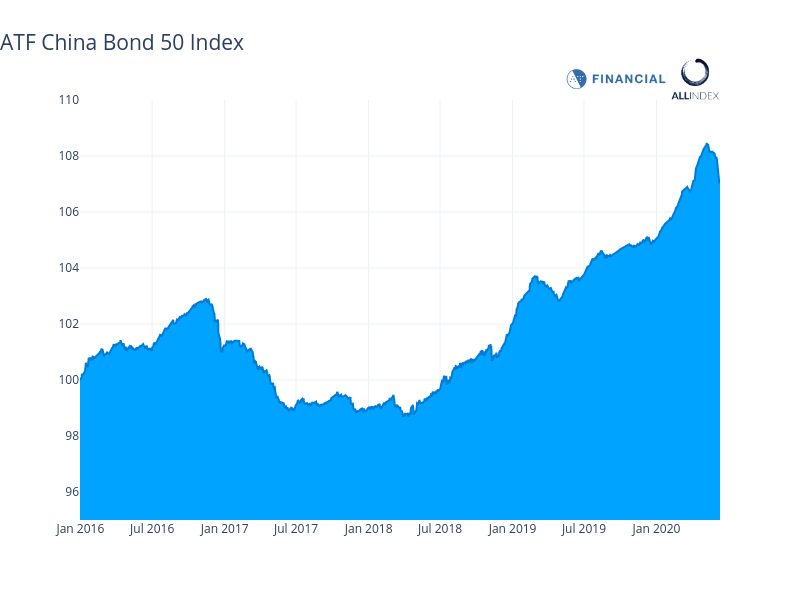

(ATF) The ATF China bond indexes posted another quiet performance on Wednesday as a larger-than-expected drop in inflation stoked expectations that monetary loosening is on the cards once again.

Chinese inflation missed targets in May, with both CPI and PPI slipping more than expected. CPI came down to 2.4% versus a consensus of 2.7%, while PPI deflation widened to -3.7%, versus a consensus of -3.3%, according to a research note by Morgan Stanley.

Falling inflation will leave room for policy stimulus to counter the impact of coronavirus on the economy, according to Ting Lu, China Chief Economist at Nomura. This will support bond prices.

