State-run Indian refiner Bharat Petroleum Corp is seeking extra oil from Middle Eastern producers for April, fearing Western sanctions against Russia could hit deliveries of Urals crude, a source familiar with the matter said.

BPCL, India second biggest state refiner, buys an average two million barrels of Russian Urals every month on a delivered basis, where the seller arranges for insurance of the cargo and ships. The oil is processed at BPCL’s 310,000 barrels per day (bpd) Kochi refinery in southern India.

BPCL has booked one million barrels of Urals for loading in March and three million in April.

Traders are willing to meet the existing commitments, but have told BPCL they will not quote for supplies in future months, the source said, adding: “No one knows how the situation will pan out in April, so BPCL wants to be prepared.”

Russia’s invasion of Ukraine, which Moscow calls a “special operation,” was met with widespread condemnation and an array of sanctions by Western countries.

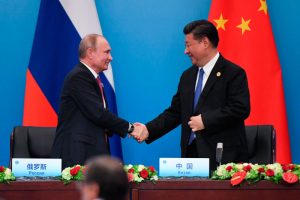

The United States and its allies have targetted Russia’s central bank, top businesses, oligarchs and officials, including President Vladimir Putin himself.

The source said Gulf producers had not committed to additional supplies for BPCL, as allocations for April loading are due to be finalised next week.

BPCL also intends to draw from its inventories to make up for any shortfall of Russian oil, the source said.

The company did not respond to an email seeking comment.

On Monday, Indian Oil Corp (IOC), the country’s top refiner, said it would accept Russian oil and Kazakhstan’s CPC blend only on a delivered basis due to insurance risks. IOC last week bought Russian oil in a tender after a two-year gap.

India’s top lender State Bank of India has told clients it won’t handle trade relating to sanctioned entities in any currency.

- Reuters with additional editing by Jim Pollard

ALSO READ

Asian Powers Split On Sanctions, SWIFT Ban On Russian Banks

China Ramped Up Oil Purchases After Xi Met Putin, Traders Say

Japan Plans Oil Reserve Release Amid Price Spike Fears

BPCL Privatisation Might Be Pushed Back – Mint