Foreign investors sold nearly $9 billion worth of Asian ex-China equities in September, because of doubts caused by US rate hikes, the strong dollar and weaker regional prospects.

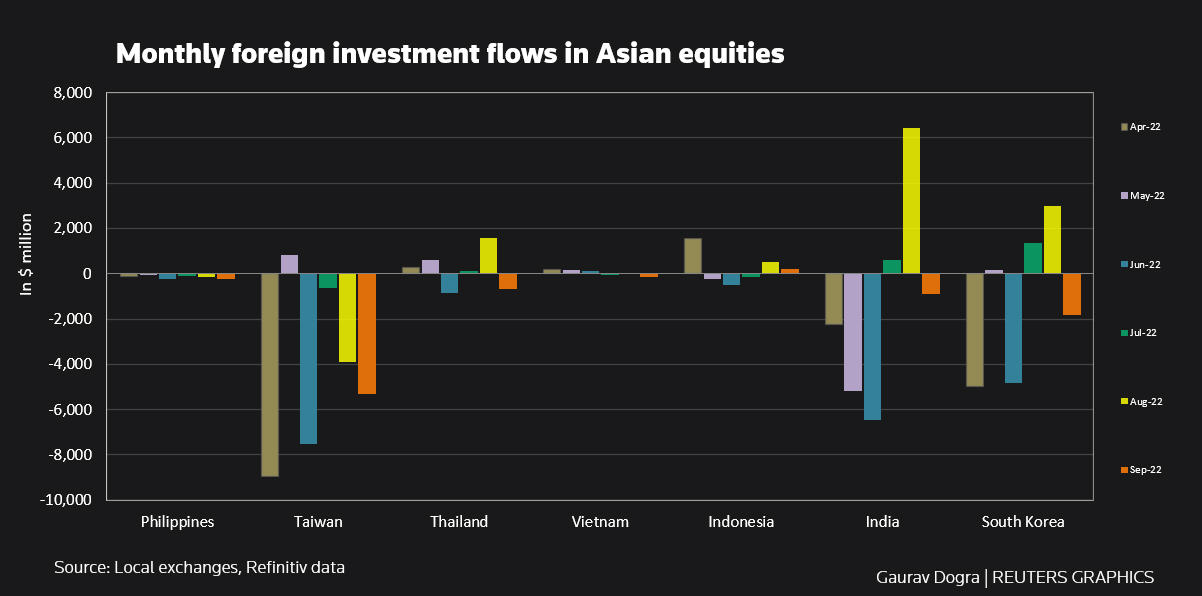

Data from stock exchanges in South Korea, India, Taiwan, the Philippines, Vietnam, Indonesia, and Thailand showed that foreign stock holding dropped by a net $8.83 billion.

Asian stock markets have so far faced total outflows of $69.7 billion in the first three quarters of the year, a big jump in outflows of $47.6 billion faced in 2008, when the global financial crisis occurred.

Last month, the US Federal Reserve raised its benchmark interest rate by 75 basis points, the third hike in a row, and analysts expect the US central bank to keep lifting rates to tame inflation.

The Asian region is grappling with mounting inflationary pressures, interest rate hikes and slowing economic growth, according to Mark Haefele, chief investment officer at UBS Global Wealth Management, who said aggressive US rate hikes had also hurt the region’s currencies and export markets.

Goldman Sachs cut the region’s 2022 and 2023 earnings-per-share growth by 2 percentage points (pps) and 3 pps respectively at the end of last month, citing the negative impact of rising rates, the stronger dollar, and slower growth on earnings.

Outflows from tech-reliant South Korea and Taiwan last month jumped to a three-month high of $1.8 billion and $5.3 billion, respectively.

India and Thailand witnessed outflows worth $903 million and $653 million, respectively, after each seeing inflows in the previous two months.

Foreigners were also net sellers of equities in the Philippines and Vietnam markets last month. On the other hand, Indonesian equities gained small inflows of $209 million.

“The cloudy outlook on economic conditions and firm policy stance from the Fed, risk sentiments may still lean towards some caution, which may lead to a lukewarm inflow for Asian equities in the near-term at best,” Yeap Jun Rong, a market strategist at IG, said.

- Reuters with additional editing by Jim Pollard

ALSO SEE:

US Seen Blocking More Chip Exports From China’s Military

US Slams ‘Reckless’ North Korean Missile That Caused Japan Alert

Samsung to Triple Microchip Production Due to Soaring Demand