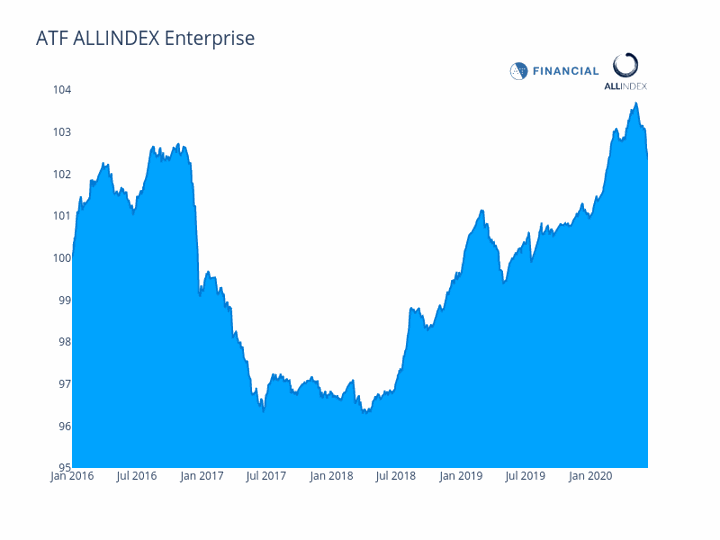

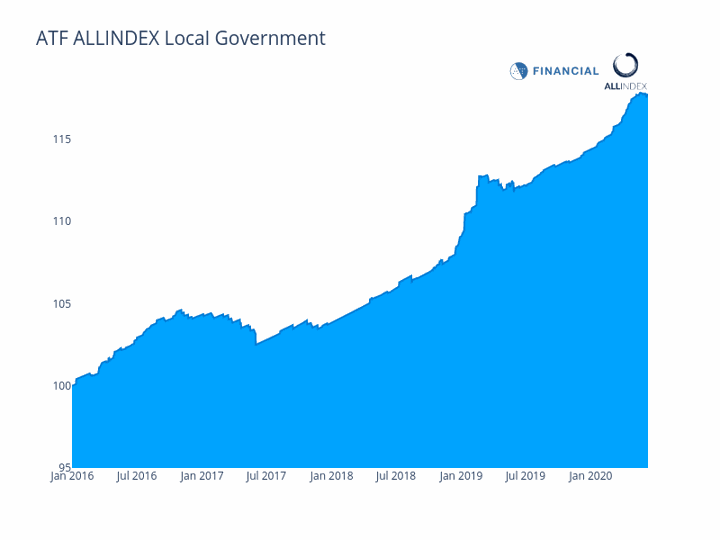

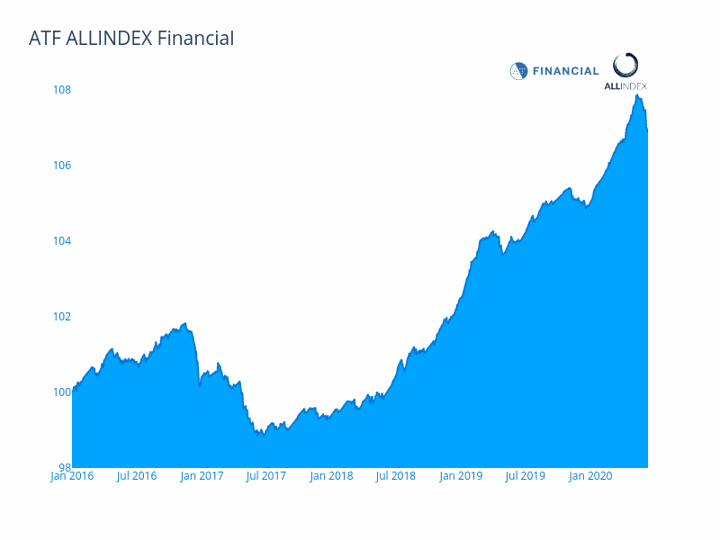

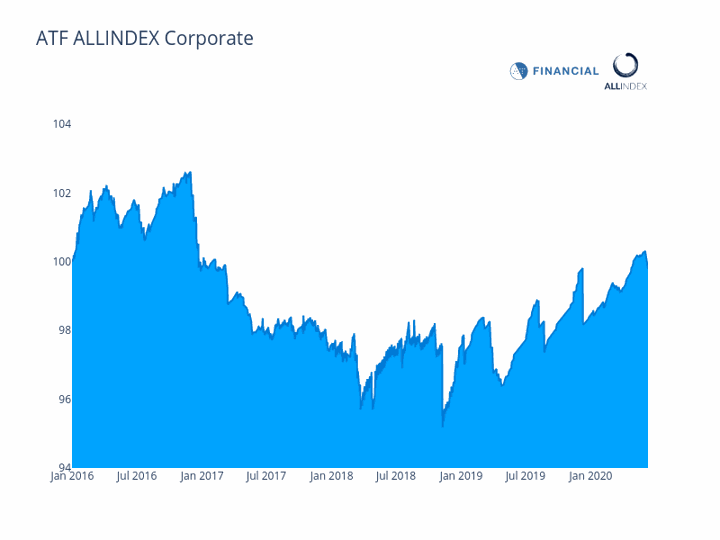

The China Bond 50 index, the flagship index, gained 0.03% to close at 107.84, while the ATF ALLINDEX Local Governments gauge also closed in positive territory. It gained 0.01%, and closed at 117.76. Muted losses were seen in ATF ALLINDEX Corporates, Enterprise, and Financials, which retreated 0.06%, 0.03% and 0.01%, respectively.

On Wednesday, the People’s Bank of China (PBoC) injected another 60 billion yuan ($8.5bn) into the banking system via reverse repos, underscoring its intention to ensure adequate liquidity. The open-market operation followed injections of 60bn yuan, 120bn yuan and 150bn yuan on Tuesday, Monday and Friday. It also added 70bn yuan on Thursday.

The PBoC is further incentivised to maintain stable liquidity in the interbank market to support China’s ambitious bond issuance program, Morgan Stanley said. The American bank estimates net government bond issuance to reach 4 trillion yuan ($566bn) in June-September.

Several financial names within the ATF China Bond 50 index continued to recoup some of their recent losses following sharp drops on 3-8 June. Gains were seen in the bonds of China Minsheng Banking (0.14%), Industrial Bank (0.25%), Ping An Bank (0.06%), China CITIC Bank (0.19%), Chongqing Rural Commercial Bank (1.27%), the Agricultural Development Bank of China (0.46%), and the Export-Import Bank of China (0.07%).

However, China Merchants Bank, Xiamen International Bank and China Development Bank lost 0.31%, 0.07% and 0.08% respectively. As reported, China Merchants Bank announced on 1 June that it would be issuing capital bonds of no fixed term of up to 50 billion yuan ($7 billion).

In the industrial sector, Zhuhai Da Heng Qin, a construction company, dropped 1.14%, and closed at 103.72.