-year earnings will reach double digits.

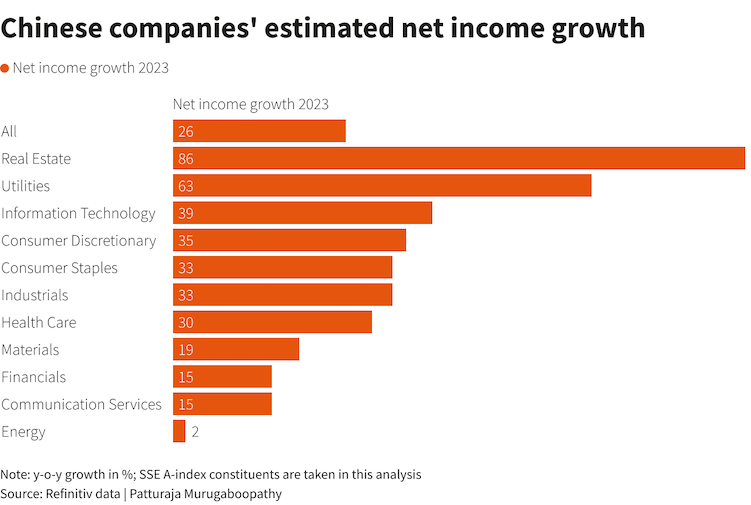

Refinitiv data forecasts full-year earnings growth of 26% for companies listed on the Shanghai Stock Exchange.

“Investors may look past the first-quarter results and focus on the momentum of earnings revision for the second quarter,” Redmond Wong, Greater China market strategist at Saxo Markets, said.

The benchmark Shanghai Composite has risen 8% so far in 2023, although stocks retreated somewhat in April as corporates delivered a mixed bag of results.

Construction sector slump

The materials sector posted the worst results, with earnings in steel and building materials tumbling more than 60%, respectively. Real estate, healthcare, apparels were notable underperformers, while financials, consumer services and utilities outperformed with positive growth, (CICC) data showed.

Analysts believe earnings have reached a trough and could improve in the coming quarters, after the April Politburo meeting suggested policymakers will dole out forceful fiscal and monetary measures to support the economic recovery.

Yet the stratification in consumption seems to have continued at least into the second quarter.

Labour Day holiday data this month showed households dined out and took short domestic trips, but were not ready to spend on discretionary goods and products, David Chao, a global market strategist at Asia Pacific (ex-Japan) at Invesco, said.

- Reuters with additional editing by Jim Pollard

ALSO SEE:

China Car Sales Growth Slows as Price War Boost Wanes

China Raids Capvision Amid Crackdown on Due Diligence Firms

China’s Security Focus Undermining Its Economic Goals