Latest News: Bonds

With nearly $11 billion of offshore bonds and $6 billion of offshore loans, a default by Country Garden would set the stage for one of China's biggest corporate debt restructurings

The PBOC said it is pumping $39.5 billion of fresh liquidity into the banking system, the biggest net injection of its kind in nearly three years

Shares of China's largest private developer sank nearly 11% on Tuesday after it warned liquidity is very tight and it faces uncertainty on the sale of assets and restructuring of its debts

Bondholders of China Evergrande express surprise at debt plan failure, fear it faces liquidation, while Country Garden may announce a restructuring of its offshore debt soon

Analysts say officials may have vetoed the group's debt restructuring and that a risk management committee is likely to step in to deal with the company's unfinished projects and huge debts

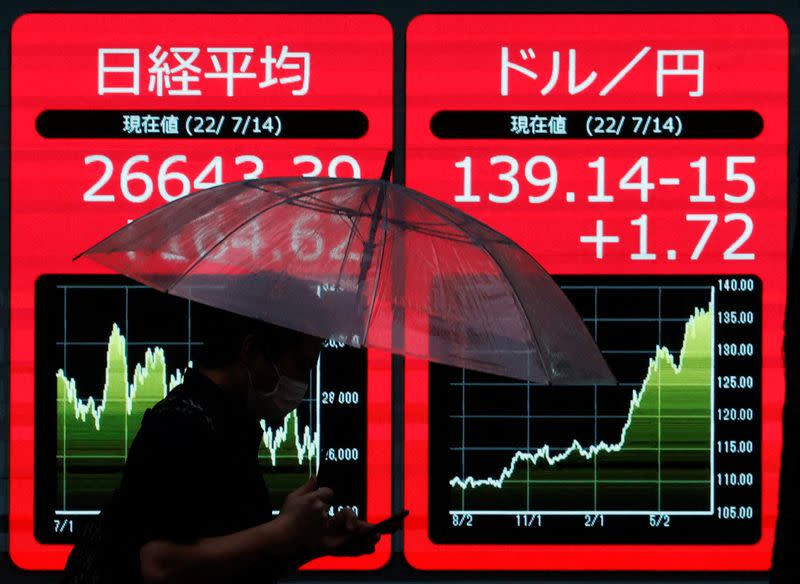

The pace of the bond rout drove the safe-haven dollar higher and piled the pressure on other currencies like the yen, as well as on equity markets

The move by major companies to reduce production in China has boosted inflation, but the western shift to 'friendly shores' has been positive for countries like India and Vietnam

Bank of Japan Governor Kazoo Ueda says there is "still a way to go" before the BOJ ends its stimulus policy, but noted that the cost of the move was not a factor for the central bank

In a filing to Hong Kong Stock Exchange, Evergrande said it had been told by authorities that Hui "has been subject to mandatory measures" due to suspicion of unspecified crimes

Shares of embattled developer plunged 19% in afternoon trading in Hong Kong after a report police were monitoring the activities of the group's founder, amid fear the group faces liquidation

China’s blue-chip dipped 0.8%, with Hong Kong’s Hang Seng and the ASX in Sydney both tumbling 1.3%, while the BSE Sensex in Mumbai was also down 0.85%.

Tokyo, Hong Kong, Shanghai, Sydney, Mumbai and Singapore, all dropped on Wednesday, as did the smaller regional markets in Wellington, Manila, Taipei and Bangkok.

AF China Bond

- Popular