(ATF) Returns on a key China bond index slid Thursday in line with Asian stock markets as concern that inflation will rise returned to haunt investors.

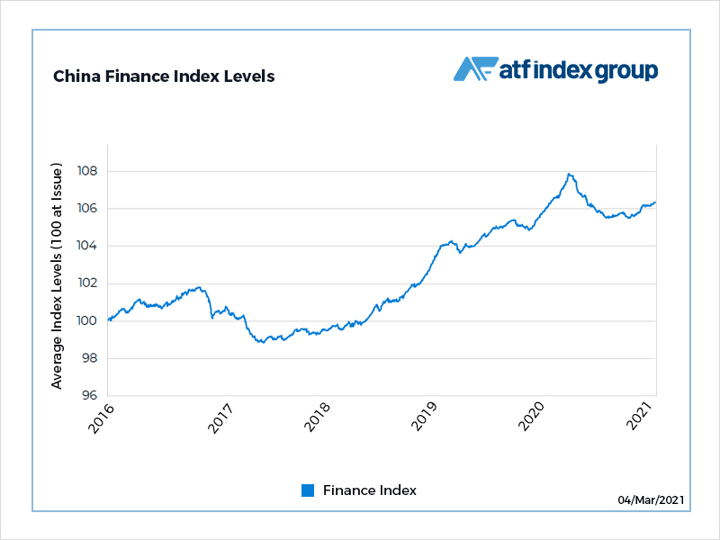

Financial bonds gained after Hong Kong’s financial chief said he hoped to see the launch this year of a scheme to give mainland investors grater access to global bond markets.

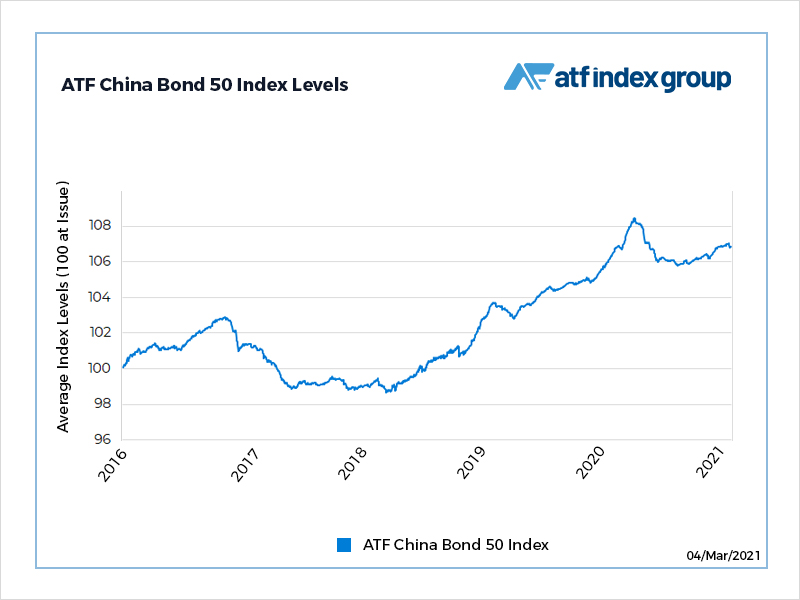

The benchmark ATF China Bond 50 Index of AAA rated corporate and local government credits fell 0.01% to 106.82, extending losses in the past week to 0.15%. The measure has been in decline amid a global selloff in bonds and risk assets. Investors have been pulling back on concern that pent-up demand during pandemic lockdowns of the past year will be unleashed as the global vaccine rollout tames Covid’s spread.

Also on ATF

- Central banks ‘should shut their mouth and open their wallets’

- Rates sell-off spooks markets

- India tells Tesla: We’ll give you the lowest production costs

While those forecasts are good for the real economy, markets fear the sudden surge in spending will send inflation higher. Bonds tend to fall when consumer and producer prices rise because higher living costs erode the value of the fixed payments on the securities.

A measure of financial company bonds climbed 0.02%.

Hong Kong Financial Secretary Paul Chan Mo-po told the South China Morning Post newspaper that the so-called southbound leg of the Bond Connect scheme to promote cross-border debt trading will launch this year.

“We are doing out best,” Chan said when asked when this year the programme would go live.

China’s financial companies are expected to reap a fees windfall from managing the trades of mainland investors via their offshore, Hong Kong-based subsidiaries.

Analysts have expressed concern that central banks may be doing too little to contain inflationary pressure.

Although 10-year yields have eased from the one-year peak of 1.614% struck last week, there is still nervousness about whether central banks are behind the curve in raising interest rates.

“The Fed will have to change its language as policy rates are inappropriate given where nominal growth will be – most forecast for growth to be 4% and with above trend 3% in subsequent years, anchoring 10-year yields at 1.40% is not appropriate,” Gary Dugan, CEO at Purple Asset Management, said.