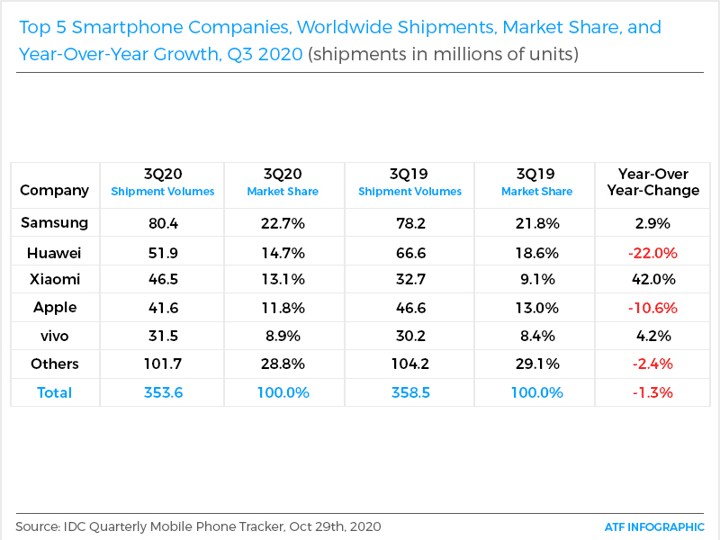

(ATF) As the global smartphone market begins to recover, Samsung has become the number-1 brand, but Chinese manufacturers – led by Huawei and Xiaomi – are still taking a big chunk of the pie. Huawei has slipped to second place, while Xiaomi has risen to third spot, ahead of Apple.

According to the latest data, for third quarter of 2020, shipments declined just 1.3% year-on-year, according to preliminary information from the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker. In total, 353.6 million smartphones were shipped during 3Q20 and while the market declined, the results were stronger than IDC’s forecast of a 9% year-on-year decline. This is largely attributed to the re-opening of economies around the globe as Covid-19 restrictions were gradually relaxed.

Samsung shipped 80.4 million phones, which was 22.7% of the market, IDC said. That represented a 2.9% rise from 2019. Samsung Electronics posted its best quarterly operating profit in two years in the third quarter, when its profit jumped by 59% to 12.35 trillion won ($11 billion). Executives said this was caused by a spike in demand for its chips after the US restrictions on Huawei took effect. But executives at the Korean tech giant said last Thursday they expect its fourth-quarter profit to fall, due to weak server chip demand and rising smartphone competition.

Huawei lost the top spot and slipped to second position in 3Q20 with 51.9 million smartphones shipped and 14.7% share. The vendor suffered a large drop – down 22% year-on-year – with continued declines in international markets and a drop of more than 15% in China. The company continues to face challenges due to the increasing impact of US sanctions, which are taking a toll on its performance even in China as the brand is trying to pace its shipments over a longer period.

Xiaomi shipped 46.5 million devices to grab the number 3 position globally, beating Apple for the first time with 13.1% share and 42% growth. This is due to strong gains in India and a continued strong presence in China, which accounted for 53% of the company’s volume in 3Q20. In India, Xiaomi’s production capacity recovered to nearly 85% of its pre-pandemic level, which helped it cater to strong demand. Xiaomi’s low-end portfolio, particularly the Redmi 9 Series, did well in both India and China. Xiaomi also launched the mid-range Redmi K30 Ultra and high-end MI 10 Ultra in China, which further captured consumers’ attention.

Apple shipped 41.6 million iPhones in 3Q20, down 10.6% year-on-year, which saw the tech giant placed fourth for the first time with 11.8% share. This drop was expected and is mainly due to the delayed launch of the iPhone 12 series (their launches are usually in the third quarter). Regardless, the iPhone 11 series did exceptionally well, contributing the majority of Apple’s volume, followed by the SE device. Looking ahead, we expect Apple to grow in coming quarters with strong early demand for iPhone 12 paired with robust trade-in offers across major carriers, especially in the US.

Vivo, another Chinese handset maker, returned to the Top 5 with 31.5 million units shipped in the third quarter, which represented 4.2% year-on-year growth and an 8.9% share of the market. The company is trying to grow in other markets and India delivered huge growth of nearly 30% year-on-year in its low-end models under $200. In China, the brand enhanced the market positions of its S, iQOO, and X series phones that helped continue its strong presence there.

The big and more developed markets like China, Western Europe, and North America all witnessed the largest declines in the third quarter. Given these are the largest markets for Apple, the month delay in the iPhone 12 launch contributed to its decline. However, across many of these markets 5G promotions are starting to heat up and a full array of products is quickly becoming available to consumers at all price points.

Counterpoint’s data was slightly different to IDC. It said that Apple’s shipments fell 7% year-on-year, and shipments were 41.7 million units (about the same as IDC), while Canalys said Apple shipped 43.2 million units.

However, the data of the three companies all show that Apple lags behind Xiaomi. Apple recently announced that its revenue in China had fell 29% year-on-year in the third quarter.

Milestone breakthrough

Xiaomi’s shipments saw a 45% year-on-year rise. Xiaomi’s milestone breakthrough was related to two external factors: First, the global smartphone industry shipments declined during the same period, because many consumers postponed plans to buy mobile phones and chose to wait for the first 5G iPhone to be launched in mid-October. And second, Xiaomi’s rival Huawei is in a hole due to sanctions. Xiaomi has seizes the opportunity to benefit from Huawei’s woes.

Canalys analyst Mo Jia told cc.cn that Xiaomi still faces competition from its “comrades” Oppo and Vivo. Oppo and vivo have launched products covering various price ranges in Southeast Asia and are entering the European market. In Europe, Oppo and Vivo position themselves more in the high-end price range, which may trap Xiaomi in the low-end market.

At the same time, some analysts believe that Xiaomi’s overtaking Apple may only be temporary, because the long-awaited 5G iPhone 12 went on sale in October, and that may cause its shipments to rebound. So, its sales are not included in the third quarter figures.