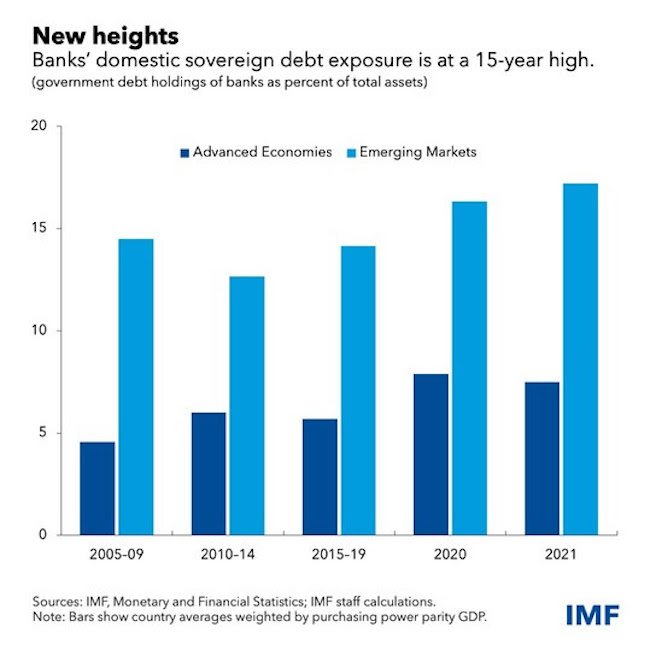

The coronavirus pandemic has left emerging-market banks – including those in Asia-Pacific – holding record levels of government debt, increasing the odds that public-sector finance pressures could threaten stability, according to the International Monetary Fund.

The average ratio of public debt to gross domestic product—a key measure of a country’s fiscal health—rose to a record 67% last year in emerging market countries, according to the IMF’s most recent Global Financial Stability Report.

Many emerging markets are facing especially difficult conditions, such as China, where financial vulnerabilities remain elevated amid ongoing stress in the property sector and new Covid-19 outbreaks, the fund said.

“Authorities should act quickly to minimise that risk,” the IMF added, saying that emerging-market governments rely heavily on their banks for credit.

These banks in turn rely heavily on government bonds as an investment that they can use as collateral for securing funding from the central bank.

“Large holdings of sovereign debt expose banks to losses if government finances come under pressure and the market value of government debt declines,” the IMF said.

“That could force banks—especially those with less capital—to curtail lending to companies and households, weighing on economic activity.”

As the economy slows and tax revenues shrivel, government finances could come under even more pressure, further squeezing banks and creating a destructive “doom loop”.

The IMF said such a loop could be triggered by a sharp tightening of global financial conditions—resulting in higher interest rates and weaker currencies on the back of monetary policy normalisation and intensifying tensions caused by Russia’s war in Ukraine.

That could undermine investor confidence in the ability of emerging-market governments to repay debts. A domestic shock, such as an unexpected economic slowdown, could have the same effect, the fund said.